Jumbo Loan vs. Conforming Loan: Which is Right for You?

Introduction: Jumbo vs. Conforming Loans

Navigating the mortgage landscape can feel like charting a course through unfamiliar waters, especially for first-time homebuyers. Understanding the nuances of different loan types is crucial for making informed financial decisions. Two primary mortgage options dominate the market: jumbo loans and conforming loans. This comprehensive guide breaks down the key distinctions between these two loan types, empowering you to confidently choose the best fit for your individual financial goals and homeownership aspirations. Understanding these differences is paramount in personal finance, as the right mortgage can significantly impact your long-term financial health.

The choice between a jumbo and conforming loan will largely depend on the price of the property you’re looking to purchase, your financial standing, and the prevailing market conditions within the real estate sector. For instance, in high-demand real estate markets where property values exceed typical loan limits, jumbo loans often become the primary financing vehicle. Choosing the right loan product is akin to selecting the right investment strategy—it requires careful consideration of your risk tolerance, financial capacity, and long-term objectives.

Conforming loans, adhering to limits set by the Federal Housing Finance Agency (FHFA), are often more accessible due to standardized underwriting guidelines and generally lower interest rates. These loans are typically easier to qualify for, making them attractive to a broader range of borrowers. However, their inherent limitations regarding loan amounts can restrict access to higher-priced properties in competitive real estate markets. Jumbo loans, on the other hand, offer access to significantly higher borrowing amounts, catering to luxury properties and high-value homes.

This expanded borrowing power comes at a cost, however, as jumbo loans typically involve stricter eligibility requirements, including higher credit scores, larger down payments, and lower debt-to-income ratios. The trade-off between accessibility and purchasing power underscores the importance of understanding your financial profile and aligning it with the appropriate loan type. Furthermore, the interest rate environment plays a critical role in determining the overall cost of both jumbo and conforming loans. Fluctuations in market interest rates can significantly impact affordability and long-term financial planning, making it essential to compare loan offers carefully and consider the long-term implications of interest rate variations. This guide will delve into these aspects, providing clarity and expert insights to help you navigate the complex world of mortgages and make a well-informed decision that aligns with your home buying objectives and overall financial well-being.

Defining Jumbo and Conforming Loans

Conforming loans, the backbone of the U.S. mortgage market, are defined by their adherence to specific loan limits set by the Federal Housing Finance Agency (FHFA). These limits are not static; they are reviewed annually and adjusted to reflect changes in housing prices. The FHFA establishes a baseline conforming loan limit, which for 2023 was $726,200. However, this figure is not uniform across the nation. In areas deemed ‘high-cost,’ where property values significantly exceed the national average, the conforming loan limit is substantially higher, allowing more prospective homebuyers to access conventional financing options.

Understanding these nuances is crucial for anyone navigating the home financing landscape, as it directly impacts the types of loans available. Jumbo loans, in contrast, are designed to finance properties that exceed these established conforming loan limits. They cater to a segment of the market seeking higher-priced real estate, often in affluent urban centers or desirable suburban locations. For instance, a prospective buyer looking at a luxury condominium in Manhattan or a sprawling estate in Silicon Valley would likely require a jumbo loan due to the elevated property values in these regions.

The threshold for a jumbo loan is not fixed; it is directly tied to the FHFA’s conforming loan limits. This means that as conforming limits rise, so does the effective threshold for needing a jumbo loan. It’s important to note that while a jumbo loan enables access to higher-value properties, it also comes with different terms, eligibility criteria, and associated costs compared to conforming loans. The distinction between conforming and jumbo loans extends beyond mere loan amounts.

Conforming loans, because they are guaranteed by Fannie Mae and Freddie Mac, typically offer more favorable interest rates and are more widely accessible to a broader range of borrowers. These government-sponsored enterprises purchase these loans from lenders, freeing up capital and encouraging further lending. This increased liquidity in the market often translates to more competitive interest rates for borrowers and a greater variety of loan products. Private mortgage insurance (PMI) may be required on conforming loans with down payments less than 20%, adding an extra cost.

However, with a 20% down payment, PMI is typically waived, making it an attractive option for those who can afford the upfront investment. Jumbo loans, on the other hand, are not backed by Fannie Mae or Freddie Mac. This lack of government backing introduces more risk for lenders, which translates into stricter eligibility requirements and often, higher interest rates. Borrowers seeking a jumbo loan must demonstrate a strong credit history, a low debt-to-income ratio, and a substantial down payment, typically 20% or more.

Lenders scrutinize these factors more closely due to the higher loan amounts and the greater potential for financial loss. The increased scrutiny and potentially higher costs associated with jumbo loans underscores the importance of careful financial planning and comparison shopping when considering this type of home financing. For those seeking high-end real estate, it’s imperative to navigate the jumbo loan market with an informed approach, understanding its distinct dynamics and potential implications. In the context of personal finance and real estate strategy, understanding the differences between jumbo and conforming loans is paramount.

A potential homebuyer must consider their financial profile, the type of property they are pursuing, and the local real estate market conditions. A first-time homebuyer in a mid-sized city might find a conforming loan sufficient for their needs, while a seasoned investor targeting luxury properties in a high-cost area would likely need to explore jumbo loan options. The interplay between loan limits, interest rates, and eligibility requirements creates a complex landscape that requires careful consideration. A thorough loan comparison, guided by expert advice, is essential to securing the most suitable mortgage and achieving one’s real estate goals.

Interest Rates and Fees

Jumbo loans, exceeding conforming loan limits set by the Federal Housing Finance Agency (FHFA), often come with higher interest rates. This reflects the increased risk lenders assume with these larger loans. Because these loans aren’t backed by government-sponsored enterprises like Fannie Mae and Freddie Mac, lenders bear a greater potential loss if the borrower defaults. This elevated risk translates to a higher cost of borrowing for consumers. For instance, if the conforming loan rate is 6% in a given market, a jumbo loan rate might be 6.5% or higher.

This seemingly small difference can result in tens of thousands of dollars more in interest paid over the life of the loan. Shopping around and comparing rates from multiple lenders is crucial to securing the most favorable terms on a jumbo loan. Consulting with a mortgage broker can streamline this process, as they have access to a wider network of lenders and can help identify competitive offers. Beyond interest rates, fees also play a significant role in the overall cost of borrowing.

While conforming loans have standardized fee structures, jumbo loan fees can vary more widely between lenders. These fees can include origination fees, appraisal fees, and underwriting fees. Borrowers should carefully scrutinize the loan terms and compare the total cost, including all fees, not just the interest rate. For example, a lender offering a slightly lower interest rate might charge higher origination fees, ultimately increasing the overall cost of the loan. A comprehensive loan comparison is essential to identify the most cost-effective option.

The interest rate difference between jumbo and conforming loans is influenced by several market factors, including investor demand for mortgage-backed securities and the overall economic climate. When investor confidence is high, the spread between jumbo and conforming loan rates tends to be narrower. Conversely, during times of economic uncertainty, the spread can widen, reflecting the heightened risk perception associated with jumbo loans. Understanding these market dynamics can help borrowers anticipate potential rate fluctuations and make informed decisions about their home financing strategy.

It also underscores the importance of securing a pre-approval for a jumbo loan, as this locks in the interest rate and protects the borrower from potential rate increases before closing. Debt-to-income ratio (DTI) requirements also tend to be more stringent for jumbo loans. Lenders assess a borrower’s DTI, which compares their monthly debt payments to their gross monthly income, to gauge their ability to manage debt. Jumbo loan applicants often face lower DTI thresholds, requiring them to demonstrate a stronger capacity to repay the loan.

This higher standard reflects the greater financial risk associated with larger loan amounts. For example, while a conforming loan might be approved with a DTI of 43%, a jumbo loan might require a DTI of 36% or lower. Careful budgeting and debt management are crucial for prospective jumbo loan borrowers to meet these stricter requirements. Finally, borrowers considering a jumbo loan should factor in the potential impact of private mortgage insurance (PMI). While typically associated with conforming loans with less than a 20% down payment, PMI can also apply to certain jumbo loan products. This added expense protects the lender in case of borrower default and can significantly increase the monthly mortgage payment. Understanding PMI requirements and exploring options to mitigate this cost, such as making a larger down payment or requesting lender-paid mortgage insurance (LPMI), is essential for managing the overall cost of a jumbo loan.

Eligibility Requirements

The path to securing a jumbo loan is often more challenging than that of a conforming loan, reflecting the increased risk lenders assume with these larger mortgages. Lenders meticulously evaluate a borrower’s financial profile, placing heightened emphasis on credit scores, debt-to-income ratios (DTI), and down payment amounts. For instance, while a conforming loan might be accessible to an applicant with a credit score of 680, a jumbo loan could necessitate a score of 720 or even higher.

This stringent approach ensures that borrowers demonstrate a strong history of responsible credit management and a reduced likelihood of default, aligning with the elevated loan amounts involved in the realm of high-end real estate financing. Debt-to-income ratios are another critical factor in the jumbo loan approval process. Lenders prefer lower DTI ratios, meaning a smaller percentage of your monthly income is allocated to debt obligations. While a conforming loan might tolerate a DTI of 43% or even slightly higher in certain circumstances, jumbo loans often require a DTI below 40%, sometimes as low as 35%.

This requirement directly impacts how much you can borrow, particularly when dealing with the high loan amounts associated with jumbo mortgages. A lower DTI signals to lenders that you have a greater capacity to manage monthly mortgage payments alongside other financial responsibilities, mitigating their lending risks. Down payment requirements for jumbo loans are typically more substantial than those for conforming loans. While some conforming loan programs allow for down payments as low as 3%, jumbo loans often mandate down payments of 20% or more.

This larger initial investment serves as a buffer for the lender, reducing their potential losses in the event of a foreclosure. In the context of home buying, this means that a potential buyer of a $1.5 million home would likely need to provide at least $300,000 upfront, a significant financial hurdle for many. This requirement is a key consideration when comparing loan options, impacting the overall affordability of a higher-priced home. Furthermore, lenders may scrutinize an applicant’s cash reserves more closely when considering a jumbo loan.

They want to ensure that borrowers have sufficient funds beyond the down payment to cover closing costs, property taxes, insurance, and several months of mortgage payments. This buffer provides further security to the lender and demonstrates the borrower’s capacity to withstand unforeseen financial challenges. For instance, a lender might require proof of reserves equivalent to six to twelve months of mortgage payments, in addition to the down payment. This requirement is a critical aspect of the personal finance evaluation, ensuring the long-term viability of the mortgage.

In addition to these core eligibility criteria, lenders may also assess the type and stability of an applicant’s income. Borrowers with consistent and verifiable income streams from employment, investments, or other sources will generally be viewed more favorably than those with inconsistent income. Self-employed individuals, for example, may need to provide more extensive documentation to demonstrate the stability of their earnings. This thorough evaluation ensures that the borrower is well-positioned to meet the ongoing financial obligations associated with a jumbo loan, reflecting the higher stakes involved in these types of mortgages. Understanding these requirements is paramount for anyone navigating the complex landscape of home financing.

Down Payment Requirements

Down payment requirements represent a critical differentiator between jumbo and conforming loans, significantly impacting both upfront costs and long-term financial obligations. While conforming loans offer greater flexibility, often allowing for down payments as low as 3% of the purchase price, jumbo loans typically necessitate a more substantial upfront investment. This can range from 10% to 20% or even higher, depending on the lender and the specific loan product. For prospective homebuyers, understanding these varying requirements is crucial for accurate budgeting and financial planning.

The rationale behind the higher down payment requirement for jumbo loans stems from the increased risk they represent to lenders. As these loans exceed the limits set by the Federal Housing Finance Agency (FHFA), they cannot be sold to Fannie Mae or Freddie Mac, the government-sponsored enterprises that back most conforming loans. This lack of a secondary market makes jumbo loans potentially less liquid and more challenging to manage in the event of default. Consequently, lenders mitigate this risk by requiring borrowers to demonstrate a greater financial stake in the property through a larger down payment.

This also helps to buffer against potential fluctuations in home values. The difference in down payment requirements can translate into significant upfront costs. For instance, on a $1 million home, a 3% down payment for a conforming loan would be $30,000, while a 20% down payment for a jumbo loan would necessitate $200,000. This disparity underscores the importance of careful financial planning when considering a home purchase, particularly in higher price brackets. For borrowers aiming to minimize their initial cash outlay, a conforming loan might be more accessible.

However, those comfortable with a larger upfront investment can unlock access to higher-priced properties through a jumbo loan. Furthermore, the down payment amount influences other aspects of the loan, such as private mortgage insurance (PMI). With conforming loans, PMI is generally required for down payments below 20%. This insurance protects the lender in case of borrower default but adds an extra monthly expense for the homeowner. By contrast, while PMI isn’t typically associated with jumbo loans, lenders may require other forms of insurance or risk mitigation strategies depending on the specific loan terms.

Therefore, understanding the interplay between down payment, PMI, and overall loan costs is paramount for making informed decisions. “Navigating the down payment landscape requires careful consideration of your financial resources and long-term goals,” advises financial advisor, Sarah Miller. “A larger down payment might reduce monthly payments and build equity faster, but it also ties up more capital upfront. Working with a financial advisor can help you weigh these factors and determine the optimal down payment strategy for your unique situation.” Ultimately, the choice between a jumbo and conforming loan hinges on individual circumstances, the desired property, and a comprehensive understanding of the associated financial implications.

Advantages and Disadvantages

Conforming loans, backed by government-sponsored enterprises like Fannie Mae and Freddie Mac, present a more accessible path to homeownership for many due to their adherence to standardized loan limits and underwriting guidelines. This standardization translates to potentially lower interest rates and less stringent eligibility requirements compared to jumbo loans. For instance, a prospective buyer with a solid but not exceptional credit score of 680 and a 10% down payment may find a conforming mortgage readily available, whereas a jumbo loan might be out of reach.

This accessibility is a significant advantage for first-time homebuyers or those with less robust financial profiles, allowing them to enter the housing market without the hurdles associated with higher-value loans. The predictability and wider availability of conforming loans make them a cornerstone of the U.S. mortgage system. Jumbo loans, on the other hand, cater to the higher end of the real estate market, providing the necessary capital for the purchase of more expensive properties that exceed conforming loan limits.

While they unlock access to luxury homes and properties in high-cost areas, the trade-off comes in the form of stricter requirements and typically higher interest rates. Lenders perceive these loans as riskier due to the larger loan amounts, and thus, they demand a more substantial down payment, often 20% or more, a higher credit score, and a lower debt-to-income ratio. For example, a borrower seeking a $1.2 million home might need a credit score of 740 or higher and demonstrate a very low debt burden to qualify for a jumbo loan, whereas a conforming loan for a $600,000 property may be attainable with a score in the low 700s.

The higher risk is reflected in the interest rate, which can be notably higher than that of a conforming loan, significantly impacting the total cost of the mortgage over its term. The difference in interest rates between jumbo and conforming loans is not merely a matter of basis points; it can translate to tens or even hundreds of thousands of dollars over the life of a 30-year mortgage. While the initial interest rate may seem only slightly higher, the increased loan amount inherent in jumbo loans magnifies the impact of even small percentage differences.

Furthermore, fees associated with jumbo loans may also be higher, reflecting the increased complexity and risk assessment involved. Borrowers considering a jumbo loan should meticulously compare offers from multiple lenders to minimize these costs and ensure they are getting the most competitive terms. This diligence is especially important as the long-term financial implications of a mortgage can vary drastically based on these factors. Another significant consideration is the down payment requirement. Conforming loans, particularly those backed by government agencies, can allow for down payments as low as 3%, opening the door to homeownership for individuals with limited savings.

This lower barrier to entry is further facilitated by the option of private mortgage insurance (PMI), which allows borrowers to purchase a home with a smaller down payment, albeit with an added monthly expense. Jumbo loans, however, typically require a much more substantial down payment, often 20% or more. This large upfront investment is a significant hurdle for many potential buyers, necessitating a considerable accumulation of capital before they can qualify for a jumbo loan.

The requirement is a direct reflection of the lender’s desire to mitigate risk and ensure the borrower has a significant stake in the property. Finally, the availability and terms of both jumbo and conforming loans can be influenced by broader economic conditions and market dynamics. During times of economic uncertainty, lenders may tighten their credit standards, making it more difficult to qualify for both types of loans. Interest rates can also fluctuate, impacting the affordability of both conforming and jumbo mortgages. Therefore, prospective homebuyers should not only assess their individual financial situation but also monitor market trends and seek expert advice from mortgage professionals to navigate these complexities effectively. Understanding the interplay between these factors is crucial for making an informed decision about which type of loan best suits one’s needs and circumstances.

Real-World Examples

Let’s illustrate the choice between jumbo and conforming loans with a few scenarios. Imagine a first-time homebuyer aiming to purchase a $500,000 property. In many U.S. locations, this falls within the conforming loan limit. With a 10% down payment of $50,000, they could secure a conforming loan, potentially benefiting from lower interest rates and more flexible underwriting guidelines. This buyer might also explore FHA or VA loan options, further expanding their financing choices. Conversely, consider a buyer targeting a luxury condominium priced at $1.5 million in a major metropolitan area.

This purchase price necessitates a jumbo loan, as it significantly exceeds conforming loan limits. Lenders will scrutinize their financial profile more rigorously, requiring a larger down payment, perhaps 20% or more ($300,000), a higher credit score (potentially above 740), and a lower debt-to-income ratio. The interest rate on this jumbo loan will likely be higher than the conforming loan example, reflecting the lender’s increased risk. This higher rate, coupled with the larger loan amount, will result in substantially higher monthly mortgage payments.

Another factor influencing loan choice is the location of the property. High-cost areas, such as San Francisco or New York City, have higher conforming loan limits. A property priced at $900,000 might qualify for a conforming loan in a high-cost area, whereas it would require a jumbo loan in a location with the baseline conforming loan limit. This geographic variation underscores the importance of understanding local market dynamics. Finally, consider a self-employed borrower. Qualifying for a jumbo loan can be more challenging for self-employed individuals due to the complexities of verifying income. Impeccable credit and substantial financial reserves become even more critical in these situations. These examples highlight how individual financial circumstances, property location, and prevailing market conditions determine the appropriate loan type for each homebuyer. Consulting with a qualified mortgage advisor is crucial to navigate these complexities and secure the most favorable financing terms.”

Conclusion: Seek Expert Advice

Navigating the complex landscape of mortgage financing requires careful consideration of various factors, and seeking expert advice is paramount. A qualified mortgage professional can provide invaluable insights tailored to your unique financial situation. They begin by thoroughly assessing your income, assets, debts, and credit history to determine your borrowing capacity and affordability range. This personalized analysis goes beyond simply pre-qualifying you for a loan; it helps establish a realistic budget for your home purchase, factoring in not just the mortgage but also associated costs like property taxes, insurance, and potential private mortgage insurance (PMI).

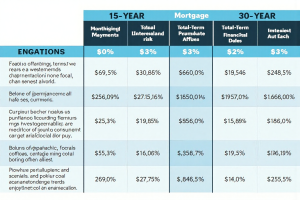

For instance, a mortgage advisor can illustrate how different down payment scenarios on a $750,000 home, comparing a conforming loan with a smaller down payment requiring PMI versus a jumbo loan with a larger down payment, would impact your monthly cash flow and long-term costs. Furthermore, a mortgage professional stays abreast of the ever-changing market conditions, including fluctuating interest rates and loan program availability. They can explain the nuances of jumbo versus conforming loans, comparing interest rate trends, loan limits, and eligibility criteria specific to your target market.

This expert interpretation of market dynamics is crucial in making informed decisions. For example, if interest rates are rising, they can advise on whether locking in a rate now on a conforming loan for a $600,000 property is more advantageous than waiting, or if the potential for slightly lower rates on jumbo loans in the future justifies delaying a purchase of a $1 million property. They can also help you understand how changes in loan limits set by the Federal Housing Finance Agency (FHFA) might affect your loan options.

Comparing loan offers from multiple lenders is a time-consuming process. A mortgage broker can streamline this by presenting you with a range of options from their network of lenders, highlighting the terms, fees, and closing costs associated with each. This allows for a more efficient and transparent comparison, ensuring you secure the most favorable terms. For example, they can compare a conforming loan offer with a 3% down payment and PMI from one lender to a jumbo loan offer from another with a 15% down payment, outlining the total cost of each loan over its lifetime.

Beyond simply securing the loan, a mortgage professional also guides you through the entire closing process, coordinating with underwriters, appraisers, and escrow agents, ensuring a smooth and timely transaction. This expert guidance minimizes stress and allows you to focus on the excitement of purchasing your new home. Finally, a mortgage professional’s value extends beyond the immediate transaction. They serve as a long-term financial advisor, offering guidance on refinancing options, home equity loans, and other financial strategies related to homeownership. This ongoing support ensures you make sound financial decisions throughout your homeownership journey. By consulting a mortgage professional, you gain access to personalized expertise, market insights, and tailored solutions, empowering you to confidently navigate the mortgage process and achieve your homeownership goals.

Post Comment