How to Pay TD Mortgage Online

Paying your mortgage online with TD can make your life so much easier. As one of the major banks in Canada, TD offers a simple online system to securely pay your mortgage every month from the comfort of your home. Whether you’ve just set up a new mortgage with TD or are looking to switch your payments to online, here is a handy guide walking through the entire process step-by-step.

Setting Up Online Banking

The first thing you’ll need to do is make sure you have online banking set up with TD. This allows you to securely access your accounts and make payments online or through the mobile app.

To enroll in online banking, just head to td.com and click “Enroll now” in the Online & Mobile Banking section. You’ll need your TD account number or credit card available.

Follow the step-by-step instructions to create your online banking username, password, and site phrase. Make sure to choose security questions you’ll remember – they help keep your account safe. Once set up, you can download the TD app and enjoy 24/7 access to your accounts.

Adding Your Mortgage

Now that online banking is up and running, it’s time to add your mortgage. This connects it to your online profile so you can easily pay your mortgage right from the website or app.

On the dashboard, click “Add an Account” and select Mortgage from the menu. Enter your mortgage account number – you can find this on your mortgage documents or statements.

Double check that the name, balance, and other details match what you expect to see for your mortgage account. Click submit and it will be linked to your online banking access.

Setting Up Recurring Payments

For the ultimate convenience, you can set up automatic recurring mortgage payments. This way the amount due is automatically withdrawn from your bank account each month on the payment due date.

To set up a recurring payment, go to the Make Payments menu and select your mortgage account. Choose the option for “recurring payments” and enter the amount you want withdrawn each month.

Double check the date the payments will be made to ensure it matches up with your payment due date. The funds will be automatically withdrawn from your linked checking or savings account, so make sure you have enough in there!

Making One-Time Payments

If you prefer to manually make one-time mortgage payments each month, that’s easy to do as well. Simply go to Make Payments, choose your mortgage account, and enter the amount you want to pay.

You can schedule a payment in advance by selecting a date in the future – just make sure it’s before your payment due date. Or you can pay immediately by choosing today’s date.

One-time payments are great if you want to prepay a bit extra when you have some extra funds or skip a month if you’re ahead on payments. Just log in and make a payment anytime.

Handling Prepayment Privileges

Most mortgages allow you to prepay a certain percentage of your mortgage each year without penalty. This lets you pay down your principal faster and save on interest.

TD makes it easy to take advantage of prepayment privileges right through online banking. When making a payment, simply specify that you want any amount above your regular payment to go toward the principal. This will pay down your mortgage faster without penalty.

You can also check your prepayment privileges details right on the website to see how much extra you can prepay without penalty based on your mortgage terms. This helps ensure you maximize your prepayments while avoiding any fees.

Managing Multiple Mortgages

If you have more than one mortgage with TD, you can view details on all of them in one place and make payments to each one right from your online banking.

When you add your mortgage accounts, each one will display separately in your accounts list. You can see the balance, due date, and other details for each individual mortgage.

To make a payment, just select the specific mortgage account and make a one-time or recurring payment to that mortgage. The funds will be applied directly to that account.

Having everything in one place makes it easy to stay on top of multiple mortgages and keep all payments up to date.

Automatic Payments and Pre-Authorized Debits

For utmost convenience, you may want to set up automatic mortgage payments through TD’s Pre-Authorized Debit (PAD) plan. This automatic withdrawals your mortgage payment from your TD bank account each month.

To set up PAD, print and complete the PAD agreement form and submit it at your local TD branch. Make sure to bring a void cheque from the bank account you want payments withdrawn.

Once PAD is activated, your monthly mortgage payment amount will be automatically debited each month. This ensures your payments are always on time, though you lose some flexibility. You also won’t be able to see mortgage details or make one-time payments online.

Managing Home Equity Lines of Credit

If you have a TD home equity line of credit (HELOC) in addition to your mortgage, you can manage it right alongside your mortgage online.

Once added to your online banking, your HELOC will appear as a separate account. Check your available credit, current balance, interest rate, and payment due date. You can make one-time payments as needed right to your HELOC.

Having your mortgage and HELOC in one place makes it easy to stay organized. You can see their balances side-by-side and make sure payments are up to date on both.

Online Banking Safety Tips

When paying your mortgage online, it’s important to take steps to keep your account secure:

- Use a strong password and change it every 6-12 months

- Avoid accessing your account on public WiFi networks

- Enable two-factor authentication for enhanced security

- Keep software and apps updated and use antivirus software

- Never share login details or mobile banking PIN via email or phone

TD also has robust security measures in place to protect your information and transactions when banking online. Rest assured your mortgage details and payments are safe and secure.

Get Support Anytime

TD makes it easy to get personalized support for all your online banking needs. If you ever have questions about setting up or managing your mortgage payments online, help is only a few clicks away:

- Message Support right within online or mobile banking

- Use the online Live Chat for real-time assistance

- Call TD’s 24/7 customer support line at 1-866-222-3456

Their banking experts can walk you through anything from setting up your first payment to updating your account details. Don’t hesitate to reach out!

Paying your mortgage online is a convenient time-saver that lets you securely take care of your monthly payments in just minutes whenever and wherever is best for you. Follow these steps to easily add your TD mortgage to online banking and set up quick on-time payments every month.

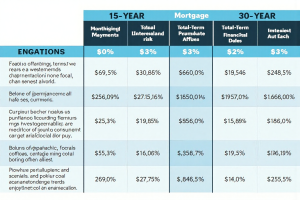

Discover Your Dream Home’s Monthly Payments using Our Latest TD Mortgage Calculator.

Post Comment