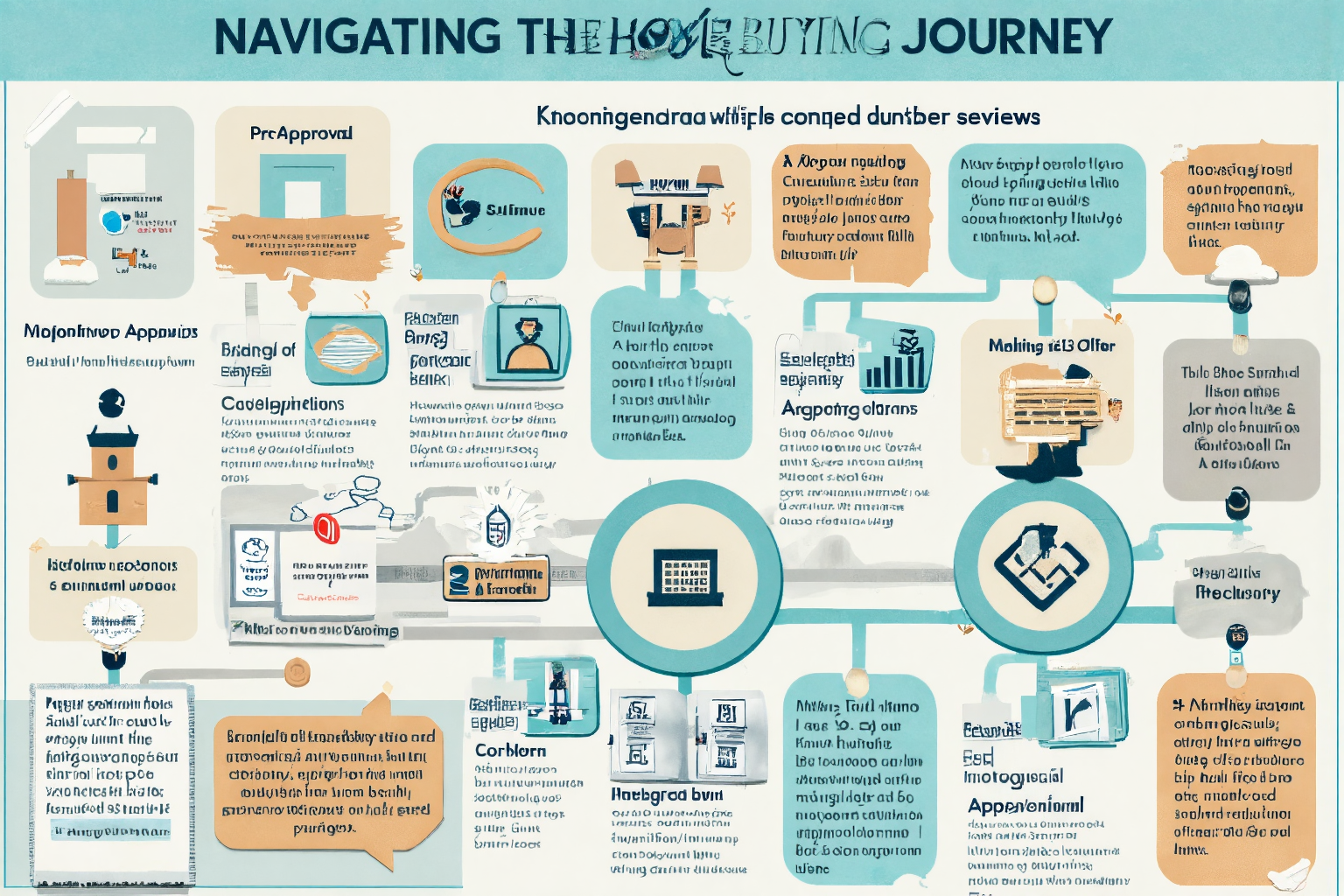

Navigating the Home Buying Journey: A Step-by-Step Guide from Pre-Approval to Closing

Introduction: Your Journey to Homeownership

Embarking on the journey of buying a home can be both exciting and daunting, a blend of dreams realized and complex processes to navigate. This comprehensive guide, “Navigating the Home Buying Journey: A Step-by-Step Guide from Pre-Approval to Closing,” is designed to empower you with the knowledge and resources you need to confidently navigate every step of the home buying process, from the initial mortgage pre-approval to the final closing. Whether you’re a first-time homebuyer stepping into the real estate market or a seasoned homeowner seeking a refresher on the intricacies of buying a house, this guide will provide valuable insights and practical tips tailored to your needs. Understanding the current real estate market dynamics is crucial, and this guide will equip you with the necessary tools to make informed decisions. For first-time homebuyers, the process can feel particularly overwhelming, so we’ll break down each step, explaining key terms like closing costs and the importance of a real estate agent. Finding the perfect property often involves extensive property searches, and we’ll guide you through effective strategies for navigating online listings and working with a real estate agent to find the ideal home. We’ll also discuss the importance of securing a mortgage pre-approval, a critical first step that determines your buying power and strengthens your offer. From understanding the nuances of the mortgage application to the final steps of the closing process, this guide provides a roadmap for a smooth and successful home buying experience. The home inspection, a vital part of protecting your investment, will be thoroughly explained, as will the importance of understanding market value through the appraisal process. By following this comprehensive guide, you’ll be well-prepared to navigate the complexities of the home buying journey and confidently achieve your dream of homeownership. This guide will cover everything from making a competitive offer in a dynamic market to understanding the intricacies of the underwriting process. You’ll learn how to effectively negotiate terms, manage contingencies like the home inspection, and understand the role of title insurance in protecting your property rights. Whether you’re unsure about the different types of mortgages available or navigating the final stages of the closing process, this guide provides the clarity and support needed to make informed decisions and successfully transition into your new home.

Pre-Approval: Setting the Foundation

Before you even begin browsing dream homes online or scheduling open house visits, getting pre-approved for a mortgage is paramount in the home buying process. This crucial first step establishes your buying power and sets a realistic budget, preventing potential disappointments down the line and giving you a competitive edge in the real estate market. Pre-approval involves a lender thoroughly reviewing your financial documents, such as pay stubs, tax returns, bank statements, and credit reports, to determine the loan amount you qualify for. This provides you with a clear understanding of your affordable price range and demonstrates to sellers that you are a serious and qualified buyer. For first-time homebuyers, understanding the pre-approval process can be especially valuable, as it clarifies the financial commitment involved and helps manage expectations. Imagine, for instance, a young couple excited to enter the real estate market. Obtaining pre-approval empowers them to focus their property search on homes within their budget, avoiding the heartbreak of falling in love with a house beyond their means. A pre-approval letter significantly strengthens their offer, assuring the seller of their ability to secure financing. This can be the deciding factor in a competitive market. Moreover, getting pre-approved allows you to shop around for the best mortgage rates and loan terms. Different lenders offer varying interest rates, closing costs, and loan products, so it’s essential to compare options and choose the best fit for your financial situation. Researching lenders and understanding different mortgage types, like fixed-rate and adjustable-rate mortgages, can help you make informed decisions. Consulting with a real estate agent during this stage can also be beneficial, as they can provide valuable insights into the local market and recommend reputable lenders. Don’t hesitate to ask questions and seek clarification on any aspect of the pre-approval process. By taking this proactive step, you’ll be well-prepared to navigate the exciting journey of buying a house with confidence and financial clarity. Understanding the intricacies of mortgage pre-approval empowers first-time homebuyers to confidently enter the real estate market and make informed decisions. It’s an essential step in the home buying process, setting the stage for a successful and less stressful experience. By having your financial ducks in a row and understanding your borrowing capacity, you’ll be in a strong position to make a competitive offer when you find the perfect property. This preparation not only streamlines the home buying journey but also allows you to focus on the excitement of finding your dream home. Once you have your pre-approval in hand, you can confidently begin your property search, knowing you have a clear budget and the financial backing to make your homeownership dreams a reality. This step sets a solid foundation for the entire home buying process, from the initial home search to the final closing.

Home Search: Finding the Perfect Property

Embarking on your home search begins with defining your ideal property and aligning it with your pre-approved mortgage budget. Consider not just the purchase price, but also potential closing costs, property taxes, and homeowners insurance to ensure a realistic budget. First-time homebuyers often benefit from online mortgage calculators and budgeting tools to gain a clearer understanding of their affordability range. Partnering with a skilled real estate agent is invaluable during this phase. A buyer’s agent can provide expert guidance, access to exclusive listings, and insights into market trends, saving you time and effort in the competitive real estate market. They can also help you navigate the complexities of the home buying process, from making an offer to negotiating closing costs. Utilize online resources like property listing websites to explore available homes and refine your search based on criteria like location, size, and features. These platforms offer a wealth of information, including virtual tours, neighborhood demographics, and recent sales data, empowering you to make informed decisions. Researching potential neighborhoods is essential to finding the right fit. Consider factors such as school districts, proximity to amenities like parks and shopping centers, and commute times to work. Explore local community resources and connect with residents to gain a deeper understanding of the neighborhood’s character and lifestyle. For first-time homebuyers, attending open houses and neighborhood events can offer valuable insights and help visualize their future in the community. Remember that buying a house is a significant investment, and due diligence is crucial. Don’t underestimate the importance of a thorough property inspection to uncover any potential issues. A professional home inspection can identify hidden problems, such as structural damage, plumbing issues, or electrical faults, which can be costly to repair later. Negotiating repairs or credits with the seller based on the inspection report can protect your investment and provide peace of mind. In a competitive market, a pre-inspection can strengthen your offer by demonstrating your commitment and reducing potential delays. Finally, explore different mortgage options and understand the long-term financial implications of your decisions. Comparing interest rates, loan terms, and closing costs from various lenders can significantly impact your monthly payments and overall cost of homeownership. For first-time homebuyers, government-backed loans like FHA loans may offer more flexible qualification requirements and lower down payment options. A mortgage pre-approval not only strengthens your offer but also helps you stay within your budget throughout the home search process.

Making an Offer: Securing Your Dream Home

Crafting a competitive offer in today’s real estate market requires a strategic approach, especially for first-time homebuyers. Understanding market dynamics, such as inventory levels and average sale prices, is crucial. Your real estate agent can provide valuable insights into comparable sales, also known as “comps,” which are recently sold properties similar to the one you’re targeting. Analyzing comps helps determine a fair and competitive offer price. For example, if similar homes in the neighborhood have recently sold for above asking price, you may need to offer more to be competitive. In a buyer’s market, however, you might have more negotiating power. Include contingencies in your offer to protect your interests during the home buying process. Common contingencies include financing, which allows you to back out if you’re unable to secure a mortgage, and a home inspection, which identifies potential issues with the property. For instance, if the home inspection reveals significant repairs, you can renegotiate the price or request the seller to address the issues before closing. Negotiating terms like price, closing date, and repairs is a normal part of the home buying process. Your real estate agent will act as your advocate, guiding you through negotiations and ensuring your offer stands out. They can leverage their expertise and market knowledge to present your offer in the most favorable light. Consider offering a larger earnest money deposit to demonstrate your seriousness and commitment to the purchase. In a competitive market, a higher earnest money deposit can make your offer more appealing to sellers. Be flexible with the closing date if possible, as accommodating the seller’s timeline can sometimes give you an edge. While navigating the complexities of making an offer can seem daunting, especially for first-time homebuyers, having a skilled real estate agent by your side can make all the difference. They can help you understand the nuances of the market, craft a compelling offer, and negotiate favorable terms, ultimately increasing your chances of securing your dream home. Remember, buying a house is a significant investment, and making a well-informed offer is a crucial step in the process. From mortgage pre-approval to closing costs, understanding every aspect of the transaction empowers you to make confident decisions and navigate the real estate market effectively. By working closely with your real estate agent and utilizing available resources, you can successfully navigate the offer process and move closer to achieving your homeownership goals.

Mortgage Application and Underwriting: Securing the Financing

Once your offer is accepted, the formal mortgage application process begins, marking a significant step in the home buying process. This stage transitions you from the excitement of finding the perfect property to the crucial task of securing the financing. It’s essential to be prepared and organized to ensure a smooth and efficient experience. Begin by compiling all necessary documentation, including pay stubs, tax returns, bank statements, and any other financial records requested by your lender. Having these readily available will expedite the process and demonstrate your financial responsibility to the lender. For first-time homebuyers, this can feel overwhelming, so creating a checklist or working with a real estate agent can help keep you on track. Remember, a well-organized application strengthens your position and streamlines the underwriting process. The underwriting process is where your financial stability and creditworthiness are thoroughly assessed. Underwriters delve into your financial history, verifying employment, income, debts, and credit score to determine the level of risk involved in lending to you. A strong credit score and a stable financial history are crucial for securing favorable loan terms. This is where the importance of mortgage pre-approval becomes evident. Being pre-approved gives you a clear understanding of your borrowing power and instills confidence in sellers, making your offer more competitive in the real estate market. During underwriting, be responsive to your lender’s requests for additional information. Promptly providing any requested documentation will prevent delays and keep the process moving forward. Buying a house is a significant investment, and the underwriting process is a critical component of protecting both you and the lender. Understanding this process empowers you to navigate this stage with confidence. Working closely with your lender and real estate agent throughout the mortgage application and underwriting phase can significantly contribute to a successful closing. They can offer valuable insights, answer your questions, and provide guidance, ensuring you’re well-informed and prepared for each step. This collaborative approach streamlines the journey from offer acceptance to closing, making the process less daunting and more manageable. From property search to closing costs, each step builds upon the previous one, culminating in the realization of your homeownership dream. By understanding the intricacies of the mortgage application and underwriting process, you’re better equipped to navigate the complexities of the real estate market and secure the financing for your dream home.

Home Inspection and Appraisal: Protecting Your Investment

Protecting your investment and ensuring a fair purchase price hinges on two crucial steps: the home inspection and appraisal. These processes provide an objective assessment of the property’s condition and market value, empowering you to make informed decisions. The home inspection, conducted by a qualified professional, scrutinizes the property’s structure, systems, and components, from the foundation to the roof. Inspectors look for potential issues like plumbing leaks, electrical problems, roof damage, and structural deficiencies. For example, a home inspector might identify a faulty HVAC system, providing you with leverage to negotiate repair costs with the seller or adjust your offer accordingly. This detailed report equips you with a comprehensive understanding of the property’s condition, allowing you to anticipate potential future expenses and avoid costly surprises down the road. Especially for first-time homebuyers, understanding the nuances of a home inspection report can be invaluable. The appraisal, on the other hand, focuses on determining the fair market value of the property. This independent assessment, conducted by a licensed appraiser, considers factors like the property’s size, location, condition, and recent comparable sales in the area. The appraisal is a critical component of the mortgage process, as lenders use it to ensure the loan amount doesn’t exceed the property’s value. For instance, if the appraisal comes in lower than the agreed-upon purchase price, you may need to renegotiate with the seller, increase your down payment, or even walk away from the deal. A thorough review of both the inspection and appraisal reports is essential for protecting your interests as a buyer. Carefully examine the findings, ask questions, and discuss any concerns with your real estate agent. If the inspection reveals significant issues, you can request the seller to make repairs, offer a credit towards closing costs, or adjust the purchase price. Remember, this is your opportunity to address potential problems before finalizing the purchase. In the competitive real estate market, navigating these steps strategically can be crucial, especially for first-time homebuyers. By understanding the importance of the home inspection and appraisal, and by working closely with your real estate agent and mortgage lender, you can confidently move forward in the home buying process, ensuring a sound investment and a smooth closing. These safeguards are essential for all homebuyers, but particularly for those entering the market for the first time, providing a layer of protection and peace of mind during this exciting yet complex journey.

Closing Process: The Final Steps

The closing process, the final stage of your home buying journey, involves finalizing all legal and financial aspects of the transaction. It marks the official transfer of ownership from the seller to you. This stage can seem complex with its numerous documents and procedures, but understanding the key components will empower you to navigate it confidently. Your real estate agent and closing agent will be invaluable resources, guiding you through each step and ensuring a smooth transition to homeownership. Preparing in advance and asking questions will make the closing process less daunting and more of a celebration of achieving your homeownership dream.

A crucial step in the closing process is the title search, which examines public records to confirm the seller has clear ownership of the property and that there are no outstanding liens or encumbrances. This protects you from inheriting any legal issues tied to the property’s ownership history. Title insurance, another essential component, safeguards you from potential future title disputes or claims that may arise after closing. For example, if a previously unknown heir emerges to claim ownership, title insurance would cover the legal costs of defending your ownership rights. While the seller typically pays for the owner’s title insurance policy, securing your own lender’s title insurance policy protects the lender’s interest in the property and is a standard requirement of most mortgages.

Homeowners insurance is another critical element to secure before closing. This insurance policy protects your investment from various risks, including fire, theft, and natural disasters. Lenders require proof of homeowners insurance before closing to ensure the property, which serves as collateral for the loan, is adequately protected. Shopping around for homeowners insurance and comparing quotes from different providers is essential to find the best coverage at a competitive price. Factors such as your home’s location, age, and construction materials can influence your insurance premiums. Bundling your homeowners insurance with other policies, like auto insurance, can often lead to discounts.

The closing meeting, often held at a title company or attorney’s office, is where the final transfer of ownership takes place. During this meeting, you’ll review and sign a multitude of documents, including the final loan agreement, mortgage note, and property deed. Be prepared to bring a government-issued photo ID and certified funds or a cashier’s check for your closing costs, which include fees for appraisal, title search, loan origination, and other services. These costs typically range from 2% to 5% of the loan amount. Carefully review the Closing Disclosure, a document that details all closing costs, before the meeting to ensure accuracy and avoid any surprises. Ask your closing agent to clarify any questions you may have about the documents or the closing process itself.

After all documents are signed and funds are transferred, you’ll receive the keys to your new home. This signifies the official completion of the home buying process and the beginning of your journey as a homeowner. While the closing process may seem complex, being prepared and informed will ensure a smooth and successful conclusion to your real estate transaction. Remember to maintain open communication with your real estate agent, lender, and closing agent throughout the process, as they are there to support you and address any concerns you may have. From mortgage pre-approval to property search to finalizing the mortgage application and navigating the real estate market, each step culminates in this final stage, marking the exciting transition to owning your dream home. Congratulations on embarking on this significant milestone and welcome to the rewarding experience of homeownership.

Conclusion: Welcome Home!

Congratulations, you’ve successfully navigated the complex home buying process and are now a homeowner! This journey, from initial mortgage pre-approval to the final closing, has been a significant undertaking, and you should be proud of your accomplishment. Remember that the knowledge and tools you’ve gained, especially if you’re a first-time homebuyer, will serve you well in the future. Staying organized with all your documents, from your property search notes to your mortgage application details, will prove invaluable as you settle into your new home. Don’t hesitate to reach out to your real estate agent and lending professionals with any questions that may arise even after the closing; they are your partners in this ongoing journey of homeownership. Buying a house is a major financial decision, and having a team of experts to support you can make all the difference.

As you begin to settle into your new home, take time to understand your property and its systems. Review the home inspection report again to familiarize yourself with any potential maintenance items. Creating a maintenance schedule can help you proactively address issues and protect your investment. This is especially important for first-time homebuyers who may not have experience with home maintenance. Also, consider connecting with your neighbors and exploring your new community. This can help you feel more connected and at home, and can also provide valuable insights into the local real estate market. Remember that your home is not just a building but also a part of a larger neighborhood.

Understanding the ongoing financial aspects of homeownership is also crucial. Keep track of your mortgage payments, property taxes, and homeowners insurance costs. These are essential elements of your monthly budget. Also, consider building an emergency fund to cover unexpected repairs or expenses. The real estate market can fluctuate, so it’s wise to stay informed about your property’s value over time. Regular check-ins with your financial advisor can help you understand how your home fits into your overall financial plan. You might also consider building equity through renovations or upgrades, which can further enhance your investment.

Finally, remember that the home buying process is a learning experience. Whether it’s your first time or not, each transaction presents unique challenges and opportunities. The experience you gained from your mortgage pre-approval, working with your real estate agent, navigating the home inspection, and understanding closing costs will be invaluable for any future real estate endeavors. The skills you’ve developed in property search, making an offer, and managing the mortgage application process will empower you to make informed decisions in the future. Enjoy the excitement of owning your new home and the security and stability it brings. It’s a major accomplishment, and now you can truly call it your own.

Post Comment