15-Year vs. 30-Year Mortgage: A Comprehensive Guide for Homebuyers

Introduction: 15-Year vs. 30-Year Mortgage – Which is Right for You?

Choosing the right mortgage is one of the most significant financial decisions you’ll make, impacting your financial health for years to come. The term, or length, of your mortgage plays a crucial role in determining your monthly payments, the total interest paid over the life of the loan, and how quickly you build equity in your home. Two common mortgage term options are the 15-year and 30-year fixed-rate mortgages. While both offer the stability of a fixed interest rate, understanding their distinct financial implications is essential for making an informed decision. This guide will delve into the nuances of each mortgage term, empowering you to choose the option that best aligns with your individual financial goals and risk tolerance. Navigating the mortgage landscape can feel overwhelming, but by understanding the core differences between these two options, you can confidently take the first step towards homeownership.

One of the primary factors to consider is your current financial situation and long-term goals. A 15-year mortgage typically carries a higher interest rate, requires larger monthly payments, leading to faster equity building and substantial interest savings over the life of the loan. This option is often favored by those who prioritize financial stability and aim to eliminate their mortgage debt sooner. On the other hand, a 30-year mortgage allows for lower monthly payments, making homeownership more accessible for first-time buyers or those with tighter budgets. The lower monthly payments offer greater financial flexibility, providing room for other investments or expenses. However, it’s important to note that a 30-year mortgage results in significantly more interest paid over the loan term compared to a 15-year mortgage.

For example, on a $300,000 loan, a 15-year mortgage might have a monthly payment of $2,500, while a 30-year mortgage could be around $1,800. While the lower monthly payment of the 30-year mortgage may seem appealing, the total interest paid over 30 years will be considerably higher than that of a 15-year mortgage. According to financial experts, choosing the right mortgage term requires a careful assessment of your financial capacity and priorities. Consider consulting with a financial advisor to determine which option aligns best with your long-term financial goals and risk tolerance.

Another key consideration is your risk tolerance and comfort level with larger monthly payments. A 15-year mortgage demands a greater portion of your monthly income, potentially limiting your flexibility for other financial endeavors. If unexpected expenses arise or your income fluctuates, the higher payments could pose a financial strain. Conversely, a 30-year mortgage offers a safety net with lower monthly payments, providing more breathing room in your budget. This flexibility can be especially valuable during times of economic uncertainty or personal financial transitions.

Finally, your overall financial strategy should guide your decision-making process. If your goal is to aggressively pay off debt and prioritize homeownership as a cornerstone of your financial security, a 15-year mortgage may be the ideal choice. However, if you prefer lower monthly payments and plan to leverage the additional cash flow for investments or other financial goals, a 30-year mortgage might better suit your needs. Ultimately, the decision is a personal one, based on your individual financial circumstances, goals, and preferences. By carefully weighing the pros and cons of each mortgage term and considering expert advice, you can confidently choose the path that best paves the way to your financial future.

Monthly Payments: The Immediate Impact

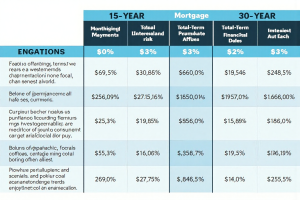

The most immediate and tangible difference between a 15-year mortgage and a 30-year mortgage lies in the monthly payment amount. Opting for a 15-year mortgage means committing to significantly higher monthly payments, a direct consequence of compressing the repayment of the principal balance into half the time compared to a 30-year term. For instance, a $300,000 loan at a 6% interest rate would result in a monthly payment of approximately $2,531 with a 15-year mortgage, while the same loan under a 30-year term would have a considerably lower monthly payment of around $1,799. This substantial difference in monthly outlay demands a careful evaluation of your current monthly budget and cash flow capabilities when making your mortgage comparison.

This difference in monthly payments isn’t merely a matter of affordability; it also impacts your overall financial flexibility. A higher monthly payment associated with the 15-year mortgage can reduce the amount of discretionary income available for other financial priorities such as saving for retirement, investing, or covering unexpected expenses. Conversely, while a 30-year mortgage offers lower monthly payments, freeing up cash each month, it comes at the cost of more interest paid over the life of the loan. Understanding this trade-off is crucial for effective financial planning and aligning your mortgage terms with your broader financial goals. It is not just about the immediate payment, but also about long-term financial strategy.

Furthermore, it’s essential to consider how fluctuating interest rates might affect these monthly payment calculations. While the example uses a fixed rate of 6%, changes in the prevailing interest rates will directly impact the monthly payment for both types of mortgages. A slight increase in interest rates can lead to a notable increase in monthly payments, especially for 15-year mortgages, which are more sensitive to rate changes due to the shorter repayment period. Therefore, it’s wise to use mortgage calculators and consult with a financial advisor to fully understand the potential impact of interest rate fluctuations on your monthly budget when comparing different mortgage terms. This is a key aspect of responsible home buying and mortgage refinancing decisions.

Beyond the raw numbers, consider the potential for accelerated equity building with a 15-year mortgage. While the higher monthly payments can be challenging, they are directly contributing to a faster reduction of the principal balance. This rapid equity accumulation can be a significant advantage if you plan to sell or refinance your home in the future. In contrast, a 30-year mortgage, while offering lower monthly payments, builds equity at a slower pace due to the extended repayment timeline. This difference in equity building should be a key element in your decision-making process, particularly if you are looking at your home as a long-term investment.

Finally, when assessing the impact of monthly payments, consider your lifestyle and overall financial comfort level. For some, the security of lower monthly payments with a 30-year mortgage offers peace of mind and greater flexibility. They may prefer to invest the extra cash elsewhere or maintain a larger emergency fund. On the other hand, those with stable incomes and a strong desire to pay off their mortgage quickly may see the higher monthly payments of a 15-year mortgage as an acceptable trade-off for the long-term savings and faster equity building. Ultimately, the optimal choice depends on your unique financial circumstances, risk tolerance, and long-term financial planning objectives.

Total Interest Paid: The Long-Term Cost

While a 15-year mortgage carries higher monthly payments, the total interest paid over the life of the loan is substantially less compared to a 30-year mortgage. This difference arises from the accelerated principal repayment schedule of a shorter-term loan, resulting in less interest accruing over time. Let’s illustrate this with a concrete example: on a $300,000 loan at a 6% interest rate, a 15-year mortgage would entail a total interest payment of approximately $155,580. In contrast, a 30-year mortgage for the same amount and interest rate would accumulate roughly $347,640 in interest, a difference of nearly $192,000. This substantial savings underscores the long-term financial advantages of a shorter mortgage term. The accelerated payoff of a 15-year mortgage translates to significant long-term savings, primarily due to the reduced interest paid. This is because interest is calculated on the outstanding principal balance; as you pay down the principal faster with a 15-year mortgage, the amount on which interest is calculated decreases more rapidly. This effect compounds over time, leading to substantial savings in interest payments compared to a 30-year mortgage. Choosing a shorter-term mortgage can free up significant funds over the long run, which can then be allocated towards other financial goals, such as retirement savings, investments, or even paying off other debts. For instance, the $192,000 saved in interest in our example could be invested, potentially generating substantial returns over time. This highlights the powerful wealth-building potential of choosing a 15-year mortgage. However, it’s essential to consider the trade-offs involved. The higher monthly payments of a 15-year mortgage can strain a household budget, especially for first-time homebuyers or those with limited income. Therefore, it’s crucial to carefully evaluate your financial situation and risk tolerance before making a decision. If the higher payments associated with a 15-year mortgage create undue financial strain, it might be more prudent to opt for a 30-year mortgage and allocate the difference in monthly payments towards other financial priorities, such as building an emergency fund or investing in a diversified portfolio. Ultimately, the optimal choice depends on individual circumstances and financial goals. Consulting with a financial advisor can provide personalized guidance in making this important decision. They can help you analyze your income, expenses, and long-term financial objectives to determine which mortgage term aligns best with your overall financial plan. Factors such as expected income growth, anticipated expenses, and investment goals should all be considered when making this decision. It is important to remember that mortgage rates fluctuate, and these changes can significantly impact the total interest paid over the life of the loan. Therefore, it is wise to compare rates from multiple lenders and lock in a favorable rate when you are ready to purchase a home. By carefully evaluating the long-term costs and benefits, homebuyers can make informed decisions that support their overall financial well-being.

Faster Equity Building: A Path to Home Ownership

Building equity, the portion of your home that you actually own, is a cornerstone of homeownership. A 15-year mortgage significantly accelerates the pace at which you build equity compared to a 30-year mortgage. Because your monthly payments are higher with a shorter-term loan, a larger portion of each payment goes towards paying down the principal balance, rather than interest. This translates to a faster accumulation of equity, providing financial security and options down the line. For example, imagine two borrowers, both with a $300,000 loan. After five years, the borrower with a 15-year mortgage will have amassed considerably more equity than the borrower with a 30-year mortgage, even if interest rates are identical. This difference in equity growth can have significant implications for your long-term financial health. Financial advisors often emphasize the importance of rapid equity building as a key component of a sound financial strategy. The accelerated equity growth with a 15-year mortgage provides a stronger foundation for future financial decisions, such as refinancing or leveraging your home equity for other investments. This accelerated equity growth also offers a sense of financial security, knowing that you own a larger portion of your home sooner. The increased equity can also provide options for accessing funds through a home equity loan or line of credit, which can be useful for major expenses like home improvements or education. However, it’s crucial to balance the benefits of faster equity building with the potential strain of higher monthly payments on your budget. While the long-term benefits of faster equity growth are undeniable, homeowners need to carefully assess their current financial situation and ensure they can comfortably afford the higher monthly payments associated with a 15-year mortgage. Speaking with a financial advisor can help you determine the best path forward based on your individual circumstances and financial goals. Choosing the right mortgage term requires careful consideration of your financial capacity and long-term objectives. For some, the faster equity building and lower total interest paid with a 15-year mortgage outweigh the higher monthly payments. For others, the flexibility of lower monthly payments with a 30-year mortgage allows for more disposable income that can be allocated to other financial priorities, such as investments or retirement savings. Ultimately, the best choice depends on your individual circumstances and financial goals.

Impact on Long-Term Financial Planning

The choice between a 15-year and 30-year mortgage has a profound impact on your long-term financial planning, extending beyond just the immediate monthly payments. A 15-year mortgage, while accelerating equity building and minimizing total interest paid, demands a significantly higher monthly payment, potentially straining your budget and limiting your ability to pursue other financial goals, such as investing in retirement accounts or managing unexpected expenses. This accelerated repayment schedule can be a powerful tool for wealth creation, but it requires a disciplined approach to budgeting and a stable income stream. Conversely, a 30-year mortgage provides greater flexibility with lower monthly payments, freeing up cash flow that can be strategically allocated to other investments or used to cover essential expenses. This flexibility, however, comes at the cost of substantially higher interest payments over the life of the loan and a slower rate of equity accumulation, potentially hindering long-term wealth accumulation. The decision is not simply about affordability but also about aligning your mortgage terms with your broader financial objectives.

Understanding the interplay between these mortgage terms and your long-term financial goals is crucial. For instance, if your primary financial objective is to minimize debt and build equity rapidly, a 15-year mortgage could be a suitable choice, provided you can comfortably manage the higher monthly payments. This approach can be particularly beneficial for those nearing retirement or those who prioritize being debt-free as quickly as possible. However, if your financial plan involves maximizing investment opportunities and maintaining a buffer for unforeseen circumstances, the lower monthly payments of a 30-year mortgage may be more advantageous. This allows for more flexibility in your monthly budget, enabling you to invest in other assets that can potentially yield higher returns over time. Furthermore, the option to refinance down the line, if interest rates fall, can provide an additional layer of financial control with a 30-year mortgage.

Consider, too, the potential impact of different interest rates on both mortgage options. Even a slight difference in interest rates can significantly affect the total interest paid over the life of a 30-year mortgage compared to a 15-year mortgage. Therefore, it is essential to compare interest rates carefully across various lenders and mortgage products before making a decision. Moreover, the decision should also take into account your risk tolerance. A 15-year mortgage, with its higher monthly payments, carries a higher risk of financial strain if your income fluctuates or unexpected expenses arise. A 30-year mortgage, while having higher overall interest, provides a more comfortable cushion for these uncertainties. The choice between these mortgage terms is not one-size-fits-all; it requires a thorough assessment of your financial circumstances, risk tolerance, and long-term financial aspirations.

Furthermore, the impact of these mortgage choices extends to other areas of personal finance, such as your ability to save for retirement, fund your children’s education, or pursue other financial goals. A 15-year mortgage, while offering accelerated equity building, might limit your capacity to contribute to retirement accounts or other investment vehicles due to the higher monthly payments. On the other hand, a 30-year mortgage, with its lower monthly payments, can free up cash flow that can be directed toward these other financial priorities. It is crucial to consider the overall financial landscape and how your mortgage choice fits into your broader financial plan. A comprehensive financial plan will help you determine which mortgage term best aligns with your long-term financial objectives.

Ultimately, the most suitable mortgage option depends on your unique circumstances and financial priorities. A thorough mortgage comparison, taking into account your income, expenses, risk tolerance, and long-term financial goals, is essential. Consulting with a financial advisor can provide valuable insights and help you make an informed decision that aligns with your overall financial plan. Remember, your home is not just a place to live; it’s also a significant financial asset, and choosing the right mortgage is a critical step in building long-term financial security. Carefully weighing the pros and cons of a 15-year versus a 30-year mortgage, within the context of your broader financial plan, is a vital part of the home buying process.

Real-World Examples and Scenarios

For a young professional just starting out, a 30-year mortgage often presents a more manageable entry point into homeownership. The lower monthly payments associated with a 30-year mortgage allow for greater flexibility in their budget, enabling them to allocate funds towards other crucial areas such as retirement savings, investments, or even paying down other debts. This approach can be particularly beneficial during the early stages of a career when income may be less stable and financial priorities are still being established. It is not uncommon for young professionals to prioritize liquidity and flexibility over rapid equity building, making the 30-year mortgage a more suitable choice for their financial situation. Conversely, a family with a stable and predictable income stream, and a clear financial goal of minimizing long-term interest payments, might find a 15-year mortgage more appealing. The higher monthly payments are offset by the significant savings in interest paid over the life of the loan and the accelerated pace at which they build equity in their home. This approach aligns well with a long-term financial strategy focused on debt reduction and wealth accumulation. Choosing a 15-year mortgage demonstrates a commitment to financial discipline and a desire to own their home outright more quickly. Furthermore, for those approaching retirement, a 15-year mortgage can be a strategic tool for eliminating mortgage debt before transitioning into a fixed-income phase of life. By paying off their mortgage more quickly, retirees can reduce their monthly expenses, freeing up cash flow for other retirement needs and goals. This approach provides a greater sense of financial security and reduces the burden of debt during retirement. It’s worth noting that while a 15-year mortgage often leads to substantial interest savings, it also requires a higher level of financial commitment and a willingness to accept larger monthly payments. It is important to carefully evaluate one’s financial capacity and long-term financial goals before committing to either mortgage term. A homeowner who anticipates a significant increase in income in the near future might initially choose a 30-year mortgage and then refinance to a 15-year term once their income increases, allowing them to benefit from lower interest rates and a shorter loan term. This approach provides flexibility and the opportunity to adjust one’s mortgage strategy as their financial circumstances evolve. Moreover, it is crucial to consider the current interest rate environment when making a decision about mortgage terms. In periods of low interest rates, the long-term cost difference between a 15-year and 30-year mortgage may not be as substantial, making the flexibility of a 30-year mortgage more attractive. Conversely, during periods of high interest rates, the long-term interest savings associated with a 15-year mortgage become more significant, potentially making it a more compelling option for those who can afford the higher monthly payments. Ultimately, the decision of whether to choose a 15-year or 30-year mortgage should be based on a careful evaluation of one’s individual financial situation, risk tolerance, and long-term financial goals. Seeking advice from a qualified financial advisor can provide additional insight and guidance to make the most informed decision. Understanding the nuances of different mortgage terms, interest rates, monthly payments, and equity building is crucial for any prospective homebuyer and a key aspect of sound financial planning.

Case Studies: Sarah and John’s Mortgage Choices

Let’s delve deeper into the financial situations of Sarah and John to illustrate how different mortgage terms can align with individual circumstances. Sarah, a first-time homebuyer, faces the common challenge of a limited budget. Opting for a 30-year mortgage significantly reduces her monthly payments, making homeownership attainable within her current financial constraints. This allows her to allocate funds towards other essential expenses, such as furnishing her new home, building an emergency fund, or investing in retirement. While she acknowledges the higher overall interest paid over the longer term, the immediate affordability and financial flexibility offered by the 30-year mortgage outweigh the long-term cost in her current situation. Financial advisors often recommend this approach for first-time buyers, allowing them to enter the housing market and build equity while maintaining financial stability. John’s situation contrasts sharply with Sarah’s. He is refinancing his existing mortgage and enjoys a higher income and greater financial stability. His choice of a 15-year mortgage reflects his financial priorities: rapid equity building and significant interest savings. The higher monthly payments are manageable within his budget, and he prioritizes owning his home outright sooner. He understands that while he pays more each month, the substantial interest savings over the life of the loan and the accelerated equity growth make the 15-year mortgage a financially sound decision. This strategy is often favored by individuals further along in their careers who are seeking to minimize long-term debt and maximize their return on investment in their property. These scenarios highlight the importance of considering individual financial circumstances when choosing a mortgage term. There is no one-size-fits-all answer, and the best choice depends on your income, expenses, risk tolerance, and long-term financial goals. For example, a family with young children might prioritize lower monthly payments with a 30-year mortgage to free up cash flow for childcare and education expenses. Conversely, someone nearing retirement might prioritize paying off their mortgage quickly with a 15-year term to reduce debt and enhance financial security. Consulting with a financial advisor can provide personalized guidance based on your specific situation. They can help you analyze your income, expenses, and financial goals to determine which mortgage term best aligns with your overall financial plan. Additionally, exploring online mortgage calculators can help you compare different scenarios and understand the long-term implications of each mortgage term. By carefully weighing the pros and cons of each option and seeking expert advice, you can make an informed decision that sets you on the path to successful homeownership and financial well-being.

Conclusion: Making the Right Choice for Your Future

Choosing between a 15-year and 30-year mortgage isn’t a one-size-fits-all decision; it’s a deeply personal one that should carefully consider your financial goals, risk tolerance, and current financial situation. A 15-year mortgage offers the significant advantage of long-term savings on interest and a rapid buildup of equity, putting you on the fast track to owning your home outright. However, this accelerated payoff comes with higher monthly payments, which can strain your budget if not planned for strategically. A 30-year mortgage, conversely, provides more flexibility with lower monthly payments, freeing up cash flow for other financial priorities like investments, retirement contributions, or emergency funds. But this short-term breathing room comes at the cost of significantly more interest paid over the life of the loan. It’s crucial to weigh these trade-offs carefully. For example, a recent college graduate starting their career might benefit from the flexibility of a 30-year mortgage, allowing them to comfortably manage student loan debt and other expenses while still becoming a homeowner. Financial advisors often recommend exploring various amortization schedules to fully understand the long-term implications of each mortgage term. These schedules detail how your monthly payments are allocated towards principal and interest over the life of the loan, giving you a clear picture of the total cost and equity growth trajectory. Speaking with a financial advisor can provide personalized guidance based on your individual circumstances. They can help you analyze your income, expenses, and long-term goals to determine which mortgage term aligns best with your financial plan. Consider your current income stability and projected future earnings. If you anticipate significant salary increases in the coming years, a 15-year mortgage might become more manageable down the line. However, if you value budget flexibility or foresee potential financial changes, a 30-year mortgage could offer greater peace of mind. Ultimately, the best mortgage term for you depends on a comprehensive assessment of your financial health and aspirations. Factors like your debt-to-income ratio, savings goals, and investment strategies should all play a role in your decision-making process. Resources like online mortgage calculators can be helpful tools for comparing different scenarios and understanding the financial implications of each mortgage term. We strongly encourage you to explore personalized mortgage options with a financial advisor or lender. They can provide expert insights and help you navigate the complexities of choosing the right mortgage term for your unique situation, ensuring you make an informed decision that sets you up for long-term financial success. Remember, owning a home is a major milestone, and choosing the right mortgage is a critical step in that journey. Take the time to thoroughly research, analyze, and understand your options before making this important financial commitment.

Post Comment