Unlocking Homeownership: A Comprehensive Guide to Physician and Professional Mortgage Programs

Unlocking Homeownership: A Comprehensive Guide to Physician and Professional Mortgage Programs

Navigating the complex world of mortgages can be particularly daunting, but for physicians, dentists, veterinarians, and other high-earning professionals, specialized loan programs offer a unique and often more accessible pathway to homeownership. These physician loan programs, also known as doctor loans or professional mortgages, recognize the inherent financial stability and promising future earnings potential associated with these professions, providing tailored benefits that traditional mortgages often lack. Unlike conventional loans, these programs are designed to accommodate the unique financial circumstances of medical professionals, such as high student loan debt and relatively short credit histories after years of education and training.

This recognition is crucial in helping these professionals achieve their dream of owning a home sooner rather than later. For instance, a recent graduate with a medical degree might be carrying a significant student loan burden, which could make it difficult to qualify for a conventional mortgage with stringent debt-to-income ratio requirements. However, a physician mortgage, often a no PMI mortgage, might offer more flexible terms, such as a low down payment mortgage option, sometimes even requiring zero down payment.

This is a significant advantage, allowing these professionals to conserve their savings for other needs, such as furnishing their new home or handling unexpected expenses. These programs often understand that a high student loan balance is not necessarily an indicator of poor financial management, but rather a necessary investment in their career. Furthermore, the benefits extend beyond just lower down payments. Many professional mortgage programs also waive the requirement for private mortgage insurance (PMI), which can save borrowers hundreds of dollars each month.

This feature is particularly attractive to medical professionals who are already managing significant financial obligations. Additionally, these loans frequently offer higher loan limits, often classified as jumbo loans, which are essential in competitive real estate markets where the average home price is higher. For a medical professional looking to settle in a specific area, this can be the deciding factor in their ability to purchase a suitable property. The higher loan limits reflect the lender’s confidence in the long-term earning potential of these professionals.

In the realm of real estate, these programs are not just about facilitating home purchases; they are also about enabling professionals to invest in their future and the communities they serve. A dentist, for example, might use a dentist mortgage to purchase a home in the area where they plan to establish their practice, fostering a sense of stability and community engagement. Similarly, a veterinarian might use a veterinarian mortgage to secure a property that allows them to better serve their clients and patients.

These examples illustrate the broader impact of these specialized loans on both the individual and the community. However, it’s crucial to understand that while these programs offer numerous advantages, they are not a one-size-fits-all solution. It’s important for medical professionals to compare offers from multiple lenders specializing in medical professional mortgages, considering factors like interest rates, loan terms, and eligibility requirements. While some programs may offer lower down payments and no PMI, they might come with slightly higher interest rates compared to some conventional loans. Therefore, a thorough assessment of one’s financial situation and a comparison of various offers is essential to secure the most favorable terms. Working with a mortgage broker who specializes in these loans can be incredibly beneficial in navigating these complexities and making an informed decision.

Understanding Physician and Professional Mortgages

Physician and professional mortgages are specialized loan programs tailored to the financial realities of high-earning professionals, particularly those in the medical field, such as physicians, dentists, and veterinarians. These mortgages address the unique challenges these individuals face, such as high student loan debt accumulated during their extensive education, while recognizing their strong earning potential and typically excellent credit histories. Unlike conventional mortgages, these programs offer distinct advantages that can significantly ease the path to homeownership.

These benefits often include lower down payments, sometimes as low as 0%, eliminating the need for private mortgage insurance (PMI), which can be a substantial monthly expense. Additionally, physician and professional mortgages frequently offer higher loan limits, enabling these professionals to purchase homes that align with their income and lifestyle. This feature can be particularly beneficial in competitive real estate markets where larger loan amounts, often referred to as jumbo loans, are required. For example, a doctor starting their practice in a metropolitan area with high property values could leverage a physician loan program to secure the necessary financing for a suitable home.

These programs cater to the specific financial circumstances of medical professionals who may have significant student loan debt but also demonstrate strong earning potential, allowing them to enter the housing market sooner and with greater purchasing power. This is a crucial advantage, as accumulating a down payment while simultaneously servicing substantial student loans can be a major obstacle to homeownership for many young professionals. Furthermore, the underwriting process for these loans often considers the projected income growth trajectory typical in these professions, providing a further advantage over traditional lending models.

For instance, a resident physician might qualify for a loan based on their future earning potential as an attending physician, even though their current income is lower. Finally, some lenders offering physician loan programs streamline the application and approval process, recognizing the demanding schedules and time constraints of medical professionals. This simplified process can reduce the stress and complexity often associated with securing a mortgage, making homeownership more accessible. However, it’s crucial to compare physician mortgage programs with conventional mortgage options and consider factors such as interest rates, closing costs, and long-term financial goals before making a decision. Working with a financial advisor and a mortgage broker specializing in physician loans can provide valuable insights and guidance in navigating these choices.

Eligibility Requirements

Eligibility for physician and professional mortgages hinges on a variety of factors, each carefully considered by lenders to assess financial stability and risk. While specific requirements can vary between institutions and loan programs, several core elements remain consistent. A strong credit score is paramount, often starting at 700 or higher, demonstrating responsible financial behavior and creditworthiness. Lenders view this as a key indicator of a borrower’s ability to manage debt and make timely payments. For example, a physician with a credit score of 760 would be considered a lower-risk borrower compared to one with a score of 680, potentially qualifying for more favorable loan terms.

Debt-to-income ratio (DTI) is another critical factor, reflecting the balance between monthly debt obligations and gross income. Lenders prefer a manageable DTI, typically below 43%, though some physician loan programs may offer flexibility given the high earning potential of these professions. For instance, a dentist with significant student loan debt but a high projected income might still qualify for a physician mortgage with a DTI slightly above the typical threshold. Proof of stable income is essential, often requiring documentation of current employment and income history.

This may involve providing recent pay stubs, tax returns, or employment contracts. Physicians in residency or fellowship programs may need to provide contracts or offer letters outlining future employment and income projections. Loan amounts and down payment requirements vary based on the specific program and lender. Some physician loan programs offer the distinct advantage of no down payment options, allowing medical professionals to enter homeownership sooner without a substantial upfront investment. Others may require a small down payment, often lower than conventional mortgages.

Jumbo loans, designed for higher-priced properties, are also available through physician loan programs, catering to the financial needs of high-earning professionals. For example, a physician purchasing a luxury condominium might utilize a jumbo loan with a 10% down payment, benefiting from the higher loan limits available through these specialized programs. Finally, understanding the nuances of different physician loan programs, such as those specifically for dentists, veterinarians, or pharmacists, is crucial. Each program may have unique eligibility requirements tailored to the specific profession. Consulting with a specialized mortgage broker can provide invaluable guidance in navigating these complexities and identifying the most suitable loan program based on individual circumstances and financial goals. This expert assistance can streamline the application process and ensure borrowers secure the most advantageous loan terms.

Pros and Cons of Physician Mortgages

{“Advantages”: “The allure of physician mortgage programs, often referred to as doctor loans, stems from their significant financial advantages tailored for high-earning professionals. One of the most compelling benefits is the potential for low down payment options, frequently as low as 0%, which drastically reduces the upfront financial burden of homeownership. This is particularly advantageous for recent graduates who may have limited savings due to student loan debt. Moreover, these programs typically waive the requirement for private mortgage insurance (PMI), a substantial saving that can significantly impact monthly payments.

The ability to secure higher loan amounts, often categorized as jumbo loans, allows professionals to purchase homes that might otherwise be financially out of reach. Furthermore, competitive interest rates are often a feature, making these loans an attractive alternative to conventional mortgages. The streamlined application process is another benefit, designed to accommodate the busy schedules of medical professionals and other high-income earners.”,”Disadvantages”: “Despite the compelling advantages, it’s crucial to acknowledge the potential drawbacks associated with physician loan programs.

One notable concern is that while interest rates are often competitive, they might, in some cases, be higher than those offered by certain conventional loans, particularly for borrowers with exceptionally strong credit profiles and larger down payments. This is a critical factor to consider when comparing various mortgage options. Additionally, the eligibility requirements for physician mortgages can be more stringent than those for standard loans, often requiring a high credit score, a low debt-to-income ratio, and proof of stable income.

Furthermore, the availability of these programs can be limited by geographic location, with some lenders not offering them in all areas. It’s also important to note that not all medical or high-earning professions qualify, so verifying eligibility is an essential first step.”,”Additional_Considerations”: “Beyond the basic pros and cons, it’s worth exploring some nuanced aspects of these mortgage programs. For instance, while a low down payment is appealing, it also means that borrowers might build equity slower.

This is a factor to consider when planning long-term financial goals. The absence of PMI, while beneficial, may result in a slightly higher interest rate, as lenders use this to mitigate their risk. Therefore, it’s crucial to weigh the long-term costs and benefits rather than focusing solely on immediate savings. Moreover, the flexibility and terms of these loans can vary significantly between lenders, so a thorough comparison is essential. Some lenders may offer more favorable terms for specific professions or geographic locations, highlighting the importance of shopping around and consulting with a mortgage professional specializing in these types of loans.”,”Real_World_Examples”: “Consider the example of Dr.

Sarah, a newly graduated dentist, who utilized a dentist mortgage to purchase her first home with a 0% down payment. This allowed her to conserve her savings for practice start-up costs and avoid the additional expense of PMI, making her monthly payments more manageable. In contrast, Dr. David, a veterinarian, found that while the interest rate on his veterinarian mortgage was slightly higher than a conventional loan, the flexibility of the program and the absence of PMI made it a better overall financial decision for his situation.

These real-world scenarios highlight that the best choice depends on individual circumstances and financial priorities. Another example could be a pharmacist utilizing a professional loan program to purchase a home in a competitive market where they needed to move quickly and the low down payment and streamlined process were key to their success.”,”Expert_Opinion”: “Financial advisors often emphasize the importance of careful consideration when opting for a physician or professional mortgage. While the benefits are compelling, it’s crucial to assess one’s long-term financial goals and compare all available options.

A mortgage broker specializing in these programs can provide valuable insights and help navigate the complexities of different lender offerings. Experts also caution against over-leveraging, even with the attractive terms of these loans. Borrowers should ensure they can comfortably manage their monthly payments and have a solid plan for managing their overall debt. They recommend a thorough assessment of one’s credit profile and debt-to-income ratio before applying for a no PMI mortgage or a low down payment mortgage. It’s also essential to consider the long-term implications of the loan, including the potential for interest rate fluctuations and changes in the housing market.”

Comparing Lenders

Navigating the lender landscape for physician and professional mortgages requires careful consideration of various factors. Multiple lenders specialize in these unique programs, each offering different terms and conditions tailored to the financial realities of high-earning professionals like physicians, dentists, and veterinarians. It’s crucial to compare offers from several lenders to identify the program that best aligns with your individual needs and financial goals. Don’t settle for the first offer you receive; exploring multiple options can potentially save you thousands of dollars over the life of the loan.

Begin your research by identifying lenders known for their physician and professional loan programs. Some prominent national banks and smaller credit unions specialize in this niche market, offering competitive rates and flexible terms. Look for lenders who understand the unique financial circumstances of medical professionals, such as high student loan debt and the potential for rapid income growth. A lender experienced in this area can offer valuable insights and guide you through the application process more efficiently.

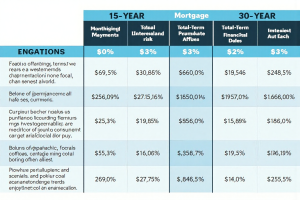

When comparing lenders, prioritize key factors like interest rates, fees, loan terms, and customer service. Interest rates directly impact your monthly payments and the overall cost of the loan. Compare not only the advertised rates but also the annual percentage rate (APR), which includes additional fees and costs. Scrutinize closing costs, including origination fees, appraisal fees, and title insurance. These costs can vary significantly between lenders and add to your upfront expenses. Loan terms, such as the loan duration (15-year, 30-year) and any prepayment penalties, should also be carefully evaluated.

Finally, consider the lender’s customer service reputation. A responsive and helpful lender can make the home-buying process significantly smoother. For instance, some physician loan programs may offer a 0% down payment option, eliminating the need for private mortgage insurance (PMI) and freeing up your savings for other investments. This can be particularly advantageous for doctors just starting their careers who may have limited cash reserves after years of medical training. However, a no PMI mortgage might come with a slightly higher interest rate compared to a conventional loan with a 20% down payment.

Weighing these trade-offs is essential in choosing the best fit for your financial situation. A physician mortgage calculator can be a valuable tool in comparing different loan scenarios and understanding their long-term financial implications. Jumbo loans, often required for higher-priced properties, are also readily available through these specialized programs, catering to the higher borrowing needs of medical professionals. For dentists, veterinarian mortgages offer similar benefits, recognizing the specific financial profiles of these professions. By exploring dentist mortgage and veterinarian mortgage options, these professionals can leverage the advantages of low down payment mortgages and potentially access more favorable loan terms than traditional mortgage programs.

Don’t hesitate to leverage online resources and consult with a mortgage broker specializing in physician and professional loans. These brokers have access to a wide range of lenders and can help you navigate the complexities of these programs, ensuring you secure the most favorable terms possible. They can also offer insights into medical professional mortgage programs tailored to your specific profession, whether you’re a physician, dentist, or another licensed medical practitioner. By conducting thorough research and seeking expert advice, you can confidently navigate the mortgage landscape and unlock the path to homeownership with a physician or professional loan program that meets your unique financial needs.

Tips for Securing the Best Loan Terms

Securing the best loan terms on a physician or professional mortgage requires diligent planning and preparation. It’s more than just getting a pre-approval; it’s about strategically positioning yourself for the most favorable rates, terms, and conditions. Start by understanding your financial landscape. A thorough review of your credit report is crucial. Dispute any inaccuracies and work on improving your credit score, as even a small increase can translate into significant savings over the life of the loan.

Lenders offering physician loan programs and no PMI mortgage options often favor borrowers with scores above 740. Next, calculate your debt-to-income ratio (DTI). A lower DTI demonstrates financial responsibility and increases your attractiveness to lenders. Consider paying down existing debt, especially high-interest credit card balances, to improve this ratio. Having a clear picture of your financial health will empower you to negotiate effectively. Getting pre-approved by multiple lenders is paramount. This allows you to compare interest rates, closing costs, and loan terms side-by-side.

Don’t limit yourself to conventional banks; explore credit unions and lenders specializing in medical professional mortgages, such as doctor loans and dentist mortgages. These specialized lenders often have a deeper understanding of the unique financial circumstances of physicians, veterinarians, and other high-earning professionals. They may offer more flexible underwriting guidelines, particularly regarding student loan debt, which can be a significant factor in traditional mortgage approvals. Comparing offers from various lenders, including those specializing in physician loan programs and low down payment mortgage options, can reveal substantial differences in interest rates and fees, potentially saving you thousands of dollars over the loan term.

Remember, a seemingly small difference in interest rates can have a substantial impact on your long-term costs. Working with a specialized mortgage broker can be invaluable. These brokers have access to a wider range of lenders and can help you navigate the complexities of physician and professional mortgage programs, including jumbo loan options for higher-priced properties. They can also assist with negotiating the best possible interest rate and closing costs on your behalf. A knowledgeable broker understands the nuances of these programs and can advocate for your best interests throughout the entire process.

Be sure to ask potential brokers about their experience with physician loans, professional mortgages, and their familiarity with specific lenders catering to medical professionals. Finally, don’t be afraid to negotiate. While interest rates are often influenced by market conditions, lenders do have some flexibility. Negotiating closing costs, lender fees, and even asking for a slightly lower interest rate can result in substantial savings. By being proactive and informed, you can significantly improve your chances of securing the most advantageous loan terms for your new home.

Consider the long-term implications of your loan choices. While a low down payment mortgage can be attractive, especially for those with limited upfront capital, it’s essential to factor in the potential for higher monthly payments and the added cost of private mortgage insurance if your down payment is less than 20%. Evaluate the trade-offs between a lower down payment and the long-term cost of the loan. A financial advisor can provide personalized guidance based on your individual financial situation. They can help you weigh the benefits of different loan programs, including physician mortgages and no PMI mortgage options, and determine the optimal strategy for your long-term financial goals. Ultimately, securing the best loan terms requires a proactive and informed approach. By taking the time to thoroughly research your options, compare offers, and negotiate effectively, you can pave the way for a successful and financially sound homeownership experience.

Common Misconceptions

Dispelling the Myths Surrounding Physician and Professional Mortgages Several misconceptions prevent eligible borrowers from exploring the benefits of physician and professional mortgage programs. One prevalent myth is the exclusivity of these loans to physicians. While the term “physician loan” is commonly used, these programs often extend to a broader range of professionals, including dentists, veterinarians, pharmacists, and even lawyers. Eligibility criteria vary among lenders, so it’s essential to inquire about specific requirements. For example, some lenders may include physician assistants (PAs) and nurse practitioners (NPs) under their physician loan umbrella, while others might categorize them under a separate professional loan program.

Understanding these nuances is crucial for prospective borrowers. Another significant misconception revolves around interest rates. Some assume that physician loans inherently carry higher interest rates compared to conventional mortgages. While this can be true in certain situations, such as when opting for an adjustable-rate mortgage (ARM) with an initial teaser rate, many physician loan programs offer competitive fixed interest rates, particularly for borrowers with strong credit profiles and substantial down payments. Moreover, the absence of PMI, a common requirement for conventional loans with down payments below 20%, can result in significant long-term savings that often offset any potential difference in interest rates.

A thorough comparison of all associated costs, including closing costs and fees, is vital for informed decision-making. Furthermore, there’s a misconception about the loan amounts available through these specialized programs. Some believe they are limited to standard conforming loan limits. However, many lenders offer jumbo loan options specifically designed for high-earning professionals, allowing them to finance properties exceeding conforming loan limits. These jumbo physician loans provide access to a broader range of properties in competitive real estate markets.

For instance, a physician looking to purchase a high-value property in a metropolitan area can leverage a jumbo physician loan to secure the necessary financing, often with more favorable terms than a conventional jumbo mortgage. Another common misunderstanding pertains to the down payment requirements. While it’s true that physician loans often feature low or no down payment options, some assume this implies a higher risk for the borrower. However, the financial stability and projected earning potential of these professionals are key factors considered by lenders, mitigating the risk associated with lower down payments.

This allows medical professionals to conserve their savings for other significant financial goals, such as student loan repayment or investment opportunities. Finally, some borrowers mistakenly believe that securing a physician loan is a complex and time-consuming process. In reality, many lenders offer streamlined application processes specifically designed for busy professionals. Leveraging the expertise of a mortgage broker specializing in physician and professional loans can further simplify the process, ensuring a seamless transition to homeownership. They can navigate the various program options, compare offers from multiple lenders, and guide borrowers through the necessary documentation and requirements.

Real-Life Examples

Real-life examples illustrate the tangible benefits of physician and professional mortgage programs. Dr. Emily, a recent medical school graduate burdened with substantial student loan debt, utilized a physician mortgage to purchase her first home. The no down payment option, a hallmark of these programs, allowed her to bypass private mortgage insurance (PMI) and conserve her savings for other financial priorities. This exemplifies how physician loan programs empower young professionals to enter the housing market sooner, despite the financial pressures of student loans.

John, an established veterinarian with a growing family, leveraged a professional mortgage to acquire a larger property. The higher loan limits available through these programs, often exceeding conventional mortgage limits, made his dream home a reality. This feature is especially advantageous for high-earning professionals seeking properties in competitive real estate markets. For instance, in a high-cost area like Southern California, John could secure a jumbo loan tailored to his professional status, bypassing the stricter requirements of conventional jumbo financing.

Consider Sarah, a dentist who recently relocated for a promising career opportunity. She secured a physician mortgage with a competitive interest rate and a streamlined application process. The expedited closing timeline allowed her to quickly settle into her new community and focus on her practice. This demonstrates how these programs facilitate career transitions and provide professionals with the financial flexibility to seize new opportunities. Finally, Dr. Maria, a seasoned physician, refinanced her existing mortgage using a physician loan program to access a lower interest rate and shorten her loan term. By leveraging her strong financial profile and the advantages of a professional mortgage, she significantly reduced her total interest paid over the life of the loan, freeing up funds for retirement savings and other long-term financial goals. These diverse scenarios highlight the flexibility and advantages of physician and professional mortgages, catering to the unique needs of medical professionals at various career stages.

Preparing for Homeownership

Preparing for homeownership, especially with specialized financing options like physician and professional mortgages, requires a proactive and informed approach. Improving your credit score is paramount. A higher credit score not only unlocks better interest rates but also strengthens your overall loan application. Review your credit report for inaccuracies, address any outstanding debts, and maintain a healthy credit utilization ratio – ideally below 30%. This demonstrates responsible financial management, a key factor lenders consider. For medical professionals burdened with student loan debt, demonstrating consistent on-time payments and exploring income-driven repayment plans can positively impact your creditworthiness.

Consulting with a financial advisor specializing in physician finance can provide tailored strategies for navigating student loan debt while optimizing your credit profile for mortgage approval. Lowering your debt-to-income ratio (DTI) is another crucial step. Lenders assess your DTI to gauge your ability to manage monthly mortgage payments alongside existing debt obligations. Aim for a DTI of 43% or lower, although some physician loan programs may offer flexibility. Strategies for improving your DTI include paying down high-interest debt, consolidating debt, and increasing your income.

For professionals early in their careers, focusing on student loan management and minimizing additional debt can significantly improve DTI. A financial advisor can help you develop a personalized debt reduction plan and budget optimization strategies. Demonstrating stable income is essential for securing any mortgage, especially specialized programs like physician loans. Lenders prefer a consistent employment history, typically two years or more in the same field. Physicians, dentists, veterinarians, and other professionals often have a clear path to higher earnings, which can be advantageous in securing favorable loan terms.

Provide thorough documentation of your income, including employment contracts, pay stubs, and tax returns. If you’ve recently transitioned to a new practice or have variable income, working with a specialized mortgage broker experienced in physician and professional loans can help present your financial profile effectively to lenders. They understand the nuances of these programs and can advocate for your application. Consulting with both a financial advisor and a specialized mortgage broker is highly recommended. A financial advisor can provide holistic financial planning, addressing debt management, investment strategies, and overall financial health.

A specialized mortgage broker acts as your advocate, navigating the complexities of physician and professional loan programs, comparing offers from multiple lenders, and negotiating the best possible terms. They understand the specific documentation requirements and can streamline the application process. For example, a dentist seeking a no PMI mortgage with a low down payment might benefit from a broker’s expertise in identifying suitable lenders and programs. Similarly, a veterinarian looking for a jumbo loan for a larger property could leverage a broker’s network to secure competitive rates and terms.

Finally, compare loan offers meticulously. Don’t focus solely on the interest rate. Consider closing costs, loan terms, and the lender’s reputation. Understanding the terms and conditions, including any prepayment penalties or adjustable rate features, is crucial. Choosing the program that aligns with your long-term financial goals is paramount. Whether you’re a physician seeking a doctor loan program or a pharmacist exploring professional mortgage options, thorough research and comparison shopping will empower you to make informed decisions and achieve your homeownership goals.

Post Comment