Best Mortgage Options for Creative Professionals (2024)

Securing Your Creative Haven: A Guide to Mortgages for Creative Professionals

Navigating the world of homeownership as a creative professional presents unique challenges. The often unpredictable nature of freelance work, project-based income, and fluctuating earnings can make securing a traditional mortgage difficult. Banks often prefer the stability of a W-2 employee, making it harder for artists, designers, writers, musicians, and other self-employed individuals to qualify for mortgages for freelancers. This guide explores the best mortgage options available in 2024 specifically tailored for creative professionals, offering insights and resources to help you achieve your homeownership dreams.

We aim to provide clarity and actionable steps, transforming the often-opaque mortgage process into a manageable journey toward owning your creative haven. The core issue lies in income verification. Traditional mortgages rely heavily on pay stubs and tax returns that reflect consistent, predictable income. For a freelancer whose income might surge one month and dip the next, these documents can paint an inaccurate picture of their financial health. Imagine an artist who sells a large painting one month but has minimal sales the next; a standard income verification process might not capture the overall financial stability.

This is where understanding alternative mortgage options becomes crucial for creative professional home loans. Fortunately, the mortgage landscape is evolving, with lenders increasingly recognizing the unique financial realities of self-employed individuals. Several innovative solutions are emerging, including bank statement mortgages, which allow lenders to assess your borrowing potential based on your cash flow rather than strict income verification. These mortgages for artists and other creatives often require 12 to 24 months of bank statements to demonstrate consistent income.

Furthermore, some lenders are now offering specialized programs tailored to specific creative industries, understanding that income patterns can vary significantly between, say, a graphic designer and a musician. Beyond alternative income verification, exploring low down payment mortgages can also be beneficial for first-time homebuyer creatives. Saving for a substantial down payment can be a significant hurdle, especially when managing fluctuating income. Several programs, including those offered by the FHA and certain state-level initiatives, offer options with down payments as low as 3% or even less.

Combining these programs with creative mortgage solutions can significantly improve accessibility to homeownership. Remember to research and compare different lenders to find the best mortgage lenders for creatives who understand your unique circumstances and offer competitive rates. In 2024, the key to securing a mortgage as a creative professional is to be informed and proactive. Understand your financial situation, explore all available mortgage options, and be prepared to present a comprehensive picture of your financial health to potential lenders. Consulting with a mortgage broker who specializes in self-employed mortgages can provide invaluable guidance, helping you navigate the complexities of the mortgage market and find the best path to realizing your homeownership dreams. By taking these steps, you can confidently navigate the mortgage process and secure the creative haven you deserve.

Exploring Mortgage Options Tailored for Creatives

Traditional mortgages often rely heavily on W-2 income verification, a significant hurdle for many creative professionals, freelancers, and self-employed individuals whose income streams are often project-based and variable. This reliance on consistent, easily documented income can exclude artists, designers, writers, musicians, and other creatives, even those with substantial earnings. Fortunately, alternative mortgage options exist that cater specifically to those with non-traditional income structures, offering pathways to homeownership that bypass the rigid requirements of conventional loans.

Understanding these alternatives is crucial for creative professionals seeking to realize their dream of owning a home. Bank Statement Loans offer a viable solution, allowing you to qualify based on the cash flow demonstrated in your personal or business bank accounts. Lenders typically require 12-24 months of bank statements to assess your average monthly income and spending habits. This approach is particularly beneficial for freelancers and self-employed creatives who may not have a consistent salary but can demonstrate a steady stream of income through their business activities.

For instance, a graphic designer with fluctuating monthly earnings can use their bank statements to showcase a consistent annual income, even if individual months vary significantly. These loans recognize the unique financial realities of the creative economy. No-Income Verification Loans, also known as asset-based loans, present another option, although they typically come with higher interest rates to compensate for the increased risk to the lender. These loans focus more on your assets, such as savings, investments, and other properties, rather than your current income.

While they offer a solution for those with limited traditional income documentation, it’s crucial to carefully consider the long-term financial implications due to the higher interest costs. Creative professionals should weigh the benefits of immediate homeownership against the potential strain on their finances over the life of the loan. Responsible financial planning is key when considering this type of mortgage. FHA loans, insured by the Federal Housing Administration, offer lower down payment options and more flexible credit requirements, making them accessible for many first-time homebuyers, including creatives.

These loans can be particularly attractive for artists or musicians just starting their careers, as they require a smaller upfront investment. For example, a freelance photographer could potentially qualify for an FHA loan with a down payment as low as 3.5%, significantly reducing the initial financial burden of homeownership. Furthermore, FHA loans can be more forgiving of past credit issues than conventional mortgages, providing a pathway to homeownership for creatives who may have experienced financial setbacks.

VA loans, guaranteed by the Department of Veterans Affairs, are an excellent option for eligible veterans who are also creative professionals. These loans often require no down payment and offer competitive interest rates, making them an incredibly valuable benefit for veterans seeking to purchase a home. A veteran who is also a freelance writer, for instance, could leverage their VA loan eligibility to secure a mortgage with favorable terms, regardless of their fluctuating income. VA loans recognize the service of veterans and provide a significant advantage in the home buying process.

Portfolio and Non-QM loans provide additional flexibility for creative professionals with unique financial situations that fall outside the guidelines of traditional mortgages. Portfolio loans are held by the lender rather than being sold to the secondary market, allowing for more customized underwriting criteria. Non-QM (Non-Qualified Mortgage) loans also offer more flexibility, catering to borrowers who may not meet the strict requirements of qualified mortgages. For example, a self-employed filmmaker with a complex business structure or a less-than-perfect credit history might find a suitable option through a portfolio or Non-QM loan. These options acknowledge the diverse financial profiles within the creative community and offer tailored solutions for those who don’t fit the conventional mold. Seeking out lenders specializing in these types of mortgages is essential for creatives with unique circumstances.

Strengthening Your Application: Tips for Mortgage Approval

Strengthening Your Mortgage Application: Tips for Creative Professionals Boosting your mortgage approval odds requires a proactive approach, especially for creative professionals whose income streams may differ from traditional W-2 employees. Maintaining a healthy credit score is paramount. Pay all bills on time, keep credit card balances low, and address any outstanding debts promptly. A good credit score demonstrates financial responsibility and can significantly impact your mortgage terms. For example, a score above 740 could unlock access to lower interest rates and better loan options, saving you thousands of dollars over the life of your mortgage.

Regularly review your credit report for errors and address any discrepancies immediately. Meticulous income documentation is crucial for freelancers and artists. Traditional lenders often rely on W-2s, but creative professionals can showcase their income stability by providing comprehensive records. Compile 12-24 months of bank statements showing consistent deposits, alongside profit and loss statements, tax returns (including Schedule C for sole proprietors), and 1099 forms. Consider organizing your income sources by project or client, providing a clear narrative of your earnings.

If you have recurring contracts, highlight these to demonstrate a steady income stream. For instance, a graphic designer with a retainer contract from a major brand can showcase this as proof of consistent income. Reducing your debt-to-income ratio (DTI) is another key factor. Lenders assess your DTI by dividing your monthly debt payments by your gross monthly income. A lower DTI indicates greater financial stability and improves your chances of approval. Prioritize paying down high-interest debts like credit card balances and consider consolidating debt into a single lower-interest loan.

Avoid taking on new debt during the mortgage application process, as this can negatively impact your DTI and potentially derail your application. For creatives with student loans, exploring income-driven repayment plans can help lower monthly payments and improve DTI. Beyond these core steps, consider building a strong financial reserve. Having a substantial amount in savings demonstrates financial stability and your ability to weather unexpected expenses. Lenders view this favorably, especially for self-employed individuals. For example, having three to six months of mortgage payments saved can provide a cushion and reassure lenders of your ability to manage your housing costs.

Also, thoroughly research different mortgage options, including bank statement loans and no-income verification loans, which cater specifically to self-employed borrowers. Consulting with a mortgage broker specializing in loans for freelancers and artists can provide valuable guidance and connect you with lenders who understand the nuances of creative professional income. These brokers can help you navigate the complexities of the mortgage process and find the best fit for your individual circumstances. Finally, if you’re a first-time homebuyer, explore down payment assistance programs specifically designed for creatives and freelancers, which can help make homeownership more accessible.

These programs can offer grants or low-interest loans to cover a portion of your down payment, reducing the initial financial burden. By taking these steps, creative professionals can strengthen their financial profile and confidently pursue their homeownership dreams in 2024. Remember to stay informed about current mortgage options and industry trends, as the landscape can change quickly. With careful planning and preparation, securing a mortgage as a creative professional is achievable, paving the way to a secure and inspiring creative haven.

Finding the Right Lender: Resources and Support

Navigating the mortgage landscape as a creative professional requires a strategic approach, starting with finding the right lender. Many mainstream banks adhere to strict income verification guidelines that may not accommodate the fluctuating income streams common among freelancers and artists. Therefore, seeking lenders specializing in serving the self-employed and creative professionals is crucial. These lenders understand the nuances of project-based income, royalty payments, and the entrepreneurial spirit that drives creative careers. They offer tailored loan products, such as bank statement mortgages and no-income verification loans, designed to assess financial stability based on alternative metrics.

For example, a graphic designer with a strong history of consistent deposits from various clients over the past two years could leverage a bank statement loan to secure a mortgage, even without traditional W-2s. Seek out lenders who advertise “mortgages for freelancers” or “creative professional home loans” as a starting point. Consultations with mortgage brokers can also prove invaluable. Brokers act as intermediaries between borrowers and lenders, leveraging their network to connect creative professionals with institutions offering the best mortgage options for their unique circumstances.

They possess in-depth knowledge of the mortgage market, including niche products like “no-income verification mortgages” or “low down payment mortgages” specifically suited for first-time homebuyer creatives. A broker can guide you through the application process, offering expert advice on optimizing your application and negotiating favorable terms. Think of a mortgage broker as your personalized financial strategist in the home-buying journey. For instance, a freelance musician might benefit from a broker’s expertise in navigating the complexities of a “bank statement mortgage,” ensuring all income sources are appropriately documented and presented to the lender.

Beyond individual lenders and brokers, numerous online resources and industry associations provide valuable support. Websites specializing in “self-employed mortgages” and “2024 mortgage options” offer comprehensive guides, calculators, and lender directories. Professional organizations for artists, writers, and other creative fields often provide financial literacy resources and may even partner with lenders to offer exclusive mortgage programs. These resources can be instrumental in understanding the current market trends and identifying the “best mortgage lenders for creatives.” Thorough research and networking within your creative community can unveil hidden gems and connect you with professionals who understand the specific financial challenges and opportunities inherent in creative careers. Leveraging these resources can significantly streamline the process of securing a mortgage and empower you to confidently pursue your homeownership dream.

Realizing Your Homeownership Dream: Next Steps

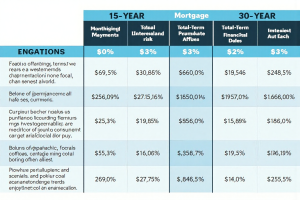

Realizing your dream of homeownership as a creative professional requires a strategic approach, blending financial preparation with an understanding of specialized mortgage options. It’s more than just finding a house; it’s about building a secure foundation for your creative endeavors. Begin by thoroughly researching available mortgage options, focusing on those tailored to fluctuating incomes. Bank statement mortgages, for example, offer a viable path by assessing your income based on cash flow rather than traditional W-2s.

Similarly, no-income verification mortgages, while potentially carrying higher interest rates, can provide access to homeownership when traditional documentation proves challenging. Understanding the nuances of these options, including their qualification requirements and potential risks, is crucial. For instance, lenders offering bank statement loans may require 12-24 months of statements and may scrutinize the regularity of your deposits. Consulting with a mortgage broker specializing in freelancers or self-employed individuals can prove invaluable during this process. They can provide personalized guidance, connect you with suitable lenders, and help you navigate the often complex application process.

Improving your financial profile significantly strengthens your mortgage application. Start by diligently managing your credit score. Pay bills on time, minimize outstanding debt, and address any discrepancies on your credit report. Meticulously document all income streams, even if they come from diverse projects or clients. Maintain detailed records of invoices, contracts, and payment confirmations. This comprehensive documentation reassures lenders of your consistent earning capacity. Consider exploring low down payment mortgage options specifically designed for first-time homebuyers, which can ease the initial financial burden.

Remember, owning a home provides more than just shelter; it’s an investment in your future and a testament to your creative success. Connect with industry associations like the Freelancers Union or the National Association of Independent Artists for additional resources and support tailored to the creative community. These organizations often offer valuable insights on financial planning, homeownership, and navigating the unique challenges faced by creative professionals. Finally, take the time to compare interest rates, loan terms, and lender fees from multiple sources.

Don’t hesitate to negotiate to secure the most favorable terms. By understanding the 2024 mortgage landscape and leveraging the resources available, you can confidently transform your homeownership dream into a tangible reality, establishing a stable and inspiring space for your creative pursuits. Securing the best mortgage for your circumstances as a creative professional involves careful planning, thorough research, and the right support system. By taking these proactive steps and arming yourself with knowledge, you can navigate the mortgage process with confidence and achieve your homeownership goals, creating a dedicated space to nurture your creativity for years to come.

Post Comment