Navigating Multi-Family Mortgage Qualification: A Step-by-Step Guide for Investors

Introduction: Entering the World of Multi-Family Mortgages

Investing in multi-family properties presents a compelling avenue for wealth creation, offering both consistent cash flow and long-term appreciation potential. However, unlike single-family homes, navigating the financing landscape for these investments requires a more nuanced understanding of specialized mortgage products and underwriting criteria. Securing the right financing is paramount to a successful investment strategy, and this guide provides a step-by-step approach to navigating the multi-family mortgage qualification process, offering valuable insights for both new and experienced investors.

Whether you’re considering a small duplex or a large apartment complex, understanding the intricacies of multi-family mortgage qualification is crucial for maximizing returns and mitigating risks. The world of multi-family financing offers a diverse range of options, each with its own set of advantages and disadvantages. Conventional loans, typically offered by banks and credit unions, often require larger down payments and stricter qualification standards, but they can provide competitive interest rates for well-qualified borrowers. Government-backed loans, such as those offered by the FHA, can be more accessible to investors with lower down payments, but they come with specific property and occupancy requirements.

Portfolio lenders, who retain loans on their books rather than selling them on the secondary market, offer greater flexibility in underwriting, which can be beneficial for investors with unique or complex investment strategies. Understanding the nuances of these various financing options is crucial for tailoring your approach to your specific investment goals. Furthermore, the qualification process for multi-family mortgages differs significantly from that of residential mortgages. Lenders scrutinize not only the investor’s personal financial standing, but also the projected financial performance of the property itself.

Metrics such as the debt service coverage ratio (DSCR), which measures the property’s ability to generate sufficient income to cover its debt obligations, play a critical role in the lender’s decision-making process. This requires investors to develop comprehensive financial projections, demonstrating the property’s potential for profitability and long-term sustainability. A thorough understanding of these key financial metrics is essential for presenting a compelling case to potential lenders and securing favorable loan terms. This guide will delve into the key lender criteria, essential documentation, and strategic considerations for navigating the multi-family mortgage qualification process, empowering investors to make informed decisions and achieve their investment objectives. From analyzing property types and understanding lender requirements to exploring financing options and overcoming common challenges, this guide will provide a comprehensive roadmap to securing the financing you need to succeed in the multi-family real estate market.

Understanding Multi-Family Property Types

Multi-family properties present a diverse range of investment opportunities, spanning from smaller duplexes and triplexes to expansive apartment complexes. Each property type carries distinct mortgage implications that significantly influence loan terms, down payment requirements, and prevailing interest rates. A clear understanding of these nuances is paramount for making well-informed investment decisions. For instance, a duplex might be considered a residential loan by some lenders, allowing for lower down payments and potentially more favorable interest rates compared to a larger complex classified as commercial real estate.

This distinction underscores the importance of early research and consultation with mortgage professionals. Investors must carefully analyze their financial capacity and investment goals in relation to the specific property type they are considering. The scale of the investment, from a smaller multi-family dwelling to a large complex, dictates not only the financial commitment but also the complexities of property management and potential returns. Navigating these considerations strategically is crucial for long-term success in multi-family real estate investing.

One key differentiator lies in the financing approach. Smaller multi-family properties, like duplexes and triplexes, are often financed through conventional residential mortgages, similar to single-family homes. These loans typically require lower down payments, ranging from 15% to 20%, and offer competitive interest rates. As the number of units increases, the financing landscape shifts towards commercial real estate loans, which often entail stricter underwriting standards, higher down payment requirements (25% or more), and potentially higher interest rates.

This shift reflects the increased complexity and risk associated with managing larger properties. For example, securing a mortgage for a 20-unit apartment building requires a more substantial down payment and a more rigorous demonstration of the investor’s financial stability and experience in property management. Understanding these financing dynamics is fundamental to crafting a viable investment strategy. Furthermore, the property type influences the lender’s assessment of potential cash flow and risk. Lenders scrutinize the property’s potential to generate rental income to cover mortgage payments and other expenses.

Larger apartment complexes, while potentially more lucrative, also carry higher operating costs and vacancy risks. Therefore, investors must present a comprehensive financial analysis, including projected rental income, operating expenses, and market vacancy rates, to demonstrate the property’s viability and secure favorable loan terms. A well-prepared investor will engage in thorough due diligence, including a detailed property inspection, market analysis, and financial projections, to mitigate potential risks and maximize the chances of mortgage approval. This careful planning is essential for successfully navigating the complexities of multi-family property financing and achieving long-term investment goals. Moreover, working with experienced real estate professionals, such as mortgage brokers specializing in multi-family properties, can provide valuable guidance and access to a wider range of financing options tailored to the specific needs of the investor and the characteristics of the chosen property type. Their expertise can prove invaluable in navigating the complexities of commercial real estate loans and ensuring a smooth and successful investment process.

Key Lender Criteria: What You Need to Qualify

Lenders meticulously evaluate several financial factors when assessing multi-family mortgage applications, with a particular focus on mitigating risk. The core criteria revolve around the borrower’s financial stability and the property’s potential for generating consistent income. A primary consideration is the applicant’s credit score, which serves as a critical indicator of their past financial responsibility. A higher credit score, typically above 700, not only increases the likelihood of loan approval but also unlocks more favorable interest rates and loan terms.

For instance, a borrower with a score of 750 may qualify for a commercial real estate loan with a significantly lower interest rate compared to someone with a score of 650, directly impacting the profitability of the investment. This emphasizes the need for investors to proactively manage their credit profiles before seeking multi-family property loans. Debt-to-income ratio (DTI) is another pivotal metric that lenders scrutinize. DTI, calculated by dividing total monthly debt payments by gross monthly income, reflects an applicant’s ability to manage their existing debt obligations.

A lower DTI, generally below 40%, signifies a healthier financial position and demonstrates that the borrower has sufficient cash flow to service the new multi-family mortgage. For instance, an investor with a high DTI due to existing personal loans and credit card debt might face challenges in obtaining favorable terms for an apartment loan. Lenders often prefer applicants with a proven track record of managing debt responsibly, as this indicates a reduced risk of default.

Therefore, managing personal debt and optimizing DTI is a crucial step in preparing for investment property financing. Beyond credit and DTI, reserve requirements play a crucial role in securing a multi-family mortgage. Lenders mandate that borrowers maintain a certain level of liquid assets, typically equivalent to several months of mortgage payments, property taxes, and insurance. These reserves act as a financial safety net, providing a cushion against unexpected vacancies, repairs, or other unforeseen circumstances that might impact the property’s cash flow.

For example, an investor seeking a multi-family mortgage may be required to show proof of reserves equivalent to six months of mortgage payments. This ensures that the investor can continue to meet their financial obligations even if the property experiences temporary vacancies or requires unexpected maintenance. These reserve requirements are a key component of mitigating risks for both the lender and the borrower in the commercial real estate loans arena. Furthermore, lenders often assess the experience of the borrower in real estate investing, particularly in managing multi-family properties.

Prior experience in property management or a proven track record of successful real estate investments can significantly strengthen an application. Lenders perceive experienced investors as lower risk due to their familiarity with the complexities of property ownership and management, and they may be more willing to offer favorable terms. For example, an investor with a history of successfully managing similar-sized multi-family properties may find it easier to secure financing than a first-time investor with limited experience.

This consideration highlights the value of building a solid portfolio of real estate investments as a foundation for future multi-family acquisitions. Finally, the property’s financial performance is a critical component of the mortgage qualification criteria. Lenders will scrutinize the property’s current and projected income, operating expenses, and occupancy rates. A property with strong cash flow, low vacancy rates, and a history of stable income is more likely to secure favorable financing. For instance, a property with a high occupancy rate and consistent rental income will be viewed more favorably than a property with high vacancies and fluctuating income. This underscores the importance of due diligence in property selection, ensuring that investors choose assets that meet stringent lender requirements for multi-family property loans and align with their overall investment strategies.

Essential Documentation for Mortgage Applications

Gathering the necessary documentation is not merely a formality but a critical step that can significantly impact the speed and success of your multi-family mortgage application. Lenders meticulously scrutinize these documents to assess the risk associated with providing investment property financing. Income verification, for example, goes beyond simply providing pay stubs; it often requires a detailed look at your business income, rental income from other properties, and any other sources of revenue. This is especially true for seasoned real estate investing professionals whose income streams might be more complex than a typical salaried employee.

Having these documents organized and readily available, including multiple years of tax returns and detailed profit and loss statements, can expedite the approval process and demonstrate your preparedness as a borrower. Property appraisals are another crucial component of the documentation process, and they are far more detailed than those for single-family homes. For multi-family properties, the appraisal assesses not only the physical condition and market value of the building but also its income-generating potential. Lenders want to ensure that the property can generate sufficient cash flow to cover the mortgage payments.

This involves analyzing comparable sales data, rental rates in the area, and the overall condition of the building. A thorough appraisal report, prepared by a licensed commercial real estate appraiser, is vital for securing favorable terms for your apartment loans or multi-family property loans. Any discrepancies or issues noted in the appraisal could lead to delays or even denial of the loan, making it imperative to select a qualified and reputable appraiser. Financial statements, including balance sheets and cash flow statements, provide lenders with a comprehensive overview of your financial health and ability to manage a multi-family property.

These statements must be accurate and up-to-date, reflecting all assets, liabilities, and income streams. Lenders will pay close attention to your debt-to-income ratio (DTI) and your net operating income (NOI) from the property. A healthy DTI and a strong NOI are key indicators of your financial stability and ability to handle the financial obligations of the mortgage. For instance, a high DTI might raise red flags for lenders, suggesting that you may be overextended financially.

Therefore, ensuring that your financial statements are meticulously prepared and reflect a strong financial position is paramount for securing commercial real estate loans. Tax returns, typically spanning the past two to three years, offer lenders a historical perspective on your financial performance and tax liabilities. These documents are used to verify the income reported in your financial statements and to assess your overall financial responsibility. Lenders will scrutinize your tax returns for any inconsistencies or red flags, such as significant fluctuations in income or deductions that may impact your ability to repay the loan.

Moreover, they will assess your tax planning strategies, looking for evidence that you have structured your finances in a way that maximizes your investment potential while complying with tax laws. For multi-family mortgage qualification criteria, tax returns provide a critical layer of verification that lenders rely on for risk assessment. Therefore, maintaining accurate and consistent tax records is essential for a smooth loan approval process. Beyond the standard documents, lenders might also request additional information specific to the property or the borrower.

This could include rent rolls, lease agreements, environmental reports, or even business plans outlining your investment strategy for the property. For example, if you are planning renovations or significant improvements, lenders may want to see detailed cost estimates and timelines. The key to successfully navigating the documentation process is to be proactive, organized, and transparent. By anticipating the lender’s needs and providing all necessary information upfront, you can significantly increase your chances of securing favorable financing for your multi-family investment.

Exploring Multi-Family Financing Options

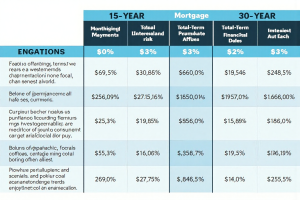

Investors seeking to finance multi-family properties have a range of options available, each with its own set of advantages and disadvantages. Understanding these nuances is crucial for making informed decisions that align with individual investment strategies. Conventional loans, a popular choice for their competitive interest rates and flexible terms, are offered by banks and private lenders. These loans typically require a larger down payment, often 20-25%, but offer long-term amortization periods, which can help manage cash flow.

For example, an investor purchasing a $1 million apartment complex might expect a down payment of $250,000 with a conventional loan. FHA loans, insured by the Federal Housing Administration, are another viable option, particularly for investors with lower down payment capabilities. FHA loans often require as little as 3.5% down, making them accessible to a broader range of investors. However, they come with certain restrictions, such as property size limitations and mandatory mortgage insurance premiums.

For instance, an FHA loan might enable an investor to acquire a four-unit property with a significantly lower upfront investment compared to a conventional loan. Portfolio lending, offered by smaller banks and credit unions, provides greater flexibility in underwriting criteria. These lenders often consider factors beyond traditional metrics, such as the property’s potential cash flow and the investor’s experience, making them a suitable option for investors with unique circumstances or non-conforming properties. For example, an experienced investor with a strong track record might secure a portfolio loan for a value-add property with significant upside potential, even if it doesn’t fully meet conventional lending standards.

Choosing the right financing option hinges on a variety of factors, including the investor’s financial strength, risk tolerance, and investment goals. Working with an experienced mortgage broker can provide invaluable guidance in navigating these options and securing the most favorable terms. They can help investors compare loan products, assess eligibility requirements, and negotiate competitive interest rates. Ultimately, understanding the landscape of multi-family financing options is paramount to successful real estate investing. Commercial real estate loans, specifically designed for properties with five or more units, often have different underwriting criteria compared to residential loans.

These loans typically emphasize the property’s net operating income (NOI) and debt service coverage ratio (DSCR), reflecting the lender’s focus on the property’s ability to generate sufficient income to cover the loan payments. Investors considering larger multi-family properties should be prepared to provide detailed financial projections and demonstrate a clear understanding of the local rental market dynamics. By carefully evaluating these financing options and aligning them with their overall investment strategy, investors can maximize their returns and achieve their long-term financial objectives.

Preparing for the Mortgage Application Process

Preparing for the multi-family mortgage application process is crucial for securing favorable loan terms and ensuring a smooth transaction. A well-structured approach, coupled with a thorough understanding of market dynamics and lender expectations, can significantly increase the likelihood of approval and optimize investment outcomes. Getting pre-qualified, working with a mortgage broker, and understanding current market trends are key steps in this preparation. Pre-qualification provides a preliminary assessment of your borrowing power, allowing you to target properties within your financial reach and demonstrate seriousness to sellers.

This involves providing basic financial information to lenders who then issue a pre-qualification letter indicating the estimated loan amount you can qualify for. Working with a mortgage broker can streamline the process significantly. Brokers have access to a network of lenders and can help you identify the best loan products and terms based on your specific investment goals and financial profile. They also assist with gathering and organizing the required documentation, navigating the underwriting process, and negotiating favorable terms on your behalf.

Understanding current market trends is essential for making informed investment decisions. Factors such as interest rate fluctuations, changes in lending regulations, and local market demand can significantly impact loan terms and investment strategies. Staying abreast of these trends allows investors to anticipate potential challenges and capitalize on opportunities. For instance, rising interest rates might necessitate adjustments to your investment criteria or financing strategy, while favorable market conditions could present opportunities for securing more competitive loan terms.

Thorough preparation also involves assembling a comprehensive financial portfolio that showcases your financial stability and investment potential. This includes meticulous documentation of income streams, asset holdings, credit history, and debt obligations. Lenders scrutinize these documents to assess your ability to manage the financial responsibilities associated with a multi-family property investment. A strong credit score, healthy debt-to-income ratio, and substantial reserves demonstrate financial strength and enhance your credibility as a borrower. Furthermore, a detailed investment proposal outlining your investment strategy, projected property performance, and exit strategy can bolster your application and instill confidence in lenders.

This demonstrates your understanding of the market, your commitment to the investment, and your ability to generate consistent cash flow from the property. By proactively addressing potential challenges and presenting a well-prepared application, investors can position themselves for success in the competitive multi-family mortgage market. In addition to these essential steps, researching different multi-family property loans is also recommended. From conventional loans offered by banks to government-backed programs like FHA loans and more specialized portfolio lending options, each avenue has unique qualification criteria and benefits.

Understanding the nuances of these options allows investors to choose the best fit for their investment strategy and risk tolerance. For example, an investor seeking long-term stability might opt for a fixed-rate conventional loan, while an investor pursuing value-add opportunities might consider a shorter-term bridge loan with a higher interest rate. By thoroughly researching available financing options, investors can make strategic decisions that align with their long-term investment objectives and maximize their returns. Finally, conducting thorough due diligence on the property itself is paramount. A professional property appraisal assesses the property’s market value, identifying potential risks and opportunities. A detailed inspection evaluates the property’s physical condition, uncovering potential maintenance or repair costs that could impact future cash flow. This comprehensive assessment provides valuable insights that inform investment decisions and strengthens the mortgage application by demonstrating a thorough understanding of the property’s potential and associated risks.

Overcoming Common Challenges in Multi-Family Mortgage Qualification

Securing financing for a multi-family property can be significantly more complex than obtaining a traditional single-family mortgage. Several unique challenges can arise during the qualification process, requiring investors to be proactive and prepared. One common hurdle is demonstrating sufficient cash flow from the property. Lenders scrutinize the property’s potential to generate income, carefully evaluating rental history, lease agreements, and operating expenses. If the projected cash flow is deemed insufficient to cover the mortgage payments and other associated costs, the loan application may be rejected.

For instance, a property with high vacancy rates or below-market rents could raise red flags for lenders. Addressing this proactively by securing long-term leases or demonstrating a plan to increase occupancy is crucial. Another potential challenge involves tenant occupancy issues. Lenders prefer properties with stable and reliable tenant occupancy as it directly impacts the property’s income stream. High tenant turnover or extended vacancies can signal potential management issues or property deficiencies, making lenders hesitant to approve financing.

Providing a comprehensive tenant history and demonstrating effective property management practices can help mitigate these concerns. Furthermore, the property’s overall condition and appraisal value play a critical role. Lenders require a professional appraisal to assess the property’s market value and ensure it aligns with the loan amount. If the appraisal comes in lower than expected, it can jeopardize the loan approval. Investors should be prepared to address any necessary repairs or renovations to ensure the property meets the lender’s valuation requirements.

Having contingency plans, such as accessing additional capital or renegotiating the purchase price, is essential in such situations. Navigating these challenges effectively requires careful planning and preparation. Working with experienced real estate professionals, such as mortgage brokers specializing in multi-family properties, can provide valuable guidance and support throughout the qualification process. They can help investors understand lender requirements, prepare a strong application package, and address any potential challenges proactively. Additionally, conducting thorough due diligence on the property, including a detailed financial analysis and market research, can help identify potential risks and inform investment decisions.

By anticipating and addressing these common challenges, investors can significantly increase their chances of securing the necessary financing for their multi-family investment and achieving their financial goals. Moreover, understanding the broader market dynamics, such as interest rate fluctuations and changes in lending regulations, is crucial for informed decision-making. Staying updated on these trends allows investors to anticipate potential challenges and adjust their strategies accordingly. For example, rising interest rates can impact affordability and loan terms, while changes in lending regulations can affect eligibility criteria and loan requirements. By staying informed and proactive, investors can navigate the complexities of multi-family mortgage qualification and position themselves for success in the competitive real estate market.

Conclusion: Navigating the Multi-Family Mortgage Landscape

Navigating the dynamic landscape of multi-family mortgage qualification requires a proactive approach to staying informed about current market trends. Factors such as interest rate fluctuations, changes in lending regulations, and market demand can significantly influence loan terms and investment strategies. Savvy investors understand that these factors are interconnected and require ongoing monitoring to optimize financing decisions. For instance, rising interest rates can impact affordability and potentially decrease the demand for multi-family properties, affecting loan terms offered by lenders.

Conversely, periods of low interest rates can fuel increased competition among investors, driving up property prices and potentially leading to stricter lending criteria. Keeping abreast of these trends is crucial for securing favorable loan terms and maximizing returns. Beyond interest rates, shifts in lending regulations play a pivotal role in shaping the multi-family mortgage market. Regulatory changes can impact loan eligibility requirements, down payment stipulations, and even the types of financing options available. For example, changes to debt-to-income ratio requirements or loan-to-value limits can directly affect an investor’s ability to qualify for a mortgage.

Staying informed about these regulatory shifts allows investors to adapt their strategies and ensure compliance with current lending standards. Consulting with experienced mortgage brokers or financial advisors specializing in multi-family properties can provide valuable insights into navigating these complexities. Such expertise can prove invaluable in identifying potential challenges and developing contingency plans to mitigate risks. Market demand also exerts a considerable influence on multi-family mortgage qualification. Strong rental demand in a particular area can enhance a property’s perceived investment value, making it more attractive to lenders.

Conversely, areas experiencing declining rental demand or high vacancy rates may face stricter lending criteria. Investors should conduct thorough market research, including analyzing vacancy rates, rental trends, and local economic indicators, to assess the viability of a multi-family investment. Understanding market dynamics enables investors to make informed decisions about property selection and financing options. This research can also strengthen loan applications by demonstrating a clear understanding of the local market and the potential for positive cash flow.

By incorporating market analysis into their investment strategies, investors can position themselves for success in the multi-family market. Furthermore, the rise of online lending platforms and fintech companies has introduced new dynamics to the multi-family mortgage landscape. These platforms often offer streamlined application processes and competitive interest rates, providing investors with alternative financing options. However, it’s essential to thoroughly vet these platforms and compare their terms with traditional lenders to ensure alignment with long-term investment goals.

Due diligence in researching and comparing lenders, considering both traditional banks and emerging online platforms, is crucial for securing the most favorable financing terms. By staying informed about these evolving trends, investors can leverage the opportunities presented by the changing multi-family mortgage market to achieve their investment objectives. This proactive approach to market monitoring, combined with expert advice and careful planning, can pave the way for successful multi-family investments. Finally, building strong relationships with experienced mortgage brokers specializing in commercial real estate loans can be a significant advantage.

These brokers possess in-depth knowledge of the multi-family mortgage market, including access to a wider range of lending options and the ability to negotiate favorable terms on behalf of their clients. They can also provide valuable guidance throughout the application process, helping investors navigate complex documentation requirements and overcome potential challenges. Leveraging the expertise of a seasoned mortgage broker can significantly streamline the qualification process and increase the likelihood of securing optimal financing for multi-family investments.

Post Comment