Demystifying Construction Loan Financing for Custom Home Builds: A Comprehensive Guide

Introduction: Building Your Dream Home, One Step at a Time

Building a custom home represents the pinnacle of homeownership for many, a chance to craft a living space perfectly tailored to individual needs and desires. Yet, the path to realizing this vision often begins with navigating the complexities of construction loan financing, a process that can seem daunting to the uninitiated. This guide aims to demystify the world of construction loans, offering prospective homeowners a comprehensive roadmap to confidently embark on their custom home building journey.

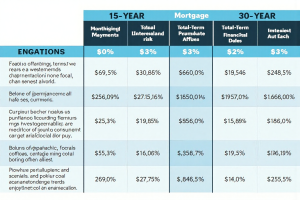

We will explore the intricacies of securing financing, understanding the different loan types, and managing the construction process effectively, ensuring that your dream home becomes a tangible reality. Unlike traditional mortgages, which finance the purchase of an existing property, construction loans are designed to fund the building process itself. These are typically short-term, interest-only loans, meaning that during the construction phase, you’ll only pay interest on the funds disbursed. This critical distinction highlights the importance of understanding the draw schedule, which outlines how and when the lender will release funds as construction progresses.

For example, a typical draw schedule might allocate funds for foundation work, framing, plumbing, electrical, and finally, interior finishes. This segmented approach to funding helps manage the risk for both the borrower and the lender, ensuring that funds are released only when specific milestones are met. One of the most common types of financing for custom home building is the construction-to-permanent loan. This option streamlines the process by combining both the construction loan and the permanent mortgage into a single loan.

Once construction is complete, the loan converts to a standard mortgage, eliminating the need for a separate application. This offers significant convenience and can often secure better interest rates by locking in terms early. However, borrowers should be aware that the conversion process involves another appraisal and loan review to ensure the completed home aligns with the original plans and meets lender requirements. For those considering a ‘self-build’ or ‘owner-builder’ approach, lenders may have additional scrutiny, often requiring proof of experience and a detailed construction plan.

Before applying for a construction loan, it is crucial to have a well-defined project plan and a realistic budget. Lenders will carefully assess the feasibility of the project, the borrower’s creditworthiness, and the qualifications of the chosen builder. A detailed construction timeline, outlining each phase of the build, is essential for securing loan approval. Additionally, a contingency fund, typically around 10-20% of the total project cost, is a prudent safeguard against unexpected expenses. For instance, a recent client in Austin, Texas, encountered unforeseen site preparation costs due to rocky soil.

Having a contingency fund allowed them to address this issue without derailing the entire project or requiring additional financing. The loan application process will also involve an appraisal of the proposed home based on the plans, a key step in ensuring the project’s value aligns with the loan amount. Understanding the loan terms is paramount. Construction loan interest rates can be variable or fixed, and the choice can significantly impact the overall cost of the project.

Variable rates may start lower but can fluctuate with market conditions, while fixed rates offer predictability but may come with a slightly higher initial cost. The draw schedule also impacts cash flow, and borrowers must work closely with their builder to ensure draws align with construction progress. Effective communication with both the lender and the builder is essential to managing the process smoothly. Real-life examples often highlight that proactive communication can prevent delays and misunderstandings, leading to a more positive and efficient home building experience. Ultimately, this journey is about building more than just a house; it’s about creating a personalized space that reflects your aspirations and lifestyle.

Understanding Construction Loans: Types and Considerations

Construction loans, the cornerstone of financing a custom home build, operate quite differently than traditional mortgages. Instead of a single lump sum, these specialized loans provide financing in stages, known as “draws,” aligned with the progress of construction. This staged disbursement mitigates risk for both the lender and the borrower, ensuring funds are available when needed and tied to verifiable construction milestones. These loans are typically short-term, interest-only, covering the 12-24 month construction period. Understanding the various types of construction loans is crucial for making informed decisions aligned with individual financial situations and project scopes.

One popular option is the construction-to-permanent loan, a streamlined approach that transitions seamlessly into a conventional mortgage upon completion of the build. This eliminates the need for a separate mortgage application, saving time and closing costs. Borrowers lock in an interest rate at the outset, providing predictability in a potentially fluctuating market. However, qualifying for this type of loan often requires a higher credit score and a larger down payment compared to other construction loan options.

Alternatively, construction-only loans offer greater flexibility, particularly for complex projects with potentially variable timelines. These loans cover only the construction phase, requiring borrowers to secure a separate mortgage once the home is built. This two-step process allows borrowers to explore different mortgage options after construction, potentially capitalizing on more favorable market conditions. However, it also carries the risk of interest rate increases and requires a second round of closing costs. For those undertaking extensive renovations rather than ground-up construction, renovation loans provide a tailored financing solution.

These loans factor in the current value of the property along with the projected value after renovations, allowing homeowners to access the necessary funds for substantial home improvements. Similar to construction loans, renovation loans can be structured as construction-to-permanent or construction-only, offering similar advantages and disadvantages depending on individual circumstances. Choosing the right construction loan hinges on several factors, including the overall project budget, the borrower’s financial profile, and risk tolerance. For instance, a self-build or owner-builder project, where the homeowner takes on the role of general contractor, might require a more flexible draw schedule and a lender experienced with such arrangements.

Consulting with a financial advisor specializing in construction lending is essential to navigate these complexities and secure the most favorable terms. Furthermore, comparing offers from multiple lenders, scrutinizing interest rates, fees, and draw schedules, is crucial to ensure a competitive loan package that aligns with the specific needs of the custom home project. Finally, understanding the intricacies of each draw request, including the documentation required by lenders, such as inspection reports and invoices, is essential for a smooth construction process. Effective communication with the builder and the lender throughout the project ensures timely disbursement of funds and minimizes potential delays. A well-defined budget, a realistic construction timeline, and a contingency plan for unforeseen expenses are paramount for successful project completion and a seamless transition into permanent financing.

Navigating the Construction Loan Application Process

Navigating the construction loan application process requires careful planning and a thorough understanding of the steps involved. Before embarking on the journey of building a custom home, prospective borrowers should first undergo pre-qualification. This initial step involves a preliminary assessment of creditworthiness and financial capacity by a lender. It provides a realistic picture of borrowing power and helps determine the budget for the project. Finding a lender specializing in custom home construction is crucial. Their expertise in this niche lending area is invaluable, as they understand the nuances of construction projects and can offer tailored loan products.

For instance, a local bank with a dedicated construction lending department might be a better fit than a large national bank that primarily handles conventional mortgages. A thorough appraisal of the project plans is another essential element. This involves a professional assessment of the proposed construction, including the land value, building plans, specifications, and estimated construction costs. The appraisal ensures the project’s feasibility and provides the lender with an independent valuation, protecting both the borrower and the lender’s investment.

Lenders meticulously assess several key factors. The borrower’s creditworthiness, including credit score, debt-to-income ratio, and credit history, plays a significant role in loan approval and interest rate determination. A strong credit profile signals financial responsibility and increases the likelihood of securing favorable loan terms. The project’s feasibility is evaluated based on the appraisal, the construction timeline, and the builder’s qualifications. Choosing an experienced and reputable builder with a proven track record is vital. Lenders often require proof of the builder’s licenses, insurance, and financial stability.

A detailed construction timeline and budget are crucial for approval, serving as a roadmap for the project and demonstrating financial organization. This detailed plan outlines each stage of construction, associated costs, and the projected draw schedule. For example, the timeline might specify foundation completion by a certain date, followed by framing, roofing, and interior work, each triggering a specific draw request. This granular level of detail provides lenders with confidence in the project’s management and reduces the risk of cost overruns or delays.

Furthermore, having a contingency reserve, typically around 10-20% of the total budget, is essential to cover unforeseen expenses, such as material price increases or unexpected site conditions. This financial buffer protects against potential disruptions and ensures the project can be completed successfully, even with unexpected challenges. By addressing these elements proactively, borrowers significantly increase their chances of securing a construction loan and realizing their dream of building a custom home. Finally, the closing process involves finalizing the loan agreement, signing all necessary documents, and disbursing the initial funds to begin construction. This marks the official commencement of the building process and the transition from planning to realization. Working with a real estate attorney throughout the process can help navigate the legal complexities and ensure a smooth closing.

Managing the Build: Budget, Draws, and Communication

Managing the intricacies of a construction loan requires diligent oversight of the budget, draw schedule, and communication with all parties involved. Understanding the loan terms, including interest rates, is paramount. These rates can be fixed, offering predictable payments, or variable, fluctuating with market conditions. Choosing the right type depends on your risk tolerance and financial outlook. For instance, a fixed-rate loan provides stability in a volatile market, while a variable rate might be more appealing if rates are projected to decline.

The draw schedule, a critical component of the construction loan, outlines the phased disbursement of funds tied to specific construction milestones. This ensures that funds are released only when the builder completes agreed-upon stages of the project, protecting both the borrower and the lender. For example, the first draw might cover site preparation and foundation work, followed by subsequent draws for framing, roofing, and interior finishes. Effective budget management is crucial throughout the build process.

A detailed budget, outlining all anticipated costs, should be developed and closely monitored. This includes not only material and labor costs but also permits, inspections, and other related expenses. A contingency reserve, typically 10-20% of the total budget, is essential to accommodate unforeseen issues, such as material price increases or unexpected repairs. This financial buffer provides flexibility and peace of mind, ensuring the project can continue smoothly despite unexpected challenges. For example, if a sudden storm damages partially completed work, the contingency fund can cover the necessary repairs without derailing the project timeline.

Working closely with builders and inspectors is vital for a successful outcome. Regular site visits allow you to monitor progress, address any concerns promptly, and ensure adherence to the agreed-upon plans and specifications. Maintaining open communication with the builder facilitates proactive problem-solving and prevents misunderstandings that could lead to delays or cost overruns. Inspectors play a critical role in verifying that the construction meets local building codes and quality standards, protecting your investment and ensuring the long-term value of your custom home.

Their involvement provides an independent assessment of the work, offering an extra layer of assurance. Transparent communication with the lender is equally important. Regular updates on the project’s progress, including any changes to the budget or timeline, should be provided to maintain a positive working relationship. This proactive communication demonstrates your commitment to the project and builds trust with the lender. Furthermore, it allows the lender to address any potential issues early on, preventing complications with the draw schedule or loan terms.

By effectively managing the budget, maintaining open communication with builders and inspectors, and keeping the lender informed, you can navigate the construction process with confidence and ensure the successful completion of your dream home. Finally, consider leveraging technology to streamline communication and project management. Several software platforms and apps are designed specifically for construction projects, allowing for real-time updates, document sharing, and budget tracking. These tools can enhance collaboration among all stakeholders, from the homeowner and builder to the lender and inspectors, fostering transparency and efficiency throughout the entire building process. This can be especially valuable for owner-builders who are more directly involved in managing the project’s details. By combining meticulous planning with proactive communication and leveraging available technology, you can transform the complexities of construction financing into a manageable and rewarding experience, culminating in the realization of your custom-built dream home.

Conclusion: Building Your Future with Confidence

Securing favorable loan terms for a custom home build requires diligent research, comparing offers from multiple lenders, and skillful negotiation. Don’t settle for the first offer you receive. Treat construction loan shopping like any major financial decision: explore various options, compare interest rates, fees, and loan structures. Negotiating effectively can save you thousands of dollars over the life of the loan. For instance, negotiating a lower interest rate or reducing closing costs can significantly impact your overall financial commitment.

Understanding the fine print, including prepayment penalties, draw schedules, and contingency clauses, is crucial for avoiding costly surprises down the line. Common pitfalls, such as unrealistic budgeting or inadequate contingency planning, can derail even the most meticulously planned projects. A realistic budget that accounts for potential cost overruns is paramount. Industry experts recommend a contingency reserve of at least 10-20% of the total construction budget. This buffer can protect you from unexpected expenses, such as material price increases or unforeseen construction delays.

Real-life examples of successful custom home financing illustrate the importance of meticulous planning and financial preparedness. Consider the case of a family who secured a construction-to-permanent loan with a fixed interest rate, allowing them to lock in a predictable monthly payment after the construction phase. They also negotiated a flexible draw schedule that aligned with their builder’s payment terms, ensuring smooth progress throughout the project. Another example involves an owner-builder who opted for a construction-only loan, allowing them to explore multiple permanent financing options after completing the build.

By carefully evaluating their long-term financial goals, they were able to secure a more advantageous mortgage rate upon project completion. The current trend towards tighter lending standards underscores the importance of meticulous planning and financial preparedness. A strong credit score, a detailed project plan, and a qualified builder are essential for securing approval. Lenders scrutinize loan applications more closely, requiring comprehensive documentation and thorough due diligence. Prospective home builders should be prepared to provide detailed financial records, a comprehensive construction timeline, and a realistic budget that accounts for all potential costs.

Partnering with an experienced custom home builder and a reputable lender specializing in construction loans can streamline the process and increase the likelihood of a successful outcome. They can provide valuable insights into the local market, navigate complex regulations, and offer expert guidance throughout the construction journey. Building a custom home is a significant investment, both financially and emotionally. By understanding the intricacies of construction loan financing, prospective home builders can confidently embark on their dream project and build their future with confidence. Remember, thorough planning, careful budgeting, and open communication with lenders and builders are key to a successful and rewarding custom home building experience.

Post Comment