Building Financial Security: Balancing an Emergency Fund with Timely Mortgage Payments

The OFW Financial Tightrope: Balancing Dreams and Debt

For Overseas Filipino Workers (OFWs), the pursuit of financial security is a multifaceted journey, often fraught with unique challenges and opportunities. The dream extends far beyond simply earning a living abroad; it encompasses building a future back home, potentially starting a business, securing a comfortable retirement, and ultimately, owning a piece of the Philippines. This often involves navigating the complex landscape of mortgages, emergency savings, and investment opportunities, a balancing act that can feel like walking a financial tightrope.

This guide provides a practical roadmap for OFWs to effectively manage their finances, focusing on the crucial interplay between building a robust emergency fund and maintaining timely mortgage payments, two cornerstones of a secure financial future. Understanding the nuances of both is paramount to achieving long-term financial stability and realizing those aspirations. The financial pressures faced by OFWs are often amplified by the distance from home and the responsibility of supporting families. Remittances play a vital role in the Philippine economy, but they also underscore the delicate balance OFWs must maintain between their current obligations and future goals.

A mortgage, while representing a significant step towards homeownership, can also become a substantial financial burden if not managed carefully. Simultaneously, building an emergency fund provides a crucial safety net against unforeseen circumstances, such as job loss, medical emergencies, or economic downturns, which can disproportionately impact OFWs due to their unique employment situations. Balancing these competing priorities requires careful planning, disciplined saving, and a clear understanding of personal finance principles tailored to the OFW experience.

Investing wisely is another critical component of the OFW’s financial toolkit. While homeownership through a mortgage is a significant investment, diversifying into other asset classes can further enhance financial security. This might include mutual funds, stocks, bonds, or even starting a small business back home. However, before venturing into investments, establishing a solid emergency fund is crucial. This fund acts as a buffer, protecting against the need to liquidate long-term investments prematurely in times of crisis, thereby preserving the potential for future growth.

Furthermore, a well-funded emergency fund can provide the peace of mind necessary to make sound investment decisions, unburdened by the immediate pressures of financial emergencies. By prioritizing both an emergency fund and a mortgage while exploring sensible investment opportunities, OFWs can create a robust financial foundation for their future and pave the way for achieving their long-term financial goals. This guide will delve into practical strategies and tools to help OFWs navigate these financial complexities and build a secure future for themselves and their families.

One common pitfall for OFWs is prioritizing short-term gains over long-term financial security. The desire to provide immediate support for family members or invest in potentially high-return ventures can sometimes overshadow the importance of building a stable financial base. However, a solid emergency fund and a manageable mortgage are essential building blocks for long-term prosperity. They provide the stability and security necessary to weather unexpected storms and pursue future opportunities with confidence. By focusing on these fundamental elements of personal finance, OFWs can create a strong platform for achieving their long-term financial objectives and building a brighter future. Finally, seeking professional financial advice tailored to the specific needs and circumstances of OFWs can be invaluable. A qualified financial advisor can help navigate the complexities of mortgages, emergency funds, investments, and retirement planning, taking into account the unique challenges and opportunities faced by OFWs. They can provide personalized strategies, risk assessments, and investment recommendations to help OFWs make informed decisions and build a secure financial future.

Building Your Financial Fortress: The Emergency Fund

Building Your Financial Fortress: The Emergency Fund An emergency fund is your financial safety net, crucial for navigating unexpected financial storms. It’s designed to cushion the blow of unforeseen expenses such as medical emergencies, job loss, urgent home repairs, or family crises back home. For Overseas Filipino Workers (OFWs), this safety net takes on added significance, bridging potential income gaps and providing stability in unpredictable circumstances. But how much is enough to truly weather these financial storms?

The conventional wisdom suggests aiming for 3-6 months’ worth of essential living expenses. However, for OFWs, particularly those planning business ventures, a more conservative approach, perhaps closer to 9-12 months, might be warranted. This enhanced buffer accounts for the unique challenges OFWs face, including currency fluctuations, potential repatriation costs, and the inherent risks associated with entrepreneurial endeavors. Calculating your ideal emergency fund requires careful consideration of several factors. Start by meticulously listing all your essential monthly expenses.

This includes rent or mortgage payments, utilities, food, transportation, loan repayments (both in your host country and back home), insurance premiums, and regular remittances to family. For OFWs, this should also include estimated costs for annual trips back to the Philippines and any ongoing financial support provided to family members. Once you have a clear picture of your monthly financial obligations, assess your income stability. How secure is your current job? If you’re in a volatile industry or planning to transition to self-employment, aim for the higher end of the recommended range.

The economic landscape can change rapidly, and having a larger emergency fund provides a stronger safety net during periods of uncertainty. Furthermore, factor in your business planning. If you’re actively planning a business, consider adding a buffer for initial startup costs, unexpected delays, or potential revenue shortfalls during the early stages of your venture. Building a business requires capital, and having a robust emergency fund allows you to navigate the initial challenges without jeopardizing your financial stability or dipping into funds earmarked for mortgage payments.

This separation of funds is critical for maintaining financial discipline and ensuring your long-term financial health. For example, Maria, an OFW nurse in Dubai, spends $1,500 monthly. Considering her stable job and plans to launch a small online business selling Filipino handicrafts, she aims for a $13,500 emergency fund (9 months’ expenses) to cover both living expenses and potential business-related contingencies. Beyond the basic calculation, consider external factors that might impact your financial stability. Global economic downturns, political instability in your host country, or unforeseen changes in immigration policies can all disrupt income streams and necessitate a larger emergency fund.

Additionally, consider any pre-existing financial obligations, such as outstanding debts or supporting aging parents, when determining the appropriate size of your emergency fund. A larger emergency fund offers greater peace of mind and financial resilience in the face of unexpected challenges. It’s a proactive measure that safeguards your financial future and empowers you to pursue your dreams, whether it’s starting a business, investing in property, or securing a comfortable retirement. Finally, remember that building an emergency fund is not a one-time task.

It’s an ongoing process that requires consistent contributions and periodic reassessments. As your life circumstances change, such as getting married, having children, or taking on new financial responsibilities, adjust your emergency fund accordingly. Regularly review your monthly expenses and income to ensure your emergency fund remains aligned with your current needs and financial goals. By prioritizing your emergency fund, you are investing in your financial security and building a solid foundation for a brighter future.

Quick Start Guide: Strategies for Rapid Emergency Fund Growth

Building an emergency fund doesn’t happen overnight. It requires discipline, a strategic approach, and a clear understanding of your financial priorities, especially for Overseas Filipino Workers (OFWs) juggling multiple responsibilities. Think of it as constructing a financial shock absorber, ready to cushion the impact of life’s inevitable bumps. Here are some proven methods to accelerate your emergency fund growth, tailored for the unique circumstances of OFW finance: * **Automate Savings:** Setting up automatic transfers is the cornerstone of consistent savings.

Treat your emergency fund contribution like a non-negotiable bill, similar to your mortgage payments. Many banks offer the option to automatically transfer a fixed amount from your salary account to a dedicated savings account each payday. For OFWs, consider setting up two automated transfers: one to a local Philippine bank account and another to an overseas account, if applicable. This diversifies your savings and provides easier access to funds depending on where the emergency arises.

Even a small, consistent amount, like 5% of your monthly income, can compound significantly over time. * **Side Hustles:** Explore opportunities to earn extra income beyond your primary employment. The digital age offers a plethora of options, from freelancing in your area of expertise (writing, graphic design, virtual assistance) to online tutoring or selling products online through platforms like Etsy or Shopify. For OFWs, consider leveraging your unique skills and cultural background to offer services to both the local and international market.

Dedicate a significant portion, perhaps 50% or more, of this side hustle income directly to your emergency fund. This accelerates your progress and provides an additional layer of financial security. * **Reduce Expenses:** Scrutinize your spending habits and identify areas where you can cut back. Even seemingly small savings can add up substantially over time. Consider cooking more meals at home instead of eating out, reducing entertainment expenses, negotiating better rates on your bills (phone, internet, insurance), and exploring free or low-cost recreational activities.

For OFWs, this might involve finding more affordable housing options, optimizing your remittance strategies to minimize fees, or taking advantage of discounts offered to overseas workers. Every peso saved is a peso that can be channeled towards your emergency fund, bringing you closer to your financial goals. * **The ‘Round-Up’ Method:** This simple yet effective technique involves rounding up your purchases to the nearest dollar (or equivalent currency) and transferring the difference to your emergency fund account.

Several mobile banking apps and personal finance tools can automate this process, making it seamless and effortless. While the individual amounts may seem insignificant, they accumulate surprisingly quickly over time. This is a painless way to boost your savings without drastically altering your spending habits. * **Sell Unused Items:** Decluttering your home or apartment can not only create a more organized living space but also provide a quick cash injection for your emergency fund. Sell items you no longer need or use through online marketplaces, consignment shops, or garage sales.

Clothes, electronics, furniture, and household goods are all potential sources of extra income. OFWs returning home for vacation can use this method to downsize their belongings and generate funds for their emergency savings or business ventures. * **Leverage Tax Refunds and Bonuses:** Treat any unexpected windfalls, such as tax refunds or performance bonuses, as opportunities to supercharge your emergency fund. Instead of splurging on non-essential items, allocate a significant portion, if not all, of these funds to your savings.

This provides a substantial boost to your progress and helps you reach your target emergency fund goal faster. OFWs often receive bonuses or incentives based on their performance, making this a particularly relevant strategy for building financial security. * **Consider a High-Yield Savings Account:** While the primary purpose of an emergency fund is accessibility, consider parking your savings in a high-yield savings account or a money market account to earn a modest return on your money.

While interest rates may fluctuate, these accounts typically offer higher yields than traditional savings accounts, allowing your emergency fund to grow passively over time. Research different options and choose an account that offers both competitive interest rates and easy access to your funds when needed. Remember that the goal is liquidity and safety, not aggressive investment growth. * **Debt Snowball or Avalanche:** While seemingly counterintuitive, addressing high-interest debt can indirectly contribute to your emergency fund.

By paying down debt, you free up more cash flow each month, which can then be directed towards your savings goals. Consider using the debt snowball (paying off the smallest debts first) or the debt avalanche (paying off the debts with the highest interest rates first) method to accelerate your debt repayment and create more financial breathing room. This is particularly important for OFWs who may have accumulated debt to finance their overseas employment or support their families back home. Effective debt management is a crucial component of building long-term financial security.

The High Cost of Delay: Consequences of Missing Mortgage Payments

Missing mortgage payments can trigger a cascade of negative consequences that extend far beyond a simple late fee. These repercussions can severely impact your credit score, incur escalating penalties, and ultimately put you at risk of foreclosure, jeopardizing your dreams of financial security, especially for OFWs who often rely on homeownership as a cornerstone of their long-term financial plans. A damaged credit score can significantly hinder your ability to secure loans in the future, including those crucial for business ventures or further investments.

For OFWs, this can mean delaying or even derailing plans to start a business back home, a common aspiration for many working abroad. Late fees, which can vary depending on the lender and the terms of your mortgage, add to your financial burden, making it increasingly difficult to catch up and regain financial stability. This can create a cycle of debt that becomes harder to escape, diverting funds away from other essential financial goals like building an emergency fund or investing for retirement.

The most severe consequence of missed mortgage payments is foreclosure, a legal process where the lender takes possession of your property. Foreclosure not only results in the loss of your home, a significant financial and emotional setback, but it also severely damages your credit report, making it extremely difficult to obtain future loans or even rent a property. This can be particularly devastating for OFWs who have invested heavily in their homes as a symbol of their hard work and sacrifice.

Imagine an OFW returning home after years of working abroad, only to find their dream home lost to foreclosure. This scenario underscores the critical importance of prioritizing mortgage payments and having a robust financial plan in place. The ripple effect of missed payments extends beyond immediate financial repercussions. A lower credit score can affect your ability to qualify for favorable interest rates on future loans, including car loans, personal loans, and even credit cards. This means you’ll end up paying more in interest over the life of the loan, adding to your overall debt burden.

Furthermore, some employers and insurance companies consider credit scores when making hiring or underwriting decisions, respectively. A poor credit score could potentially limit your job prospects or result in higher insurance premiums. For OFWs, maintaining a healthy credit score is particularly important, as it can impact their ability to access financial products and services both in their host country and back home in the Philippines. Beyond the financial implications, the stress and anxiety associated with missed mortgage payments and the looming threat of foreclosure can take a toll on your mental and emotional well-being.

This can affect your overall quality of life and impact your relationships with family and friends. Therefore, proactively managing your finances, creating a realistic budget, and building a solid emergency fund are crucial steps in mitigating the risk of missed mortgage payments and safeguarding your financial future. For OFWs, seeking financial advice from reputable advisors specializing in OFW financial planning can provide valuable guidance and support in navigating the complexities of mortgages, investments, and emergency planning.

Consider the case of an OFW who diligently saved for years to purchase a condo unit in Manila as an investment property. Due to unforeseen circumstances, such as a family emergency or a sudden job loss, they began missing mortgage payments. This led to a decline in their credit score, making it difficult for them to secure a business loan to start the small restaurant they had always dreamed of. This example illustrates how a seemingly isolated financial setback can have far-reaching consequences, impacting multiple aspects of an OFW’s financial life. By prioritizing timely mortgage payments and establishing a strong financial foundation, OFWs can protect their investments, achieve their financial goals, and secure a brighter future for themselves and their families.

The Balancing Act: Prioritizing Emergency Fund vs. Mortgage

The million-dollar question for Overseas Filipino Workers (OFWs) striving for financial security: where should you prioritize your hard-earned money – building a robust emergency fund or diligently making mortgage payments? The answer isn’t a simple one-size-fits-all; it depends on a confluence of factors unique to your individual circumstances and financial goals. It’s a delicate balancing act that requires careful consideration of interest rates, job security, investment opportunities, and the safety nets you already have in place.

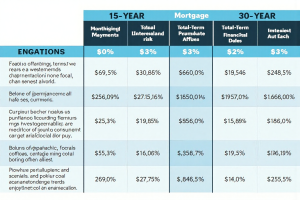

For OFWs, this decision is further complicated by the desire to invest back home, potentially starting business ventures that require significant capital. Therefore, a well-thought-out strategy is paramount. * **Interest Rates:** A high mortgage interest rate can significantly increase the total cost of your home over the loan’s lifetime. In such cases, prioritizing mortgage payments, particularly accelerating principal payments, might be more beneficial in the long run, saving you substantial money on interest. Conversely, a low-interest rate mortgage, especially if it’s lower than potential returns from relatively safe investments, might warrant prioritizing the emergency fund.

For example, if your mortgage is at 3% and you can consistently earn 6% from a diversified investment portfolio, focusing on investments after building a small emergency fund could be a smarter move. Remember to factor in taxes and investment risks when making this calculation. * **Job Security:** The stability of your employment is a critical factor. If your job as an OFW is unstable due to economic conditions in your host country or industry-specific challenges, building a robust emergency fund should take precedence.

This fund acts as a buffer against potential income loss, providing you with the financial runway to find new employment or explore alternative income streams without the added pressure of potentially missing mortgage payments. Consider the current global economic climate and its potential impact on your industry when assessing your job security. * **Alternative Investment Opportunities:** OFWs often have access to unique investment opportunities in their host countries or back home in the Philippines. If you have access to high-yield, relatively low-risk investment opportunities, such as government bonds or dividend-paying stocks, consider allocating funds to those after establishing a basic emergency fund.

The returns from these investments can then be used to further build your emergency fund or accelerate mortgage payments. However, it’s crucial to conduct thorough due diligence and understand the risks associated with any investment before committing your funds. Seek advice from a qualified financial advisor familiar with OFW finance. * **Mortgage Insurance:** Mortgage insurance, such as mortgage redemption insurance (MRI), can provide some protection in case of job loss, disability, or death, ensuring that your mortgage is paid off.

While this offers a degree of security, it’s still not a substitute for an emergency fund. Mortgage insurance typically only covers the mortgage, whereas an emergency fund can be used for a wider range of unexpected expenses, such as medical bills or urgent home repairs not covered by insurance. Think of mortgage insurance as a safety net, but an emergency fund as a comprehensive financial shield. **A Practical Approach:** 1. **Establish a Mini-Fund:** Aim for a small, readily accessible emergency fund of $1,000 – $2,000 as a starting point.

This provides a buffer for minor unexpected expenses and prevents you from resorting to high-interest debt. This initial fund can be built quickly through aggressive budgeting and temporary suspension of non-essential spending.

2. **Prioritize Mortgage Payments:** Ensure you’re consistently making on-time mortgage payments to avoid penalties, late fees, and damage to your credit score. Set up automatic payments to ensure you never miss a due date. A missed mortgage payment can have long-lasting negative consequences on your ability to secure future loans, including those needed for business ventures.

3. **Build the Emergency Fund:** Once your mortgage payments are secure, focus on building your emergency fund to the target amount of 3-6 months’ worth of essential living expenses, or even more if you’re planning to start a business.

Automate savings contributions and explore side hustles to accelerate the process. Consider high-yield savings accounts or money market accounts to earn interest on your emergency fund while maintaining liquidity.

4. **Re-evaluate Regularly:** Review your financial situation regularly, at least every six months, and adjust your priorities as needed. Changes in interest rates, job security, investment opportunities, or personal circumstances may warrant a shift in your strategy. For example, if you receive a significant salary increase, you may choose to allocate more funds to your emergency fund or accelerate mortgage payments. Conversely, if you experience a job loss, you may need to temporarily halt emergency fund contributions and focus on covering essential expenses and mortgage payments. Continuous monitoring and adaptation are key to successful debt management and achieving long-term financial security as an OFW.

Practical Tools and Strategies for Financial Harmony

Practical Tools and Strategies for Financial Harmony: Effectively managing both an emergency fund and mortgage payments requires a structured approach and the right tools. This is especially crucial for OFWs who are often juggling financial obligations both in their host country and back home in the Philippines. Utilizing these tools can empower OFWs to build a secure financial future while meeting their current obligations. Budgeting Tools: Utilize budgeting apps or spreadsheets to track your income and expenses.

This helps you identify areas where you can save money and allocate funds to your emergency fund and mortgage payments. Detailed budgeting allows OFWs to visualize their spending patterns, pinpoint areas for potential savings, and allocate funds effectively towards both short-term needs like emergency funds and long-term goals such as mortgage payments. For instance, an OFW using a budgeting app can quickly identify how much they spend on remittances, international calls, and daily expenses, allowing them to adjust their spending habits and contribute more towards their financial goals.

Debt Management Strategies: Explore strategies to reduce your overall debt burden, such as the debt snowball or debt avalanche methods. This frees up more cash flow for your financial goals. High-interest debt can significantly hinder an OFW’s ability to save and invest. By strategically tackling debt, OFWs can free up more of their income to contribute to their emergency fund and stay on track with mortgage payments. The debt snowball method, focusing on paying off smaller debts first for motivation, can be particularly effective for OFWs dealing with multiple loans.

Communication with Lenders: If you’re facing financial difficulties, communicate with your lender immediately. They may be able to offer temporary solutions, such as a payment plan or forbearance. Open communication with lenders is crucial, especially for OFWs who may experience unforeseen circumstances impacting their ability to meet mortgage deadlines. Proactive communication can prevent further financial complications and potentially lead to mutually beneficial solutions. For example, an OFW struggling with mortgage payments can contact their bank to explore options like loan restructuring or a temporary payment holiday.

Consider Refinancing: If interest rates have dropped, consider refinancing your mortgage to lower your monthly payments. Refinancing can be a valuable tool for OFWs to reduce their long-term mortgage costs. Lower monthly payments can free up funds for other financial priorities, such as boosting an emergency fund or investing in business ventures back home. However, OFWs should carefully evaluate the terms and fees associated with refinancing to ensure it aligns with their overall financial strategy.

Seek Financial Advice: Consult with a qualified financial advisor who can provide personalized guidance based on your specific circumstances. A financial advisor can offer tailored strategies for OFWs, considering their unique financial situation, investment goals, and risk tolerance. They can assist with developing a comprehensive financial plan that encompasses emergency funds, mortgage management, investment strategies, and retirement planning, ensuring a secure financial future for OFWs and their families. Investing Wisely: Beyond an emergency fund and mortgage, OFWs should consider diversifying their savings through investments.

This could include mutual funds, bonds, or even real estate back in the Philippines. Diversification helps mitigate risk and potentially generates higher returns, contributing to long-term financial security. Automating Savings: Set up automatic transfers from your salary account to dedicated savings accounts for both your emergency fund and mortgage payments. This automated approach ensures consistent contributions and instills financial discipline. For OFWs, automating savings can be particularly beneficial as it simplifies the process of managing finances across different countries and currencies.

Securing Your Future: A Final Word on Financial Balance

Balancing an emergency fund with timely mortgage payments is a cornerstone of long-term financial security, especially for Overseas Filipino Workers (OFWs) juggling the complexities of international employment, family obligations back home, and aspirations for business ventures. This balancing act requires a nuanced understanding of both, a strategic financial plan, and the right tools to navigate the often-turbulent waters of personal finance. By prioritizing both, OFWs can build a solid foundation for their future success and mitigate the financial risks inherent in their unique circumstances.

For OFWs, the dream of owning a home in the Philippines is often a primary motivator. A mortgage facilitates this dream, but it also represents a significant financial commitment. Ensuring timely mortgage payments safeguards not only your homeownership but also your credit score, a crucial factor for future loan approvals, particularly for those entrepreneurial OFWs looking to finance business ventures. Defaulting on mortgage payments can trigger a domino effect of negative consequences, from late fees and penalties to potential foreclosure, jeopardizing years of hard work and investment.

Therefore, consistent and timely mortgage payments should be a non-negotiable element of any OFW’s financial plan. Consider setting up automatic payments to eliminate the risk of accidental delays and maintain a positive payment history. However, mortgage payments shouldn’t come at the expense of a robust emergency fund. This fund acts as a financial buffer against unforeseen circumstances like medical emergencies, job loss, or unexpected family needs back home. For OFWs, this safety net is even more critical given the potential disruptions associated with international employment, currency fluctuations, and the added responsibilities of supporting family members.

A well-funded emergency fund provides peace of mind and the financial flexibility to weather unexpected storms without derailing long-term goals. Experts recommend aiming for 3-6 months of essential living expenses, but OFWs, especially those planning business ventures, should consider a larger buffer to account for the added financial uncertainties. This might involve temporarily scaling back on investments or exploring side hustles to accelerate the growth of their emergency fund. The optimal balance between prioritizing mortgage payments and building an emergency fund depends on individual circumstances, such as interest rates, existing debt, and personal risk tolerance.

If your mortgage carries a high interest rate, prioritizing extra payments can significantly reduce the total interest paid over the life of the loan. Conversely, a low-interest mortgage might allow for a greater focus on building a substantial emergency fund. Consult with a financial advisor to determine the best approach for your specific situation. Leverage budgeting apps and online tools to track your income and expenses, identify areas for potential savings, and allocate funds effectively. Regularly review your financial progress, adjust your strategies as needed, and stay committed to your goals. Financial stability is not a destination; it’s an ongoing journey that requires consistent effort, informed decisions, and a proactive approach to managing your resources. By diligently balancing mortgage payments with a healthy emergency fund, OFWs can pave the way for a secure financial future and realize their dreams of homeownership and entrepreneurial success.

Post Comment