Comprehensive Guide to Financing Tiny Homes and Alternative Housing

Introduction: The Rise of Tiny Homes and Alternative Housing

The allure of a simpler, more sustainable existence is driving a remarkable surge in interest in tiny homes and alternative housing options. This movement reflects a growing desire for financial freedom, environmental consciousness, and a lifestyle less burdened by material possessions. From charming tiny houses on wheels (THOWs) built on trailers, offering mobility and minimalist living, to eco-friendly yurts that embrace a unique circular design and connection with nature, and even repurposed shipping containers transformed into surprisingly stylish and functional homes, these unconventional dwellings present a compelling alternative to the traditional housing market.

However, navigating the financing landscape for these unique properties requires careful consideration and a departure from conventional mortgage approaches. Understanding the nuances of tiny home financing is crucial for turning the dream of simplified living into a reality. One of the primary challenges lies in the non-conformity of these dwellings to standard lending criteria. Traditional mortgage lenders often hesitate to finance tiny homes and alternative housing due to their unconventional nature and perceived risks. These properties may lack a permanent foundation, which is a cornerstone of traditional mortgage lending.

They might not adhere to standard building codes in certain jurisdictions, further complicating the appraisal process. For instance, a THOW legally classified as a recreational vehicle might not qualify for a traditional mortgage but could be financed through an RV loan, often at a higher interest rate. Similarly, a yurt built on a permanent foundation might face appraisal challenges due to its unique construction and limited comparables in the market. This ambiguity necessitates exploring specialized financing options tailored to the specific type of alternative housing.

Specialized lenders are emerging to bridge this gap, recognizing the growing demand and potential of the tiny home and alternative housing market. These lenders understand the unique challenges and offer tailored financing solutions, such as loans specifically designed for THOWs or container homes. They are more flexible in their underwriting criteria, considering factors beyond the traditional appraisal value, such as the borrower’s creditworthiness and the quality of the construction. For example, some lenders specialize in land loans for tiny homes, recognizing that securing land ownership is often the first step.

Others offer construction loans specifically for building tiny homes, allowing individuals to customize their dwellings from the ground up. Researching and connecting with these specialized lenders is a crucial step in securing financing for your alternative housing project. Beyond specialized lenders, exploring alternative financing avenues can be instrumental in realizing your tiny home dreams. Personal loans, while often carrying higher interest rates, can provide a quicker and more accessible source of funding for smaller projects or down payments.

They require less stringent property-related criteria and can be used for a variety of purposes, including purchasing a pre-built tiny home or covering renovation costs. Construction loans, as mentioned earlier, offer a tailored approach for those building their tiny homes. These loans typically disburse funds in stages as the project progresses, requiring careful budgeting and project management. Finally, securing financing for the land itself is often a separate but essential step. Land loans can be obtained through traditional lenders or specialized institutions focusing on rural or undeveloped properties.

Navigating the insurance landscape for tiny homes also requires careful consideration. Standard homeowners insurance policies may not adequately cover these unique structures. Specialized insurance providers offer policies specifically designed for tiny homes, RVs, or manufactured homes, addressing the unique risks and requirements of these dwellings. Factors such as location, construction materials, and mobility influence the insurance premiums. Understanding these nuances and securing appropriate insurance coverage is essential for protecting your investment and ensuring peace of mind.

Understanding Tiny Homes and Alternative Housing

The landscape of tiny homes and alternative housing is as diverse as the individuals who choose them. From the minimalist chic of a tiny house on wheels (THOW) to the rustic charm of a yurt, these dwellings represent a departure from conventional housing and a move towards simpler, more sustainable living. Each type presents unique financial and logistical considerations, impacting everything from securing a loan to obtaining insurance. Tiny houses on wheels, built on trailers for mobility, often face classification challenges as they straddle the line between recreational vehicle and permanent dwelling.

This can make obtaining a traditional mortgage difficult, leading many THOW owners to explore RV loans or personal loans. However, the rising popularity of THOWs is prompting some specialized lenders to offer tailored financing options, recognizing the growing demand. Yurts, with their circular design and fabric walls, offer a unique, eco-conscious living experience. While their lower cost can be attractive, financing can be challenging due to their non-traditional structure. Some lenders may consider them personal property rather than real estate, requiring a personal loan or specialized financing.

Obtaining permits and navigating zoning regulations can also be complex, varying significantly by location. Shipping container homes, with their industrial aesthetic and inherent durability, are another increasingly popular alternative. Repurposing shipping containers offers a cost-effective and environmentally friendly building solution. Construction loans or specialized lenders familiar with container homes are often the best financing routes. However, securing permits and meeting local building codes can still present hurdles. Beyond these, earthships, cob houses, and straw bale homes exemplify sustainable building practices, utilizing natural materials and minimizing environmental impact.

Financing these unique structures often requires creativity, with options like personal loans, construction loans, or loans from specialized lenders who understand alternative building practices. Proper insurance coverage for these unique structures is also crucial, and potential homeowners should consult with insurers specializing in non-traditional dwellings. Choosing land for alternative housing also presents distinct challenges. While some alternative homes are mobile, others require a permanent foundation. Securing land loans, navigating zoning regulations, and ensuring access to utilities are key considerations. The increasing demand for alternative housing is driving innovation in financing and insurance, making the dream of owning a unique, sustainable home more attainable than ever before.

The Mortgage Maze: Challenges in Financing Non-Traditional Homes

Traditional mortgage lenders often hesitate to finance tiny homes and alternative housing due to their unconventional nature, posing significant challenges for those seeking to embrace this minimalist lifestyle. These properties often lack a permanent foundation, a key requirement for most conventional mortgages. Because many tiny homes are built on wheels for mobility, they are sometimes classified as recreational vehicles rather than permanent dwellings, making them ineligible for traditional home loans. This distinction creates a significant hurdle for prospective tiny homeowners seeking conventional financing.

For example, a family looking to finance a THOW in Oregon might find their application rejected by a traditional bank because the property isn’t affixed to land, even if the family intends to keep it stationary. Instead, they might be directed towards RV financing, which often carries higher interest rates and shorter loan terms. Furthermore, even stationary tiny homes built on foundations can face financing challenges due to their unique construction and smaller square footage.

Appraisers, accustomed to evaluating traditional homes, may struggle to assign an accurate value to these non-traditional dwellings, leading to lower valuations and making it harder for borrowers to secure sufficient financing. This appraisal challenge is further compounded if the tiny home is custom-built or utilizes unconventional materials, adding another layer of complexity to the valuation process. Another significant challenge lies in meeting local building codes. Tiny homes, by their very nature, sometimes push the boundaries of conventional building practices.

While the International Code Council (ICC) has developed an appendix specifically for tiny homes, adoption by local jurisdictions varies widely. This inconsistency can create a confusing landscape for builders and homeowners, and lenders are hesitant to finance properties that may not be compliant with local regulations. For instance, a couple building a container home in California might face stricter building codes and permitting requirements than a couple building a similar structure in Texas. This regulatory variability can make it difficult for lenders to assess the long-term viability and legality of the dwelling, impacting their willingness to provide financing.

Moreover, the resale market for tiny homes, while growing, is still relatively nascent compared to the traditional housing market. This lack of established comparables makes it difficult for lenders to assess the potential resale value of the property, a crucial factor in determining loan amounts and managing risk. Lenders are primarily concerned with the collateral value of the property, ensuring that they can recoup their investment in case of foreclosure. The uncertainty surrounding the resale market for tiny homes adds to their reluctance to offer traditional mortgages.

This hesitancy forces many tiny home enthusiasts to explore alternative financing options, such as personal loans, RV loans, or specialized lenders who understand the nuances of this burgeoning market. Finally, the smaller loan amounts typically required for tiny homes can be less attractive to traditional lenders. The administrative costs associated with processing a loan are relatively fixed, regardless of the loan size. Therefore, smaller loans generate less profit for lenders, making them less incentivized to offer them.

This preference for larger loans further limits the financing options available to prospective tiny homeowners, pushing them towards alternative solutions like personal loans, which often carry higher interest rates, or specialized lenders who cater specifically to the tiny house market. These specialized lenders often have a deeper understanding of the unique challenges associated with financing tiny homes and are more willing to work with borrowers to find suitable financing solutions. As the tiny home movement continues to gain momentum, the demand for accessible financing options will likely drive further innovation and growth within this niche lending sector.

Specialized Lenders: A Path to Financing Your Dream

Fortunately, a growing number of lenders are recognizing the potential of the tiny home and alternative housing market. These specialized lenders understand the unique challenges and are willing to offer tailored financing solutions. They often have experience with different types of unconventional properties and are more flexible in their underwriting requirements, considering factors beyond traditional credit scores, such as demonstrated commitment to the project and alternative income streams. This shift is crucial for borrowers seeking tiny home financing, offering a path forward where traditional mortgage options often fall short.

One key advantage of working with specialized lenders is their familiarity with the nuances of alternative housing. They understand the various construction methods, materials, and legal considerations involved in financing tiny houses on wheels (THOWs), yurts, container homes, and other non-traditional dwellings. For instance, some lenders specialize in RV loans for THOWs, recognizing their mobility and treating them as recreational vehicles, while others offer construction loans specifically designed for building alternative dwellings from the ground up.

This expertise allows them to assess risk more accurately and offer competitive loan terms. For example, United Tiny House Builders, a company specializing in THOW construction, often works with lenders who understand the intricacies of titling and insuring these unique homes. They can guide borrowers through the process, ensuring a smoother financing experience. Similarly, some lenders partner with alternative housing communities, offering pre-approved financing options to residents, simplifying the home-buying process. This streamlined approach can be particularly beneficial for first-time tiny home buyers.

Beyond RV and construction loans, specialized lenders may also offer personal loans or land loans, catering to the diverse needs of the alternative housing market. Personal loans, while often carrying higher interest rates, can provide a quick source of funding for smaller projects or renovations. Land loans, on the other hand, can be essential for securing property to place a tiny home or build an alternative structure. Finding a lender who understands the interconnectedness of these financing options can be crucial for realizing your tiny home dream.

It’s important to research and compare these specialized lenders, considering factors such as interest rates, loan terms, down payment requirements, and their experience with specific types of alternative housing. Finally, working with a lender specializing in tiny homes often means access to valuable resources and guidance beyond financing. They may be able to connect borrowers with reputable builders, insurers, and other professionals within the tiny house community. This network of support can be invaluable, particularly for those new to the world of alternative housing. By understanding the specific needs and challenges of this growing market, specialized lenders are paving the way for more individuals to embrace a simpler, more sustainable lifestyle.

Alternative Financing: Beyond the Traditional Mortgage

While traditional mortgages and specialized lenders represent significant avenues for financing, the path to realizing a tiny home or alternative housing dream often requires exploring a broader spectrum of financial tools. Personal loans, for instance, offer a readily accessible, albeit potentially more expensive, source of funding. These loans, typically unsecured, can provide the necessary capital for purchasing materials or covering initial construction costs. However, prospective tiny homeowners should carefully evaluate the interest rates and repayment terms associated with personal loans, as these can be significantly higher than those of secured loans, impacting the overall affordability of the project.

This option is particularly useful for individuals who need quick access to funds and may not qualify for more traditional financing due to the unique nature of their dwelling. RV loans present a particularly intriguing option for those pursuing tiny houses on wheels (THOWs). Since THOWs are often classified as recreational vehicles, lenders who specialize in RV financing may be more inclined to approve loans for these types of structures. This classification allows for more flexible underwriting criteria, potentially making financing more accessible.

However, it is crucial to understand that the terms and conditions of RV loans may differ from traditional mortgages, including loan duration, interest rates, and required down payments. Furthermore, the classification of a THOW as an RV can have implications for insurance coverage and zoning regulations, requiring careful consideration of these factors. For example, some lenders may require the THOW to be certified by a recognized RV industry association. Construction loans are another valuable tool for those embarking on a build-from-scratch tiny home or alternative housing project.

These loans are specifically designed to finance the construction phase of a project, providing funds in installments as various stages are completed. This approach allows for a more controlled release of capital, mitigating some of the financial risks associated with construction. However, securing a construction loan often requires a detailed project plan, cost estimates, and proof of permits, which can add to the complexity of the process. It is important to note that these loans typically convert to a permanent mortgage or require refinancing once the construction is completed, which can further affect the overall cost of financing.

For example, a well-documented plan showing adherence to local building codes can significantly improve the chances of loan approval. Land loans are an essential, yet often overlooked, component of alternative housing finance. If the tiny home project requires the purchase of land, a separate land loan may be necessary. These loans are used to finance the acquisition of the property and can have different terms and conditions compared to other types of loans. The value of the land, its location, and its zoning designation are critical factors that influence the loan approval process.

Moreover, the cost of the land can significantly impact the overall budget of the project, so it is crucial to carefully assess the location and its suitability for the desired type of alternative housing. For instance, land in areas with strict zoning regulations might be more difficult to finance than land in more permissive areas. Finally, exploring creative financing options such as seller financing or peer-to-peer lending can provide additional avenues for securing funds. Seller financing involves an agreement where the seller of the land or the tiny home acts as the lender, which can lead to more flexible terms.

Peer-to-peer lending platforms connect borrowers with individual investors, which can sometimes offer more competitive rates than traditional lenders. These alternative approaches require due diligence and a clear understanding of the terms, but they can be valuable resources for those who face challenges with traditional financing routes. For instance, a seller might be more willing to finance a tiny home sale if they believe in the project or are having difficulty finding a buyer through traditional channels.

Navigating the Insurance Landscape for Tiny Homes

Insuring a tiny home or alternative dwelling presents unique challenges compared to insuring a conventional house. Standard homeowners insurance policies often fall short of covering these unconventional structures due to their unique construction, mobility, and sometimes, unconventional locations. This necessitates seeking specialized insurance providers who understand the nuances of tiny homes, RVs, or manufactured homes and offer tailored policies. Factors such as the home’s location, the materials used in its construction, and whether it’s stationary or mobile significantly impact insurance options and premiums.

For example, a tiny house on wheels (THOW) classified as an RV might be insured through an RV policy, while a permanently-placed tiny home built on a foundation may qualify for a specialized tiny home policy or even a modified homeowners policy. Understanding these nuances is crucial for protecting your investment and navigating the complexities of tiny home insurance. One of the first steps in securing appropriate insurance is determining how your tiny home is classified.

Is it considered an RV, a manufactured home, or a traditional dwelling? This classification will dictate which type of insurance policy is most suitable. For instance, if your THOW is registered as an RV, you’ll likely need an RV insurance policy that covers liability, collision, and comprehensive damage. These policies often include coverage for personal belongings inside the THOW and roadside assistance. If your tiny home is built on a foundation and considered a permanent structure, you might explore specialized tiny home insurance policies that address specific risks associated with smaller dwellings.

These policies may cover unique features like composting toilets, off-grid systems, and alternative building materials. Another critical aspect of tiny home insurance is ensuring adequate coverage for your specific needs. Consider factors such as the value of your home, the cost of replacing appliances and fixtures, and the potential liability risks associated with visitors or renters. If you plan to rent out your tiny home, you’ll need a landlord policy that provides broader liability protection and covers potential damage caused by tenants.

Moreover, if your tiny home is located in an area prone to natural disasters like floods, earthquakes, or wildfires, ensure your policy includes appropriate coverage for these risks. Standard policies might exclude certain natural disasters, requiring separate riders or endorsements for comprehensive protection. Navigating the insurance landscape can be daunting, so it’s highly recommended to consult with an insurance broker specializing in tiny homes or alternative dwellings. These professionals can help you understand the different policy options available, compare quotes from multiple insurers, and ensure you have adequate coverage for your unique situation.

They can also explain the specific requirements and limitations of each policy, such as restrictions on travel with a THOW or limitations on coverage for certain types of damage. Working with a knowledgeable broker can save you time, money, and potential headaches in the long run. Finally, remember that insurance premiums for tiny homes can vary significantly depending on factors like location, construction materials, and the level of coverage you choose. Obtaining quotes from multiple insurers is crucial to finding the most competitive rates.

Be prepared to provide detailed information about your tiny home, including its size, features, and any safety or security measures you’ve implemented. By taking a proactive approach and understanding the nuances of tiny home insurance, you can protect your investment and enjoy peace of mind in your smaller, simpler life. This preparation will be valuable when discussing your tiny house mortgage or exploring alternative housing finance options, as lenders often require proof of insurance before finalizing loan approvals.

The Legal and Regulatory Maze: Zoning and Building Codes

Navigating the legal and regulatory landscape for tiny homes and alternative housing can feel like traversing a maze, with rules and requirements varying significantly from one location to the next. This complexity arises from the intersection of zoning regulations, building codes, and permit requirements, each of which may treat these non-traditional structures differently than conventional homes. Before embarking on your tiny home journey, thorough research into local laws is crucial to avoid potential legal pitfalls and ensure your dream dwelling complies with all applicable regulations.

Some municipalities may outright prohibit tiny homes, while others impose specific size or construction mandates. For instance, certain jurisdictions define a minimum square footage for habitable dwellings, potentially excluding smaller tiny homes. Others may restrict the placement of tiny houses on wheels (THOWs), classifying them as recreational vehicles rather than permanent residences. Understanding these nuances is essential for securing appropriate permits and avoiding costly legal battles. Zoning regulations play a pivotal role in determining where and how you can place your tiny home.

These regulations often dictate minimum lot sizes, setbacks from property lines, and permitted uses for different zones. A tiny home on a foundation may be treated differently than a THOW, with the latter sometimes facing restrictions typically applied to RVs. For example, some municipalities only permit THOWs in designated RV parks or on properties with existing primary residences. Researching local zoning ordinances and engaging with local officials can help you understand the specific requirements for your chosen location.

Obtaining necessary variances or special permits may be required in some cases, adding complexity to the process. This is where understanding “tiny house zoning regulations” becomes paramount. Building codes present another layer of complexity, dictating the structural integrity and safety standards of your tiny home. While some jurisdictions have adopted the International Residential Code (IRC) with appendices specifically addressing tiny houses, others maintain unique building codes that may not adequately address these smaller dwellings. This can lead to challenges in meeting requirements for insulation, ventilation, plumbing, and electrical systems.

For example, a tiny home built on a trailer may need to comply with both RV and residential building codes, depending on local regulations. Engaging with a qualified builder experienced in tiny home construction and familiar with local codes can help ensure your home meets all necessary standards. This expertise can prove invaluable when navigating the intricacies of “alternative housing finance” and securing necessary permits. Furthermore, understanding how these codes impact potential “tiny home financing” options is essential for a smooth process.

Permitting requirements can also vary significantly, adding another hurdle to the process. Some jurisdictions may require separate permits for the foundation, structure, plumbing, and electrical systems of a tiny home. Others may treat THOWs as RVs, requiring different permits altogether. Navigating this permitting maze can be time-consuming and costly. Therefore, early engagement with local permitting agencies is crucial to understand the specific requirements for your project. This proactive approach can help streamline the process and avoid potential delays or setbacks.

Being prepared with detailed plans and specifications can expedite the permitting process and demonstrate your commitment to complying with local regulations. In the realm of “tiny home insurance”, understanding local building codes and having proper permits can be crucial for securing coverage. Finally, securing appropriate insurance for your tiny home can be challenging. Standard homeowners insurance policies may not cover these unique structures, particularly THOWs. Specialized insurers offering policies for tiny homes, RVs, or manufactured homes are emerging, but coverage options and costs can vary significantly.

Factors such as location, construction type, and intended use can influence insurance premiums. Researching different insurance providers and obtaining quotes tailored to your specific tiny home is essential for adequate protection. Understanding the interplay between “zoning regulations” and insurance requirements is also crucial, as some insurers may require proof of compliance with local ordinances before issuing a policy. By carefully navigating these legal and regulatory complexities, you can pave the way for a smooth and successful tiny home journey, transforming your dream of simplified living into a reality.

Tips for Securing Financing: A Practical Guide

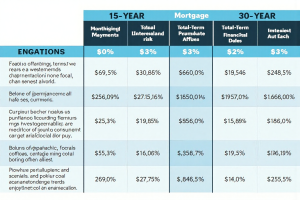

Securing financing for a tiny home or alternative dwelling requires a more strategic approach than traditional mortgages. Proactive preparation and a thorough understanding of available options are crucial for navigating this unique financing landscape. Start by enhancing your credit score. A strong credit history demonstrates financial responsibility and increases your chances of loan approval at favorable interest rates. Simultaneously, begin saving for a substantial down payment. While down payment requirements vary depending on the lender and type of financing, a larger down payment can significantly improve your loan terms and reduce your monthly payments.

Compile all necessary financial documents, including tax returns, pay stubs, and bank statements, to expedite the loan application process. This organized approach will showcase your financial stability to potential lenders. Beyond these foundational steps, understanding the nuances of tiny home financing is essential. Clearly articulate your project to potential lenders, outlining the specifics of your tiny home or alternative dwelling, its intended use, and your long-term housing goals. This transparency helps lenders assess the viability of your project and understand your commitment.

Demonstrate your ability to repay the loan by providing a comprehensive budget that includes projected expenses related to the tiny home, such as land rental, utilities, and insurance. Researching various financing options is paramount. Explore specialized lenders who cater to the tiny home market, as they often offer more flexible terms and understand the unique challenges associated with financing these unconventional dwellings. Consider alternative financing options such as personal loans, RV loans for tiny houses on wheels (THOWs), and construction loans.

Personal loans can provide quicker access to funds but may come with higher interest rates. If your tiny home is built on a trailer and classified as an RV, an RV loan might be a suitable choice. For those building their tiny home, a construction loan can finance the building process, converting to a traditional mortgage upon completion. Land loans are also a critical consideration if you plan to purchase land for your tiny home.

Compare offers from multiple lenders to secure the most favorable terms and interest rates. Seeking advice from financial professionals experienced in alternative housing finance can provide valuable insights and guidance tailored to your specific situation. Navigating the insurance landscape for tiny homes also requires careful consideration. Standard homeowner’s insurance policies may not adequately cover these unique structures. Research specialized insurance providers who offer coverage for tiny homes, RVs, or manufactured homes. Ensure the policy covers potential risks specific to tiny homes, such as transportation damage for THOWs or weather-related issues for yurts.

Understanding local zoning regulations and building codes is crucial before embarking on your tiny home journey. Zoning laws vary significantly by location, and some areas may have restrictions on tiny homes or alternative dwellings. Researching these regulations early in the planning process can help you avoid potential setbacks and ensure your tiny home project complies with local ordinances. Real-life examples illustrate successful financing strategies. Some individuals have combined personal savings, sweat equity, and construction loans to build their tiny homes, minimizing their overall debt. Others have leveraged RV loans to finance THOWs, taking advantage of the lower interest rates often associated with these loans. By exploring diverse financing avenues and demonstrating financial preparedness, aspiring tiny homeowners can overcome the challenges and achieve their dream of simplified and sustainable living.

Future Trends: The Evolving Landscape of Tiny Home Financing

The future of tiny home financing is poised for significant evolution, fueled by increasing acceptance from lenders and the emergence of innovative financial products. As the tiny home movement gains further traction, we anticipate a more robust and diverse market, offering a wider array of options for prospective owners. This includes the anticipated entry of more specialized lenders who understand the nuances of alternative housing finance, moving beyond the restrictive parameters of traditional mortgage institutions.

The development of more tailored financing products, such as those specifically designed for tiny house mortgage applications, will be crucial in facilitating easier access to capital for those seeking to embrace this lifestyle. Continued advocacy for tiny home-friendly zoning regulations and building codes will also play a vital role in shaping a more accessible and predictable financing landscape. This evolving market presents both opportunities and challenges for those looking to embrace alternative housing, demanding both due diligence and a proactive approach from prospective buyers.

One of the most promising trends is the increasing availability of specialized lenders that focus specifically on tiny home financing. These lenders often have experience with a variety of alternative housing types, including tiny houses on wheels (THOWs), container homes, and yurts, and are more willing to look beyond the limitations of traditional lending criteria. They understand that factors such as mobility and unconventional construction methods do not necessarily equate to higher risk. For example, some specialized lenders are now offering RV loans for tiny houses built on trailers, treating them as recreational vehicles, which opens up a pathway for financing that was previously unavailable.

This growing acceptance from niche lenders is a critical step in making tiny homeownership more accessible and attainable. Furthermore, the alternative financing landscape is also expanding, offering a variety of options beyond traditional loans. Personal loans, while often carrying higher interest rates, can provide a quick source of funding for smaller projects or to bridge funding gaps. Construction loans, which are designed for building projects, are becoming more readily available for tiny home builds, although the criteria for eligibility can vary significantly.

Land loans are also increasingly important as more individuals seek to own the land their tiny homes sit on, which can also be a factor in obtaining financing for the structure itself. The ability to combine multiple financing options can be a strategic advantage for those navigating the complexities of tiny home finance. For instance, a combination of a personal loan for initial construction costs and a specialized loan for the completed structure could provide a viable path to ownership.

Navigating the complexities of tiny home insurance also presents a significant hurdle. Standard homeowners insurance policies typically do not cover these unique structures, requiring owners to seek out specialized providers who understand the specific risks associated with alternative housing. These specialized tiny home insurance policies are often tailored to cover structures that may not be permanently affixed to the land or that are built using non-traditional materials. The ability to secure adequate insurance is a critical factor in obtaining financing, as lenders need assurance that their investment is protected.

The growing availability of these specialized policies is a positive sign for the industry, demonstrating an increased level of acceptance and understanding of tiny homes. This area is expected to continue to evolve, offering more comprehensive and affordable options as the tiny home market matures. Finally, the regulatory landscape for tiny homes is also beginning to adapt, though it still varies widely by location. While some areas remain restrictive, others are beginning to embrace the tiny home movement, creating more streamlined processes for permitting and zoning.

This shift is partly due to the growing awareness of the benefits of tiny homes, including their affordability and sustainability. As more municipalities recognize the potential of these structures, we can expect to see more consistent zoning regulations and building codes, which will, in turn, make it easier for lenders to assess the risks associated with tiny home financing. Continued advocacy and education will play a crucial role in shaping a more favorable regulatory environment, further facilitating the growth of the tiny home market and the availability of financing options.

Post Comment