Demystifying Physician and Professional Mortgage Programs: A Comprehensive Guide

Navigating the Mortgage Maze: A Guide for High-Earning Professionals

For doctors, dentists, lawyers, and other high-earning professionals, the path to homeownership can often feel like navigating a complex maze. Traditional mortgage options, with their stringent requirements for down payments and private mortgage insurance (PMI), can feel particularly burdensome for those early in their careers, despite their high earning potential. This is especially true in competitive real estate markets where high down payments are often essential for a successful offer. Imagine a newly established dentist in San Francisco; their substantial student loan debt coupled with the city’s exorbitant housing costs creates a significant barrier to entry for conventional homeownership.

This financial hurdle can delay or even prevent these professionals from building equity and securing their long-term financial future. Enter physician and professional mortgage programs—specialized loan products designed to address the unique financial circumstances of these professionals. These programs offer a lifeline, often providing more favorable terms than conventional mortgages, including no PMI and high loan amounts, potentially unlocking homeownership opportunities much sooner. For the dentist in our example, a physician mortgage could mean securing a home years earlier than with a traditional loan, accelerating their wealth-building journey.

These specialized mortgage programs recognize the significant earning potential and demonstrably stable career paths of physicians, dentists, lawyers, and similar professionals. By taking a more nuanced approach to risk assessment, lenders offering these programs acknowledge that while early-career professionals may have limited savings, their future income trajectory warrants a more flexible lending approach. This translates to lower down payment requirements, sometimes as low as 0%, eliminating the often substantial financial hurdle of PMI. This benefit alone can translate to thousands of dollars in savings annually, freeing up funds for other financial priorities such as investments or retirement planning.

Additionally, physician and professional loans frequently offer higher loan limits, recognizing the often higher price points of homes sought by these professionals. Furthermore, these loans often have streamlined application processes, recognizing the busy schedules of these high-demand professions, and may offer more flexible underwriting criteria regarding student loan debt, a common financial consideration for medical and legal professionals. However, it’s important to understand that while these programs offer distinct advantages, they also come with their own set of considerations. Interest rates for these specialized mortgages can sometimes be slightly higher than conventional loans, and the eligibility criteria are more stringent, often limited to specific professions and requiring proof of licensure or employment contracts. This article aims to demystify these programs, providing a comprehensive guide to understanding their benefits, eligibility criteria, application process, and potential drawbacks, empowering professionals to make informed decisions on their path to homeownership.

Defining Physician and Professional Mortgages

Physician and professional mortgages stand apart from conventional loans as specialized programs meticulously crafted for high-earning professionals in fields like medicine, dentistry, and law. These programs acknowledge the unique financial trajectory of these individuals, who often begin their careers with substantial student loan debt yet possess exceptional income potential. Recognizing this distinct profile, lenders offer tailored mortgage solutions that deviate from traditional underwriting standards, offering advantages like reduced down payment requirements and often waiving the need for Private Mortgage Insurance (PMI).

This allows professionals to overcome the initial hurdle of a large down payment, a common obstacle for those early in their careers. For instance, a physician just starting their practice might struggle to amass a 20% down payment for a conventional mortgage, even with a high salary, due to the burden of student loans. A physician mortgage addresses this by potentially requiring as little as 0% down. This distinction is crucial, as PMI can add a significant expense to monthly mortgage payments, further straining early-career finances.

The rationale behind these specialized mortgage programs is rooted in the long-term financial stability of these professions. Lenders recognize that doctors, dentists, and lawyers typically experience significant income growth throughout their careers, making them lower-risk borrowers despite their initial debt-to-income ratio. This long-term perspective contrasts sharply with the more immediate financial snapshots used in conventional mortgage assessments. For example, a doctor with $200,000 in student loan debt might be considered high-risk by traditional lending metrics.

However, a physician mortgage program factors in the expected six-figure salary growth over the doctor’s career, mitigating the perceived risk. This specialized approach allows professionals to access homeownership earlier, building equity and establishing financial stability sooner than might be possible with a conventional loan. Furthermore, some physician loan programs offer higher loan amounts, recognizing the higher price points of homes these professionals often seek. This combination of low or no down payment, no PMI, and higher loan amounts makes homeownership attainable earlier in their careers.

The benefits extend beyond the immediate financial advantages. Physician and professional mortgages often streamline the application process, recognizing the demanding schedules of these professions. Some lenders offer dedicated mortgage advisors specializing in these loan programs, providing personalized guidance and support. This specialized service can be invaluable for busy professionals navigating the complexities of the mortgage process. Moreover, these programs often offer competitive interest rates, making them a financially sound choice. While the specific terms and eligibility criteria vary between lenders, the core advantages remain consistent: easier access to homeownership, reduced upfront costs, and tailored service catering to the unique needs of high-earning professionals. In a competitive real estate market, these programs can provide the edge needed to secure a desired property, offering a significant advantage over traditional financing options. By understanding the nuances of these programs, professionals can make informed decisions and unlock the path to homeownership earlier in their careers, setting the stage for long-term financial success.

The Benefits: Lower Down Payments, No PMI, and More

Physician and professional mortgages offer distinct advantages designed to facilitate homeownership for high-earning professionals in fields like medicine, dentistry, and law. A primary benefit is the significantly lower down payment requirement. While conventional mortgages often necessitate a 20% down payment, these specialized programs may require as little as 0% or 5%, enabling professionals to enter the housing market earlier and preserve their savings for other financial goals, such as investments or practice-related expenses. For a physician just starting a practice, this can be the difference between renting and owning a home.

This reduced upfront cost can free up capital for essential investments in medical equipment or continuing education. This accessibility is particularly beneficial for those early in their careers who haven’t yet accumulated substantial savings but possess strong earning potential. For example, a newly established dentist could leverage a physician mortgage to purchase a home and simultaneously invest in new dental technology, accelerating career growth. Another key advantage is the potential elimination of private mortgage insurance (PMI).

PMI is typically required for conventional mortgages with down payments below 20%, adding a substantial monthly expense. Physician and professional mortgages often waive this requirement, translating to lower monthly payments and increased affordability. This PMI waiver can represent significant savings over the life of the loan, allowing professionals to allocate those funds towards student loan repayment, retirement contributions, or other financial priorities. Consider a lawyer purchasing a $500,000 home. Eliminating PMI could save hundreds of dollars per month, a substantial amount that could be redirected towards student loan debt, a common financial burden for legal professionals.

These specialized programs often extend higher loan amounts compared to conventional mortgages, acknowledging the robust income potential of these professions. This expanded borrowing power enables professionals to purchase properties aligned with their long-term financial goals and lifestyle needs, even in competitive real estate markets. This can be particularly relevant for professionals in metropolitan areas with high property values. For instance, a surgeon in a major city could access a larger loan to purchase a home commensurate with their income trajectory, even if it exceeds the limits of a standard conventional mortgage.

Furthermore, some lenders consider future earning potential, a crucial advantage for those in residency or fellowship programs. This forward-looking approach recognizes the substantial income growth expected in these professions, facilitating homeownership earlier in their careers. While physician and professional mortgages offer compelling benefits, it’s crucial to weigh the potential trade-offs. Interest rates for these programs can sometimes be slightly higher compared to conventional mortgages, reflecting the lender’s acceptance of lower down payments and potentially higher risk.

Borrowers should carefully compare interest rates and associated costs across multiple lenders to secure the most favorable terms. Additionally, these programs are not universally suitable. Individual financial circumstances, career stage, and long-term goals should be carefully evaluated to determine if a physician or professional mortgage aligns with one’s overall financial strategy. Consulting with a financial advisor specializing in mortgage planning for high-earning professionals can provide valuable insights and guidance in making an informed decision. Navigating the complexities of physician and professional mortgages requires diligent research and a thorough understanding of the eligibility criteria and program specifics. Prospective borrowers should meticulously compare offerings from different lenders, scrutinizing interest rates, loan terms, and associated fees. Working with a mortgage broker experienced in these specialized programs can streamline the process and ensure access to the most competitive options. By carefully considering the advantages and potential drawbacks, professionals can leverage these programs to achieve their homeownership goals while optimizing their overall financial well-being.

Who Qualifies? Eligibility Criteria Across Professions

Eligibility for physician and professional mortgage programs is primarily determined by an applicant’s profession, though specific requirements can vary significantly between lenders, making it essential to shop around. Doctors, encompassing physicians, surgeons, and specialists across various medical fields, form the largest group of beneficiaries for these specialized loans. For example, a newly graduated neurosurgeon with a high income potential but limited savings can often qualify for a physician mortgage, securing a home with a low down payment and avoiding private mortgage insurance (PMI), a significant advantage in their early career.

Similarly, dentists, including general practitioners and specialists such as orthodontists and periodontists, also frequently meet the criteria for a dentist mortgage, allowing them to establish their practices and homes simultaneously. Lawyers, particularly those in established practices or with a demonstrated high earning potential, are also commonly included in these programs. A partner at a prestigious law firm, for instance, might qualify for a lawyer mortgage even with a shorter credit history, given their stable and substantial income.

Beyond these core professions, some lenders extend eligibility to other fields, including pharmacists, optometrists, veterinarians, and even certain types of business executives. For example, a chief financial officer (CFO) of a major corporation might qualify for a professional mortgage, showcasing that these programs are not exclusively for medical professionals but also for other high-earning individuals. However, the specific criteria for these ‘extended’ professions can be more stringent, requiring a thorough review of income and career stability.

It’s crucial for professionals to confirm their eligibility with multiple lenders, as each institution has its own unique requirements. In addition to profession, lenders meticulously assess several financial factors to determine eligibility. A strong credit score is paramount, as it indicates the borrower’s ability to manage debt responsibly. While these programs offer more flexibility than conventional mortgages, a poor credit history can still disqualify an applicant or result in less favorable loan terms. Employment history is another critical factor; lenders prefer to see a stable and consistent work record, often requiring a minimum of two years in the current field.

Furthermore, the debt-to-income ratio (DTI) is closely scrutinized. While these programs recognize the high earning potential of professionals, lenders still need to ensure that the borrower can comfortably manage their monthly mortgage payments along with other existing debts. For example, even a high-earning doctor with significant student loan debt might find their application affected by a high DTI. The appeal of physician and professional mortgage programs often centers on the financial advantages they offer, such as the ability to secure a high loan amount with a low down payment, sometimes as little as 0-5%, and the avoidance of private mortgage insurance (PMI).

These features are particularly beneficial for professionals early in their careers who may not have accumulated substantial savings for a traditional down payment. Consider a dentist just starting their practice; the ability to purchase a home with a low down payment through a dentist mortgage allows them to allocate more capital to their business. These programs also often offer more flexible underwriting guidelines, recognizing the unique financial circumstances of high-earning professionals with significant student loan burdens, which can be a major obstacle when seeking a conventional mortgage.

These programs are not a free pass, but rather a recognition of the financial trajectory of these specific professions. It’s also important to note that international professional standards and licensing can impact eligibility, particularly for professionals trained or practicing outside of the United States. For instance, professionals from the People’s Republic of China (PRC) may face challenges due to variations in professional licensing and practice regulations. The PRC’s rigorous licensing requirements for medical professionals, for example, may not directly translate to equivalent credentials in other countries, potentially affecting their ability to secure these loans. However, ongoing efforts to align professional standards with international norms may ease this transition in the future. This cause-and-effect relationship between PRC policies and international mobility is a key factor to consider when applying for a physician mortgage, doctor loan, or other professional mortgage programs.

Conventional vs. Physician/Professional Loans: A Detailed Comparison

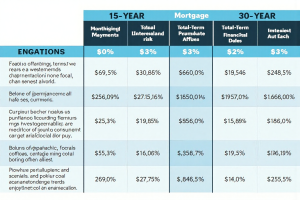

Choosing between a conventional mortgage and a physician/professional loan requires careful consideration of your financial situation and long-term goals. Conventional mortgages, the traditional path to homeownership, typically require a 20% down payment, a substantial sum that can delay homeownership for many, especially early-career professionals burdened with student debt. The financial commitment doesn’t end there; if the down payment is less than 20%, private mortgage insurance (PMI) is often required, adding to the monthly housing expense.

While conventional loans generally offer lower interest rates, the stringent down payment and PMI requirements can present significant obstacles. Physician and professional mortgages, specifically designed for high-earning professionals like doctors, dentists, and lawyers, offer a distinct alternative. These specialized loan programs recognize the unique financial trajectory of these professions, often characterized by high future earning potential coupled with significant student loan debt. One of the most compelling features of these programs is the potential for a significantly lower down payment, sometimes as low as 0%, enabling earlier homeownership.

Furthermore, these loans often waive the PMI requirement, even with lower down payments, resulting in substantial monthly savings. The trade-off, however, may be a slightly higher interest rate compared to conventional loans. For instance, a physician just starting their practice with a high student loan balance might find the low down payment option of a doctor loan significantly more accessible than the larger upfront cost of a conventional mortgage. This allows them to invest in real estate earlier, building equity and potentially benefiting from property appreciation.

A seasoned lawyer with substantial savings, on the other hand, might opt for a conventional mortgage to capitalize on the lower interest rates and minimize the long-term cost of borrowing. This decision hinges on their individual financial circumstances and risk tolerance. The difference in lending philosophy underscores the distinct nature of these loan products. Conventional lenders primarily assess risk based on current assets, debt-to-income ratios, and credit scores, prioritizing immediate financial stability. Physician and professional mortgage lenders, however, factor in the projected income growth and career stability inherent in these professions.

They understand that while a new doctor may have a high debt-to-income ratio initially, their earning potential is expected to rise significantly over their career. This specialized understanding allows them to offer more flexible terms, such as higher loan amounts, catering to the specific needs of these professionals. A dentist, for example, might qualify for a larger loan amount under a professional mortgage program compared to a conventional loan, enabling them to purchase a property that aligns with their long-term professional and personal goals.

Choosing the optimal mortgage strategy requires a comprehensive assessment of your financial profile, career stage, and long-term goals. Consulting with a financial advisor specializing in mortgage planning for medical professionals or other high-earning professions can provide valuable personalized guidance. Such an advisor can help navigate the complexities of both conventional and specialized loan programs, ensuring that the chosen path aligns with individual financial objectives. This expert guidance can be instrumental in making informed decisions and securing the most favorable terms, ultimately facilitating a successful and sustainable path to homeownership.

By carefully weighing the advantages and disadvantages of each option and considering your unique circumstances, you can make a well-informed decision that sets you on the right path toward achieving your homeownership goals. Lastly, consider the long-term implications of your choice. Calculate the total cost of each loan option over the life of the mortgage, including interest, PMI (if applicable), and other fees. This long-term perspective can help you make the most financially sound decision, whether it’s the lower upfront costs of a physician loan or the potentially lower overall cost of a conventional mortgage.

Step-by-Step Guide to the Application Process

The application process for a physician or professional mortgage, while sharing similarities with conventional mortgages, presents unique nuances that require careful attention. Initially, assembling a comprehensive suite of financial documents is paramount. This includes not only the standard proof of income, such as W-2 forms or pay stubs, but also detailed employment contracts, particularly for those in the medical field where compensation structures can be complex. Student loan statements, often substantial for professionals like doctors and lawyers, must be readily available, along with a recent credit report reflecting your financial history.

These documents serve as the foundation for your application, providing lenders with a clear picture of your financial standing and ability to manage debt. Next, the crucial step of researching and comparing lenders who specialize in physician mortgage or professional mortgage programs begins. Not all institutions offer these niche products, and terms can vary significantly, impacting your overall cost of borrowing. For example, some lenders may offer more favorable terms for a doctor loan with a lower interest rate or more flexible repayment options than others, while some lenders may offer better terms for a dentist mortgage.

It is essential to diligently compare these programs to ensure you select the one that best aligns with your individual financial situation and long-term goals. This step is critical because the potential benefits, such as no PMI and low down payment options, can be substantial, but the specific terms can differ significantly between lenders. Once a suitable lender is identified, the formal loan application process begins. This involves providing all the necessary documentation and completing the lender’s application forms, often requiring detailed information about your professional background and financial history.

The lender will then conduct a thorough review, which includes a credit check to assess your creditworthiness. This is a critical stage where any inaccuracies or inconsistencies in your financial records can cause delays or even denial of the loan. Therefore, ensuring the accuracy and completeness of your application is crucial. Upon approval, the lender will issue a loan estimate, outlining the specific terms of the loan, including the interest rate, loan amount, and monthly payments.

It is imperative to carefully review this document, paying close attention to all the details, including any fees or charges associated with the loan. This is where you’ll see the full impact of the low down payment and no PMI benefits that are characteristic of these programs. Comparing this estimate with other offers is essential to ensure you are securing the most advantageous terms available. The underwriting process follows, where the lender verifies all the information you provided and assesses the value of the property you intend to purchase.

This process is often more rigorous than with conventional loans, as lenders are taking on a greater risk with these specialized programs, which often feature high loan amounts and lower down payments. Finally, after all conditions are met, you’ll proceed to the closing, where you’ll sign the final loan documents and receive the keys to your new home. Throughout this intricate process, maintaining open and consistent communication with your lender is critical. Addressing any questions or concerns promptly can help streamline the process and avoid unnecessary delays.

Furthermore, engaging a mortgage broker specializing in physician and professional loans can be exceptionally beneficial. These brokers possess in-depth knowledge of the market and can help you navigate the complexities of the process, identifying the best loan options and terms tailored to your unique circumstances. They can also act as an intermediary, facilitating communication between you and the lender, and helping to resolve any issues that may arise. For example, a mortgage broker might be familiar with a specific lender that offers a particularly favorable lawyer mortgage program, or they might be able to negotiate better terms on your behalf. This expertise can be invaluable, saving you time and money, and ensuring a smoother path to homeownership. This is particularly true for professionals who have demanding schedules and may not have the time to navigate the complexities of the mortgage process on their own.

Tips for Securing the Best Rates and Terms

Securing the best rates and terms for a physician or professional mortgage requires careful planning and research, much like any significant financial decision. For professionals in fields like medicine, law, and dentistry, understanding the nuances of these specialized loans is crucial for maximizing their benefits. One of the most impactful steps towards securing a favorable loan is improving your credit score. A higher credit score signals financial responsibility to lenders, often translating into lower interest rates and more advantageous loan terms.

Paying down outstanding debts, such as student loans or credit card balances, and diligently correcting any inaccuracies on your credit report are essential steps in this process. For physicians burdened with substantial student loan debt, a physician mortgage’s potential for no PMI, even with a lower down payment, can significantly impact long-term financial health. Beyond credit score optimization, comparing offers from multiple lenders is paramount. Don’t settle for the first offer you receive. Different lenders have varying risk appetites and may offer different interest rates, fees, closing costs, and terms.

Working with a mortgage broker specializing in physician and professional loans can be invaluable. Brokers possess access to a wider network of lenders, including those specifically catering to high-earning professionals, and can leverage their expertise to negotiate the best possible terms on your behalf. For instance, a broker might identify a lender offering a slightly higher interest rate but significantly lower closing costs, resulting in overall savings for a dentist purchasing their first practice and home concurrently.

This targeted approach can be particularly beneficial for lawyers establishing their own firms, as their income streams might be less predictable in the initial years. Consider the long-term costs of the loan, not just the allure of a low monthly payment. While a lower monthly payment might seem attractive initially, it’s essential to calculate the total interest paid over the life of the loan. A lower interest rate, even with a slightly higher monthly payment, can result in substantial savings over time.

This long-term perspective is particularly relevant for physicians and dentists investing in specialized equipment or further education, as it allows them to manage their debt strategically. Negotiating the terms of the loan is another crucial step. Don’t hesitate to ask for a lower interest rate, reduced fees, or other favorable terms. Lenders are often open to negotiation, particularly with borrowers demonstrating strong credit histories, stable income, and substantial down payments. Finally, prompt and transparent communication with your lender and timely submission of all necessary documentation, such as proof of income, employment history, and student loan statements, are crucial for a smooth and efficient closing process. This proactive approach can expedite loan approval, allowing professionals to capitalize on favorable market conditions and secure their dream homes. By following these tips, you can navigate the mortgage landscape effectively and secure the best possible terms for your physician or professional mortgage, setting a strong foundation for your financial future.

Post Comment