Urban vs. Suburban Mortgages: Unpacking the Qualification Differences

Urban vs. Suburban Mortgages: A Comprehensive Guide

Navigating the mortgage landscape can feel like traversing a complex maze, particularly for first-time homebuyers or those contemplating a move between the vibrant pulse of urban centers and the more tranquil settings of suburban life. This comprehensive guide aims to demystify the nuances of urban versus suburban mortgages, shedding light on the critical qualification differences that can significantly impact your home buying journey. We will explore the unique financial considerations involved in each setting, providing actionable insights to help prospective homeowners make informed decisions and secure the best possible financing for their dream home, whether it’s a city loft or a house with a yard in the suburbs.

Understanding these distinctions is crucial for a smooth and successful home purchase experience. The fundamental premise of securing a mortgage remains consistent across both urban and suburban environments; however, the specific factors influencing lender decisions can vary considerably. For example, urban areas are often characterized by higher property values and a greater prevalence of condominium and cooperative housing options. This can directly affect the types of loans available, often requiring larger down payments and potentially impacting mortgage insurance premiums.

First-time homebuyers in cities might encounter stricter lending criteria due to these higher costs. Suburban markets, with their more common single-family homes and diverse property types, may present different challenges, such as varying property tax rates and the need to factor in commute times and related costs into their overall budget. These differences require a tailored approach to the mortgage application process. One of the most significant areas of divergence lies in the qualification processes.

Lenders meticulously evaluate various financial metrics, including credit scores, debt-to-income ratios (DTI), and the size of the down payment. In urban settings, where property values are often elevated, a higher credit score and a lower DTI may be necessary to secure a favorable loan. Moreover, a substantial down payment can mitigate risk for the lender and reduce the monthly mortgage payment. Suburban areas, while potentially offering lower property prices in some regions, might still require strong financial credentials, especially if the desired area is highly sought after.

It is essential for prospective buyers to assess their financial standing and understand the specific requirements of their target location. The availability of different loan types, including FHA, conventional, and VA loans, can also vary based on the specific characteristics of urban and suburban markets. The financial implications of homeownership extend beyond the mortgage itself. Property taxes, a significant ongoing expense, can differ substantially between urban and suburban locations, often impacting the overall affordability of a home.

Mortgage insurance, which is often mandatory for loans with lower down payments, adds another layer of cost. Furthermore, housing market trends, such as inventory levels and price fluctuations, play a critical role in both loan qualification and the long-term financial commitment. In urban areas, the market can be more sensitive to economic shifts and supply constraints, while suburban markets may be influenced by factors like school districts and proximity to amenities. Relocating between urban and suburban areas requires careful consideration of these factors to ensure a sound financial decision.

First-time homebuyers, in particular, should be aware of these nuances. Prospective homeowners can significantly improve their chances of mortgage approval by proactively managing their financial profiles. This includes maintaining a strong credit score, diligently reducing existing debt to improve the DTI, and accumulating a sufficient down payment. Exploring various loan options and understanding the local housing market dynamics are equally crucial. For those considering a move from an urban to a suburban environment, or vice versa, it is essential to consult with experienced mortgage lenders and real estate professionals who can provide tailored guidance. These experts can offer valuable insights into the specific challenges and opportunities presented by each market, ensuring that your home buying journey is both informed and successful. This proactive approach is key to navigating the complexities of the mortgage landscape and achieving your homeownership goals.

Defining Urban and Suburban Mortgage Landscapes

While the fundamental principles of securing a mortgage remain consistent across geographic locations, the practical application of these principles diverges significantly between urban and suburban markets. Urban areas, characterized by their high density and proximity to commercial centers, frequently exhibit elevated property values, often necessitating larger loan amounts. The prevalence of condominiums and co-operative apartments in cities also introduces complexities related to homeowner association fees and specific loan types that cater to these property structures.

For instance, a first-time homebuyer in a major metropolitan area might find that a conventional loan requires a 20% down payment, whereas an FHA loan, though more accessible, may come with stricter property eligibility requirements. These factors directly impact the qualification process and financial planning for potential urban homeowners. Suburban markets, in contrast, typically feature a greater proportion of single-family homes, often with larger lot sizes and more space. This shift in property type can translate to different mortgage considerations, including variations in property tax rates and the potential for higher commuting costs if the suburb is further from employment hubs.

While the price per square foot might be lower than in the city, the overall cost of a larger home and the associated maintenance can still present a significant financial hurdle. Moreover, suburban areas often have distinct housing market trends, influenced by factors like school district quality and the availability of amenities, which can affect property values and, consequently, mortgage qualifications. For example, a suburban homebuyer may find that while the initial purchase price is lower than a comparable urban property, ongoing costs like property taxes and maintenance could be higher.

The qualification differences between urban and suburban mortgages extend beyond just property values. Lenders often assess a borrower’s credit score and debt-to-income ratio (DTI) with particular scrutiny in high-cost urban areas, where the risk of default might be perceived as higher due to the sheer magnitude of the loans. A strong credit history and a low DTI are paramount for securing favorable interest rates and loan terms. In suburban areas, while these factors remain important, lenders might also consider the stability of the local economy and the long-term value of the property.

For example, a first-time homebuyer relocating from an urban setting to a suburban one might find that their existing credit profile is viewed slightly differently by lenders, based on the perceived risk associated with the new location. Furthermore, the availability and suitability of various loan types can differ between urban and suburban contexts. In urban areas, where co-ops and condos are common, lenders might offer specific loan products tailored to these property types, often with unique requirements related to the building’s financial health and insurance coverage.

Conversely, suburban markets may see a greater prevalence of traditional single-family home loans, including VA loans for eligible veterans and USDA loans in qualifying rural areas. The choice of loan program can significantly impact the required down payment, mortgage insurance premiums, and overall cost of borrowing, making it crucial for first-time homebuyers to research their options carefully. For example, a buyer looking at a condo in the city may need to navigate more complex loan requirements than someone buying a single family home in a suburb.

The impact of property taxes and mortgage insurance also varies considerably. Urban areas often have higher property tax rates due to the increased demand for public services and infrastructure. This can add a substantial amount to the monthly mortgage payment, potentially affecting a borrower’s ability to qualify for a loan. Mortgage insurance, typically required when a down payment is less than 20%, also adds to the monthly expenses and needs to be factored into affordability calculations. Suburban areas may have lower property taxes but may involve higher commuting costs and other transportation expenses, which indirectly affects the affordability of homeownership. Understanding these nuances is crucial for first-time homebuyers as they navigate the urban versus suburban mortgage landscape. Therefore, prospective buyers should meticulously evaluate all costs to ensure long-term financial stability.

Comparing Qualification Processes

The divergence in qualification processes between urban and suburban mortgages is more pronounced than many first-time homebuyers might initially realize. Lenders, while fundamentally assessing the same core financial metrics—credit scores, debt-to-income ratios (DTI), and down payments—often apply varying levels of scrutiny based on location. For instance, a borrower with a solid credit score of 720 and a DTI of 40% might find themselves readily approved for a suburban mortgage, while facing additional hurdles in a competitive urban market where lenders may favor those with even lower DTIs or higher credit scores.

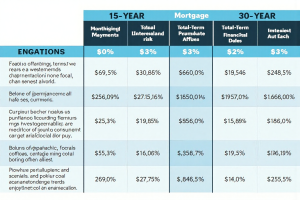

This is primarily due to the higher median property values and perceived risk in densely populated urban centers, which can translate to more stringent lending criteria. The urban mortgage landscape often requires a more robust financial profile to navigate successfully. Down payments, a critical component of mortgage qualification, also exhibit notable differences between urban and suburban settings. In urban areas, particularly in major metropolitan hubs, the higher cost of real estate often necessitates larger down payments.

While a 5% down payment might suffice for a suburban single-family home, urban condos or co-ops may demand 10%, 15%, or even 20% down payments. This is driven by factors such as higher property values and lender concerns about market volatility in densely populated areas. Moreover, some urban properties, especially co-ops, may have specific financial requirements, including minimum post-closing liquidity reserves, which can further complicate the qualification process for first-time homebuyers. These financial hurdles underscore the importance of meticulous financial planning when considering an urban purchase.

Loan type availability further contributes to the qualification differences. While conventional loans are generally accessible in both urban and suburban areas, the availability and terms of government-backed loans, such as FHA and VA loans, may differ. Urban properties, especially condos, may have restrictions on FHA loan approvals, requiring thorough due diligence to ensure eligibility. In contrast, suburban areas with more single-family homes often present fewer restrictions on various loan types. Additionally, jumbo loans, which are necessary for higher-priced properties, are more common in urban settings and come with their own set of stringent qualification criteria.

Understanding the nuances of loan type availability is crucial for prospective homebuyers, especially those relocating from one setting to another. Furthermore, the assessment of debt-to-income ratios (DTI) often reflects the cost of living differences between urban and suburban areas. Lenders recognize that urban dwellers may face higher costs for transportation, entertainment, and other everyday expenses, which can impact their ability to repay a mortgage. Therefore, lenders might scrutinize DTI more closely in urban settings, potentially requiring a lower DTI than in suburban areas.

For example, a lender might approve a DTI of 43% for a suburban homebuyer but prefer a DTI closer to 38% for an urban buyer, reflecting the perceived increased financial strain in urban environments. This underscores the need for careful financial planning and budgeting, especially for those considering an urban mortgage. Finally, the overall housing market trends significantly influence qualification processes. In competitive urban markets with low inventory, lenders may be more cautious, favoring buyers with stronger financial profiles and pre-approvals.

Conversely, in suburban areas with more inventory, lenders might be slightly more flexible in their qualification criteria. These fluctuations in housing market trends can impact the loan approval process and the overall cost of the mortgage, making it essential for prospective buyers to stay informed about the local market dynamics. For first-time homebuyers, understanding these qualification differences is key to navigating the complexities of the mortgage landscape and achieving their homeownership goals, whether in an urban or suburban setting.

Impact of Taxes, Insurance, and Market Trends

Property taxes, a significant factor in the total cost of homeownership, often present a stark contrast between urban and suburban areas. Urban centers, with their extensive infrastructure and public services, typically levy higher property taxes compared to their suburban counterparts. For instance, a first-time homebuyer considering an urban mortgage in a city like New York or San Francisco might encounter significantly higher annual tax bills than someone purchasing a comparable property in a nearby suburb.

These higher taxes directly impact the monthly housing expenses and can influence a lender’s assessment of a borrower’s debt-to-income ratio, a critical metric in the mortgage qualification process. Understanding these local tax implications is crucial for both first-time homebuyers and those relocating between urban and suburban settings. Mortgage insurance, another key element in the affordability equation, is often required when a down payment falls below 20% of the property’s purchase price. This insurance, which protects the lender in case of borrower default, adds to the monthly housing costs and can vary based on the loan type and the borrower’s credit score.

In urban areas, where property values tend to be higher, securing a 20% down payment can be more challenging, potentially leading to higher mortgage insurance premiums. Suburban markets, while often offering more affordable properties, may still necessitate mortgage insurance for first-time homebuyers with limited savings. The interplay between down payment, loan type, and mortgage insurance is a significant consideration when comparing urban and suburban mortgage scenarios. Housing market trends, including inventory levels and price fluctuations, play a pivotal role in the loan qualification process and the overall cost of homeownership.

Urban markets, characterized by higher demand and limited inventory, often experience more volatile price swings and competitive bidding situations. This can make it challenging for first-time homebuyers to secure a property at their desired price point and may require a more aggressive approach to loan pre-approval and property selection. Suburban markets, while generally less volatile, are not immune to market fluctuations and can experience their own unique supply and demand dynamics. For instance, a sudden influx of families relocating to the suburbs can drive up prices and make it more difficult to find an affordable home, thus affecting the qualification for a suburban mortgage.

Furthermore, the availability of specific loan types, such as FHA, conventional, or VA loans, can vary based on location and property type. Urban areas, with a higher prevalence of condos and co-ops, may have different loan eligibility requirements compared to suburban areas dominated by single-family homes. For example, FHA loans, popular among first-time homebuyers, may have specific restrictions on the types of condominiums they will finance. Understanding these nuances and exploring various loan options is crucial for navigating the complexities of both urban and suburban mortgages.

Prospective buyers should consult with mortgage lenders who are familiar with the local market to determine the most suitable loan program for their specific circumstances. Finally, the long-term financial implications of property taxes, mortgage insurance, and market trends must be carefully evaluated. A seemingly affordable mortgage in one location might become financially burdensome due to unexpected increases in property taxes or insurance premiums, or sudden market downturns. Therefore, a thorough analysis of these factors, along with careful budgeting and financial planning, is essential for both first-time homebuyers and those relocating between urban and suburban environments. Consulting with financial advisors and real estate professionals can provide valuable insights into the long-term financial implications of different housing choices and help ensure a sound financial decision.

Conclusion: Navigating Your Path to Homeownership

Navigating the path to homeownership, whether in the bustling heart of a city or the tranquil expanse of the suburbs, requires careful financial planning and a thorough understanding of the mortgage landscape. Prospective homebuyers can significantly enhance their qualification prospects by proactively managing key financial factors. This includes meticulously maintaining a healthy credit score, as even slight variations can impact interest rates and loan approvals. Minimizing debt, particularly high-interest consumer debt, is crucial for improving your debt-to-income ratio, a key metric lenders scrutinize.

Accumulating a substantial down payment not only strengthens your application but also reduces the loan amount, potentially lowering monthly payments and eliminating the need for private mortgage insurance. For first-time homebuyers, navigating these financial intricacies can feel overwhelming, but understanding these fundamentals is paramount. Exploring various loan options, such as FHA, conventional, and VA loans, is essential, as each caters to different financial profiles and down payment capabilities. Understanding the nuances of urban versus suburban mortgage markets is equally vital.

Urban areas, often characterized by higher property values and a prevalence of condos and co-ops, may necessitate larger down payments or stricter lending criteria. Conversely, suburban markets, while potentially offering more single-family homes, present their own set of considerations regarding property taxes, commute costs, and community amenities. For those relocating from urban to suburban settings, or vice-versa, recognizing these market distinctions is paramount. The local housing market dynamics, including inventory levels, price fluctuations, and prevailing interest rates, also play a crucial role in the qualification process and overall affordability.

In a competitive urban market with limited inventory, buyers might need to act quickly and present a strong financial profile to secure their desired property. Suburban markets, while potentially less frenzied, still require careful consideration of long-term affordability, including property taxes, which can vary significantly from urban centers. Consulting with experienced mortgage lenders and real estate professionals provides invaluable personalized guidance tailored to your individual circumstances and target market. These experts can offer insights into navigating the complexities of mortgage pre-approval, loan options, and local market trends, ensuring a smoother and more informed home-buying journey. By taking these proactive steps and seeking expert advice, prospective homebuyers can confidently navigate the urban or suburban mortgage landscape and achieve their homeownership dreams.

Post Comment