Navigating Mortgage Recovery After Bankruptcy and Foreclosure: A Comprehensive Guide

Introduction: A Path Forward After Financial Hardship

The path to homeownership can feel particularly daunting after navigating the turbulent waters of bankruptcy or foreclosure. These financial setbacks can leave a lasting impact on your credit, impacting your ability to secure loans, rent an apartment, or even obtain certain types of employment. More significantly, these experiences can deeply affect your perception of future possibilities, leaving you feeling discouraged and overwhelmed. However, it is crucial to understand that recovery is achievable, and the dream of owning a home again is not out of reach.

This article serves as a roadmap, offering practical guidance and resources to help you regain your financial footing, rebuild your credit, and explore the pathways back to homeownership. We will delve into the complexities of mortgage recovery, address the challenges head-on, and provide actionable strategies for navigating this journey with resilience and hope. The emotional toll of foreclosure or bankruptcy can be significant, but understanding the mechanics of credit repair and mortgage qualification can empower you to take control of your financial future.

For example, while a Chapter 7 bankruptcy can remain on your credit report for up to 10 years and a foreclosure for 7, the impact on your credit score diminishes over time, particularly with consistent positive financial behavior. “Many individuals mistakenly believe that homeownership is permanently out of reach after these setbacks,” says certified financial planner, Sarah Miller. “But with diligent effort and a well-structured plan, they can absolutely rebuild their credit and qualify for a mortgage again.”

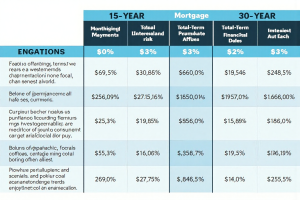

One key aspect of recovery is understanding the different types of mortgages available. FHA loans, backed by the Federal Housing Administration, are often a viable option for individuals with past credit challenges due to their lower down payment requirements and more lenient credit standards. Conventional loans, on the other hand, typically require higher credit scores and larger down payments but can offer more competitive interest rates. Exploring these options and understanding their specific requirements is a vital step in the mortgage recovery process.

For instance, someone who experienced a foreclosure three years ago and has since maintained a consistent payment history on other debts might be a suitable candidate for an FHA loan. Furthermore, rebuilding your credit involves more than just waiting for negative entries to age off your report. Actively managing your finances, paying down existing debt, and establishing a positive credit history through secured credit cards or credit-builder loans can significantly improve your creditworthiness. A credit counseling agency can provide personalized guidance and support throughout this process, helping you create a realistic budget, manage debt effectively, and navigate the complexities of credit repair.

Remember, consistent positive financial habits are the foundation of a successful mortgage recovery journey. Building a strong financial foundation through responsible spending, saving, and debt management is crucial for long-term success. Finally, don’t underestimate the power of seeking professional advice. A HUD-approved housing counselor can offer free or low-cost guidance on navigating the mortgage process, understanding your rights, and finding resources tailored to your specific situation. They can also help you create a comprehensive financial plan that includes saving for a down payment, managing closing costs, and preparing for the responsibilities of homeownership. With the right support and a proactive approach, the dream of homeownership can become a reality once again, even after experiencing the setbacks of bankruptcy or foreclosure.

Understanding the Impact of Bankruptcy and Foreclosure on Credit

Bankruptcy and foreclosure are significant financial events that cast a long shadow over your creditworthiness, impacting your ability to secure loans, rent an apartment, or even obtain certain types of employment. Understanding the nuances of how these events affect your credit report is crucial for charting a path toward financial recovery and ultimately, homeownership. A Chapter 7 bankruptcy, often referred to as liquidation bankruptcy, can remain on your credit report for up to 10 years, signaling a past inability to manage debt.

This type of bankruptcy involves the sale of non-exempt assets to repay creditors. A Chapter 13 bankruptcy, on the other hand, which involves a structured repayment plan over a period of 3-5 years, stays on your report for 7 years. Similarly, a foreclosure, the legal process by which a lender repossesses a property, also remains on your credit report for 7 years, painting a picture of past financial distress to potential lenders. These negative entries significantly lower your credit score, making it difficult to qualify for new credit, especially a mortgage.

For instance, a drop of 200 points or more is not uncommon after a bankruptcy or foreclosure, pushing many individuals into subprime credit territory. The impact isn’t just about the numbers; lenders view these events as indicators of higher risk, potentially leading to higher interest rates or outright denial of credit applications. Beyond mortgages, these negative marks can affect your ability to secure auto loans, personal loans, and even credit cards, making everyday financial management more challenging.

The long-term implications for mortgage qualification are substantial. Lenders scrutinize credit reports carefully, looking for patterns of responsible financial behavior. A bankruptcy or foreclosure signals a break in that pattern, raising concerns about your ability to repay a mortgage. The severity of the impact depends on factors such as the type of bankruptcy, the amount of debt discharged, and the time elapsed since the event. For example, a recent Chapter 7 bankruptcy with a high amount of discharged debt will present a greater obstacle to mortgage approval than a Chapter 13 bankruptcy discharged several years prior.

Understanding these nuances is essential for setting realistic expectations and developing a strategic plan for mortgage recovery. It is important to regularly check your credit report for errors and to understand the detailed information being reported by creditors. Errors can occur, and inaccuracies can further depress your credit score. The Fair Credit Reporting Act (FCRA) grants you the right to dispute errors with credit bureaus, empowering you to take control of your credit history. Review your report meticulously, paying attention to account statuses, dates, and payment histories.

If you find discrepancies, dispute them promptly with the respective credit bureau, providing supporting documentation to substantiate your claim. Monitoring your credit report through services like AnnualCreditReport.com, which provides free reports from the three major bureaus – Equifax, Experian, and TransUnion – is crucial for maintaining an accurate credit profile and tracking your progress toward recovery. This proactive approach not only helps you identify and correct errors but also provides valuable insights into your creditworthiness from the perspective of potential lenders.

By understanding the specific ways these events are reported and how they impact your score, you can begin to take actionable steps toward rebuilding your credit and eventually securing a mortgage. Navigating the mortgage landscape after a bankruptcy or foreclosure requires a comprehensive understanding of available options. FHA loans, backed by the Federal Housing Administration, are often a viable pathway for individuals with past credit challenges. These loans generally have more lenient credit requirements and lower down payment options compared to conventional loans, making them accessible to a wider range of borrowers.

However, waiting periods apply after a bankruptcy or foreclosure before you can qualify for an FHA loan. Understanding these waiting periods and the specific requirements for FHA loans is crucial for planning your mortgage application strategy. Exploring different loan programs, comparing interest rates, and consulting with a mortgage advisor specializing in borrowers with past credit issues can significantly improve your chances of securing a mortgage and rebuilding your financial future. While rebuilding credit after a financial setback can feel daunting, remember that it is a journey, not a destination. Consistent effort, responsible financial management, and a proactive approach to credit repair can pave the way toward homeownership and long-term financial stability. By understanding the impact of bankruptcy and foreclosure on your credit, you can take control of your financial narrative and build a brighter future.

Strategies for Rebuilding Credit

Rebuilding credit after bankruptcy or foreclosure is a marathon, not a sprint, demanding consistent effort and responsible financial behavior. It requires a strategic approach, much like planning for a new home purchase. The first step involves creating a realistic budget that tracks income and expenses, identifying areas where you can cut back and save. This meticulous tracking not only helps free up funds for debt repayment but also instills financial discipline crucial for mortgage approval down the line.

Prioritize paying down existing debt, especially revolving credit like credit cards, as high credit utilization negatively impacts your score. Avoid accumulating new debt, focusing instead on consistent, manageable progress. Think of it as preparing your financial foundation for the weight of a mortgage. For example, cutting unnecessary subscriptions or bringing lunch to work can free up resources to accelerate debt repayment. One effective strategy is to utilize secured credit cards, which require a cash deposit as collateral.

These cards are often accessible to individuals with damaged credit and provide a safe way to demonstrate responsible credit usage. Make small, consistent purchases, such as gas or groceries, and pay them off on time and in full each month. This consistent positive payment history is reported to credit bureaus, gradually improving your credit score. Avoid maxing out credit limits; keeping your credit utilization ratio low, ideally below 30%, is essential for demonstrating responsible credit management to potential lenders.

For example, if your secured credit card has a $500 limit, aim to keep your balance below $150. Another crucial strategy for credit repair is becoming an authorized user on a credit card held by a family member or friend with a strong credit history. This can quickly help boost your score, as long as the primary cardholder has excellent payment habits. The positive payment history on that account will reflect on your credit report, contributing to a quicker recovery.

However, be cautious; if the primary cardholder misses payments or has high credit utilization, it will negatively impact your score as well. Open and honest communication with the cardholder about their credit habits is crucial. This strategy should be part of a broader credit-building plan, including secured cards and responsible debt management. Adding a positive tradeline can significantly improve your credit mix, a factor considered in mortgage applications. Debt management plays a significant role in the mortgage recovery journey.

Consider consolidating high-interest debts into a lower-interest loan to streamline payments and reduce the overall interest burden. Explore options like balance transfers or debt consolidation loans. A lower debt-to-income ratio is vital for mortgage approval, demonstrating to lenders your ability to manage a mortgage payment alongside other financial obligations. Consulting a reputable credit counseling agency can provide valuable guidance on debt management strategies, budgeting, and creating a personalized financial recovery plan. They can help you negotiate with creditors, create a manageable repayment plan, and provide resources for financial literacy.

A well-structured debt management plan not only improves your creditworthiness but also instills financial discipline essential for responsible homeownership. Patience and discipline are key virtues in the credit rebuilding process. It takes time to demonstrate a pattern of responsible credit behavior to lenders. Consistent on-time payments, low credit utilization, and a positive credit mix are essential components of a successful credit recovery journey. Remember, securing a mortgage after bankruptcy or foreclosure is achievable with diligent effort, strategic planning, and a long-term commitment to responsible financial practices.

Understanding the nuances of credit scoring, debt management, and the mortgage application process empowers you to navigate the path toward future homeownership with confidence. Building a positive credit history is not merely about obtaining a loan; it’s about building a strong financial foundation for long-term stability and success. With each step towards credit recovery, you are moving closer to achieving your homeownership goals. Consider FHA loans as a potential pathway to homeownership after foreclosure or bankruptcy, given their more flexible credit requirements and lower down payment options. While the road to recovery may seem long, remember that every positive financial step you take brings you closer to your goal of owning a home again.

Exploring Mortgage Options After Bankruptcy and Foreclosure

While securing a mortgage after bankruptcy or foreclosure presents challenges, it is not an insurmountable obstacle on the path to homeownership. Several mortgage options cater to individuals with past financial issues, each with its own set of requirements and benefits. FHA loans, insured by the Federal Housing Administration, are often a more accessible route for those with credit blemishes. These loans typically feature lower down payment requirements, sometimes as low as 3.5%, and more flexible credit standards compared to conventional mortgages.

For instance, the waiting period after a Chapter 7 bankruptcy is often just two years, although some lenders might require a longer period depending on the specific circumstances and the borrower’s overall financial profile. This makes FHA loans a viable option for those actively engaged in financial recovery. Conventional loans, backed by Fannie Mae or Freddie Mac, generally impose stricter credit requirements and longer waiting periods. These loans often require a waiting period of seven years after a foreclosure or a short sale, and typically demand a higher credit score and a more substantial down payment, often 20% or more.

The rationale behind these stringent requirements is to mitigate the risk for lenders, as conventional loans are not insured by the government. However, for borrowers with a stronger financial profile and a longer recovery period, conventional loans can offer competitive interest rates and terms, making them a desirable option for long-term financial stability. It’s crucial for individuals to assess their financial standing and recovery timeline to determine the most suitable loan type. Beyond FHA and conventional loans, non-qualified mortgage (non-QM) loans represent another potential avenue for individuals with a history of bankruptcy or foreclosure.

Non-QM loans, as the name suggests, do not adhere to the strict lending standards of qualified mortgages, and they often come with more flexible underwriting guidelines. This flexibility, however, usually translates to higher interest rates and potentially less favorable terms, reflecting the increased risk for lenders. These loans might be suitable for borrowers who do not meet the stringent criteria of FHA or conventional loans, but it is imperative to carefully evaluate the long-term costs and implications.

A thorough comparison of the interest rates, fees, and terms associated with non-QM loans is essential before making a commitment. Understanding the nuances of each option is crucial for making an informed decision. Navigating the complex landscape of mortgage recovery after bankruptcy or foreclosure requires a strategic approach. It is not just about finding a lender willing to offer a loan; it’s about understanding the long-term implications for your financial health. For example, individuals should actively work to improve their credit score, even after meeting the minimum waiting period, to secure more favorable terms and interest rates.

Engaging in credit repair strategies, such as paying down existing debt and avoiding new debt accumulation, can significantly enhance your mortgage prospects. Additionally, building a solid financial foundation, including a stable income and a healthy savings account, will make you a more attractive borrower to lenders. This proactive approach to financial recovery is as crucial as the specific mortgage options available. Working with a mortgage broker specializing in these situations can be exceptionally beneficial. These brokers have established relationships with lenders who are more open to working with borrowers who have past credit challenges.

They can provide expert guidance in navigating the complexities of the mortgage application process, help you identify the most suitable loan options based on your specific circumstances, and offer valuable insights into the requirements of various lenders. They can also assist in compiling the necessary documentation and preparing you for the scrutiny of the underwriting process. Ultimately, the goal is not just to secure a mortgage, but to achieve sustainable homeownership that aligns with your long-term financial goals and enhances your overall financial stability. This collaborative approach can significantly improve your chances of success in mortgage recovery.

Navigating the Mortgage Application Process

Navigating the mortgage application process after bankruptcy or foreclosure requires meticulous preparation, patience, and a clear understanding of the heightened scrutiny involved. It’s a process of demonstrating renewed financial responsibility to lenders. Begin by gathering all essential documentation: proof of income (pay stubs, W-2s, or 1099s), bank statements covering at least two months, tax returns for the past two years, and a detailed written explanation of the circumstances that led to your bankruptcy or foreclosure.

This narrative should emphasize the steps you’ve taken to rehabilitate your finances and prevent similar situations in the future. For instance, if job loss contributed to your hardship, highlight your current stable employment. Lenders will analyze your application thoroughly, so honesty and transparency are paramount. Be prepared to answer questions about your current spending habits, budget, and your commitment to responsible financial management. This demonstrates your understanding of the long-term commitment involved in homeownership. One key area lenders focus on is your credit report.

While the bankruptcy or foreclosure will be listed, recent positive payment history on other accounts, such as credit cards or auto loans, significantly strengthens your application. Even small secured credit cards used responsibly can showcase your improved credit management skills. Beyond credit score, lenders assess your debt-to-income ratio (DTI). A lower DTI indicates a greater ability to manage monthly mortgage payments. Strategies to improve your DTI include paying down existing debt and increasing your income.

Providing evidence of consistent income and a manageable DTI builds lender confidence. Saving for a substantial down payment is another crucial step. A larger down payment not only reduces the loan amount but also signals to lenders your commitment and financial stability. Explore down payment assistance programs, which can help bridge the gap and make homeownership more accessible. Different loan types have varying down payment requirements. FHA loans, designed for borrowers with less-than-perfect credit, typically require lower down payments than conventional loans.

Researching these options and understanding their specific requirements will help you determine the best fit for your situation. Finally, avoid applying for multiple loans simultaneously. Each application triggers a hard inquiry on your credit report, potentially lowering your credit score. Focus on improving your financial profile before applying to multiple lenders. By addressing these key areas proactively, you can present a stronger mortgage application and increase your chances of approval, even after experiencing a bankruptcy or foreclosure. Remember, seeking guidance from a HUD-approved housing counselor can provide valuable support and personalized advice throughout this process.

Financial Planning for Future Homeownership

Reclaiming the dream of homeownership after bankruptcy or foreclosure requires a comprehensive, long-term financial plan. This journey begins with a meticulous budget that not only prioritizes saving for a down payment and closing costs but also accounts for the recurring expenses of homeownership, such as mortgage payments, property taxes, and homeowner’s insurance. A detailed budget provides a clear picture of your financial capacity and allows you to allocate funds effectively. For example, if your goal is a 20% down payment on a $300,000 home, you’ll need to save $60,000.

Mapping out a savings plan with a specific timeline, say five years, will determine the monthly savings required, which you can then factor into your budget. Consider setting up an automatic transfer to a dedicated savings account to ensure consistent progress towards your goal. This disciplined approach is crucial for demonstrating financial stability to future lenders. Beyond saving for a down payment, addressing existing debt is paramount in mortgage recovery. A high debt-to-income ratio (DTI) can significantly hinder your ability to qualify for a mortgage.

Lenders use DTI to assess your capacity to manage debt repayment alongside other financial obligations. Strategies for improving your DTI include aggressively paying down existing debts, such as credit cards and auto loans, and exploring options for consolidating high-interest debt. Even small improvements in your DTI can significantly impact your eligibility for favorable mortgage terms. For instance, reducing your DTI from 50% to 40% could open doors to lower interest rates and increased borrowing power.

Avoid accumulating new debt during this rebuilding phase, as this can negatively impact your credit score and DTI. Building a solid emergency fund is equally important. Having three to six months of living expenses in reserve provides a financial cushion to protect against unexpected events and prevents a relapse into debt, demonstrating responsible financial management to potential lenders. Navigating the mortgage landscape after bankruptcy or foreclosure often involves exploring specialized loan programs. FHA loans, backed by the Federal Housing Administration, are designed to assist borrowers with less-than-perfect credit.

These loans typically have lower down payment requirements and more lenient credit score criteria than conventional loans, making them a viable option for individuals recovering from financial hardship. Understanding the specific requirements and eligibility criteria for FHA loans is essential. For example, while FHA loans may accept lower credit scores, they often require mortgage insurance premiums, which add to the overall cost of the loan. Consulting with a HUD-approved housing counselor can provide valuable insights into various mortgage options, including FHA loans, and help you determine the best fit for your individual circumstances.

They can also guide you through the complexities of the mortgage application process, ensuring you are well-prepared and equipped to navigate the path to successful homeownership. Working with a financial advisor can provide a personalized roadmap to achieving your homeownership goals, offering expert guidance on budgeting, saving, debt management, and credit repair. They can also connect you with resources and programs specifically designed to assist individuals in rebuilding their financial lives after bankruptcy or foreclosure.

This professional support can be instrumental in navigating the complexities of mortgage recovery and achieving long-term financial stability. Finally, understanding the nuances of the real estate market in your target area is crucial. Factors like property values, inventory levels, and market trends can significantly impact your home-buying strategy. Researching neighborhoods, attending open houses, and connecting with local real estate agents can provide valuable insights and help you make informed decisions. This knowledge will empower you to identify suitable properties within your budget and navigate the negotiation process effectively. Remember, securing a mortgage after bankruptcy or foreclosure is a testament to your resilience and commitment to financial recovery. By combining a well-structured financial plan with expert guidance and market awareness, you can successfully navigate the path to homeownership and build a secure financial future.

Resources and Support

Navigating mortgage recovery after bankruptcy or foreclosure is a complex journey, yet it’s far from an insurmountable one. The path to reclaiming homeownership involves a multifaceted approach, leveraging various resources tailored to your unique circumstances. For individuals seeking guidance on debt management and credit repair, reputable credit counseling agencies offer invaluable support. These agencies, often staffed by certified counselors, provide personalized advice on budgeting, debt consolidation, and strategies to improve your credit score, which is crucial for securing a favorable mortgage rate.

For example, they can help you understand the nuances of how different types of debt impact your credit and develop a payment plan that aligns with your financial capabilities. These services are particularly beneficial post-bankruptcy, where understanding the impact of Chapter 7 or Chapter 13 filings on your credit report is essential. Furthermore, HUD-approved housing counselors play a pivotal role in helping individuals explore homeownership options. These counselors, often providing services at no cost or low cost, offer insights into the mortgage application process, helping you understand the various loan options available, including FHA loans and conventional loans.

They can guide you through the intricacies of down payment assistance programs, eligibility requirements, and the documentation needed to present a strong application. For instance, if you are considering an FHA loan, a housing counselor can explain the benefits of this type of loan, particularly its lower credit score requirements and down payment options. These counseling sessions are instrumental in demystifying the process and building confidence as you navigate the path to homeownership after financial setbacks.

Government programs, such as those offered by the Federal Housing Administration (FHA) and various state-sponsored housing initiatives, provide essential support for individuals with past financial difficulties. FHA loans, for instance, often feature more flexible credit standards and lower down payment requirements, making them a viable option for those recovering from bankruptcy or foreclosure. State programs may offer grants, low-interest loans, or tax credits to further ease the financial burden of purchasing a home. These programs are designed to help individuals overcome the hurdles that traditional lending institutions might present.

For example, some states offer “second chance mortgage” programs specifically designed to assist those who have experienced foreclosure or bankruptcy in the past. Organizations like the National Foundation for Credit Counseling (NFCC) and the Consumer Financial Protection Bureau (CFPB) also serve as valuable resources, offering tools and information to empower consumers in making informed financial decisions. The NFCC provides access to certified credit counselors, while the CFPB offers a wealth of educational materials on topics such as credit reports, mortgages, and debt management.

These resources are particularly useful for individuals looking to understand their rights and responsibilities as borrowers and to develop a sustainable financial plan. For example, the CFPB website provides user-friendly guides on understanding your credit score and how to improve it, as well as information on identifying and avoiding predatory lending practices. Ultimately, navigating mortgage recovery after bankruptcy or foreclosure is a journey that requires both knowledge and perseverance. By leveraging the expertise of credit counseling agencies, HUD-approved housing counselors, government programs, and consumer protection organizations, you can confidently move forward towards financial recovery and the dream of homeownership. Remember, these resources are designed to empower you, providing the support you need to rebuild your credit, manage your finances effectively, and ultimately secure a stable and secure future. With a clear plan and the right support, achieving your financial goals, including owning a home, is absolutely within reach.

Post Comment